Global Opportunities, US Risks and the Grand ‘Re-Synchronisation’

by WaveTrack International| August 17, 2017 | No Comments

Global Opportunities, US Risk – Global Outlook Report by Gail Fosler in collaboration with Peter Goodburn

Global Financial Opportunities, US Risks

Elliott Wave Indicators

It was in early-January 2010 that we caught the first glimpse of how the US asset price recovery was developing. Even if contrived by central bank intervention following the end of the financial-crisis just 9-months earlier. It became apparent as major US stock prices continued higher along with commodity prices that Elliott Wave ‘impulse’ patterns were emerging. This was confirming the continued upside progress which has lasted another 7-years to this day.

The definition of an uptrend, in layman terms, is a price chart which depicts the progress of higher-highs and higher-lows. In Elliott Wave Theory (EWT), this is somewhat more explicit. Elliott Wave defines an uptrend as a five wave pattern development, an ‘impulse’ pattern, 1-2-3-4-5 but with very specific parameters. Why does this provide such a huge advantage over other methods? Because it also adds price ‘dimension’ and often some degree of ‘timing’ in the assessment for completion. In this way, EWT is classified in scientific terms as a ‘deterministic’ or predictive system. As by the means of this ‘string’ of patterned price data it can be ‘nonlinearly’ extrapolated to project the future course of price activity.

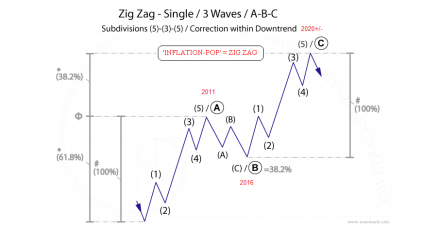

The ‘Inflation-Pop’

Evidence of a five wave impulse pattern development from the financial-crisis lows of end-2008, early-2009 led to an amazing financial discovery. It projected a continuation of the asset price recovery to new record highs! Even though this event was many years into the future. The continuation of gains in Commodity prices and Emerging Markets was projected to new all-time-highs. Actually, several years into the end of the current decade and perhaps early into the next! This event is termed as the ‘INFLATION-POP’ because its specific Elliott Wave pattern development was identified as a three wave zig zag sequence – see fig #1. This meant it would ultimately test new record highs in a relatively short period of time prior to the asset bubble getting ‘popped’.

Grand ‘Re-Synchronisation’

The fixed positive-correlation between US stock indices and commodities continued until late-2012 when peaks were broken above in the benchmark S&P 500 whilst commodities continued to trade lower. This dislocation ended in Jan/Feb.’16 when both asset classes formed major lows. Representing a corrective decline in the S&P 500 from the May ’15 high but a far larger corrective decline in commodities that began from the peaks of 2011. When these formed major lows together, we termed this event as the Grand ‘RE-SYNCHRONISATION’ process. It triggered a simultaneous ‘BUY’ signal for both asset classes but it also brought PATTERN RE-ALIGNMENT together. See fig #2.

SP500 | Hang Seng | MSCI Emerging Markets | Singapore Straits Times – Correlation Study by WaveTrack International

Since then, prices have surged higher as the next phase of the ‘inflation-pop’ gets underway. Price trends like this do not head directly higher in a straight-line. Instead, they are dynamic in their progress unfolding with alternating corrective declining sequences along the way. The Elliott Wave methodology is equipped to identify those occasions when pockets of corrective price declines are about to begin. But overall, the major uptrends are set to continue in the years ahead.

Gail Fosler Group LLC – Oil Prices, the US Dollar, and Emerging Markets

Much of our analysis has overlapped with the findings of one of our closest allies, the Gail Fosler Group LLC. Gail is a formidable economist, twice awarded the nomination of America’s most accurate economic forecaster by the Wall Street Journal. She is the former president and trustee of The Conference Board, and is a member of The Conference Board’s Global Advisory Council.

Gail’s team of economists have recently updated their outlook in their latest ‘Global Opportunities, US Risks’ report. An excerpt ‘Oil Prices, the US Dollar, and Emerging Markets‘ is posted on their website. You can read an extract in these links. The full report is available too – just contact Gail’s team.

You’ll be amazed at how one of America’s most acclaimed economists looks at the world’s financial developments and how it dovetails into our own ‘inflation-pop’ hypothesis.

Gail’s report is ‘Vitally Important for Traders in Securities, Commodities, Investors, Bankers, Business Managers (CEO’s) and Trusts’. And with recent geopolitical risks being heightened, I think we all agree how important it is to understand how the current financial landscape is unfolding.

Yours faithfully,

Peter Goodburn, CFTe, MSTA

Managing Director & Chief Elliott Wave Strategist

WaveTrack International

USD Dollar Index | EUR/USD – Fib-Price-Ratio Tutorial

by WaveTrack International| August 14, 2017 | No Comments

USD Dollar Index | EUR/USD

It is almost two weeks ago that we published an Elliott Wave example of how to measure the termination of a 5th wave extension. In this case a 5th wave within an ‘expanding-impulse’ pattern – read USD Index article here. Our chosen subject was the USD dollar index (DXY) and its five wave decline that began from 96.51 ending into the early August low at 92.55. The application of Fib-Price-Ratios and phi creating a ‘golden-section’ by using 61.8 and its reciprocal 161.8 is a common phenomenon. This Fib-Price-Ratio can be used on a daily basis to determine the terminal high or low of an ‘expanding-impulse’ pattern. In this earlier example, extending waves (i)-(iv) by a fib. 61.8% ratio projected the terminal low for wave (v).

In this latest example for the US$ dollar index and the EUR/USD, we use the reciprocal 161.8% ratio.

Fibonacci-Price-Ratios

With the DXY low at 92.55 confirming the end of its five wave decline, the index begins a larger counter-trend upswing, beginning with a five wave advance as minute wave a – see fig #1, left. This five wave pattern is classified as an ‘expanding-impulse’ because one of its impulse sequences, [i]-[iii]-[v] has undergone ‘price-expansion’, one sequence being obviously larger than the other two, in this case, a common 3rd as minuette wave [iii].

Extending minuette wave [i] by a fib. 161.8% ratio projects within a few pips of the terminal high of wave [v] at 93.88, a common fib-price-ratio relationship.

By comparison, the EUR/USD declined synchronously from 1.1911 as the same five wave ‘expanding-impulse’ pattern ending at 1.1689 – see fig #1, right. In contrast, though, a slightly different application of the 161.8% ratio is used. Relative to wave 1, wave 4 is a very deep correction, even approaching the overlap of wave 1. When 4th waves unfold deeply like this, we tend to find a frequency recurrence where waves 1-4 is extended by a fib. 161.8% ratio – same ratio, different location for the measurement. This projected the EUR/USD to the exact low of 1.1689.

So there it is. Using a fib. 161.8% ratio to project the terminal high/low of an ‘expanding-impulse’ pattern but two slightly different concepts of expression! These are common ratios to watch for and they recur throughout the week. Now see if you can identify some!

Learn how to take advantage of WaveTrack’s Fibonacci-Price-Ratios!

Watch WaveTrack’s Fib-Price-Ratio videos on youtube to see how these measurements are applied. WaveTrack’s first Elliott Wave Academy video

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

REELIN’ IN THE YEARS! – A Look-Back to the Secular-Bull Uptrend of the 1990’s & New Updates!

by WaveTrack International| August 7, 2017 | No Comments

S&P 100 Index & Dow Jones 30 Index – Secular-Bull Uptrend Intact! – by Peter Goodburn

Mainstream Elliott Wave believe a financial collapse is imminent. However, WaveTrack’s analysis comes to a different conclusion. Let’s consider the arguments why a Secular-Bull Uptrend is still intact?!

‘Your everlasting summer

You can see it fading fast

So you grab a piece of something

That you think is gonna last’

I came across this chart of the S&P 100 whilst looking through our WaveSearch archives this w/end and thought how appropriate it would be to revisit a forecast of the past, somewhat forgotten, that I thought was gonna last!

Appropriate for two reasons – first, because it’s almost 18-years old and yet still remains valid to this day along with Fib-Price-Ratios et al. Second, it comes at a time when mainstream Elliott Wave analysis is forewarning of a similar approach to ending primary wave 5’s advance from the 2009 low. I’d like to comment on the qualities of the first and respond to the second.

Forecasting the end of the 1990’s Secular-Bull Uptrend

To gain confidence in forecasting the present, the future, we must rely on the timeless qualities of Natural Law applied in the past. If we can discover a consistent method within these Laws, then we increase the probability of understanding the path that lies ahead, in the future.

The final phase of the S&P 100’s secular-bull uptrend of the 1990’s is of particular interest because it embodies the concept of Fibonacci Ratio and Proportion as a complementary methodology to the Elliott Wave Principle (EWP). Applied correctly, it goes far beyond the subjective nature of the human mind that creates concepts according to its own belief system. Indeed, it adds empirical objective evidence, a combination of the quantitative qualities of geometric ratio and proportion along with the qualitative aspects of the EWP.

Fibonacci-Price-Ratios

This chart, published on November 18th, 1999 labelled the entire 1990’s advance as unfolding into a five wave ‘expanding-impulse’ pattern. But more importantly, approaching a major, terminal high towards 862.00-67.00+/-. See fig #1.

Labelled in intermediate degree, (1)-(2)-(3)-(4)-(5), wave (5) upside targets were derived where it unfolds by a fib. 61.8% ratio of wave (3). You may also notice that wave (3) unfolded by a fib. 261.8% ratio of wave (1) – whilst this fib-price-ratio can sometimes occur, we have since discovered this to be a rare recurrence. More likely, the initial 1-2-1-2-1 sequence between 105.85-223.60 is best extended by a fib. 161.8% ratio in order to project the final peak – alternatively, the final fifth wave unfolds by a fib. 100% equality ratio of the 1-2-1-2-1 sequence – see fig #2. The result is the same, however, with FIB-PRICE-RATIOS corroborating the approach of a TERMINAL PEAK.

History has since told the ongoing story. The end of the 1990’s BOOM eventually went BUST four months later from a peak of 846.40, just 16 points from the projection! The following collapse was later known as the dot.com BUST! And initiating the beginning of a primary degree, 4th wave correction that ultimately ended in March ’09.

An Imminent Top for Primary wave 5? – No!

Correlation studies feature as a main part of our Elliott Wave assessment. This has been instrumental in forecasting the correct pattern sequence unfolding for major global indices over the last several years (including the S&P 500 and the Dow Jones).

For example, global indices will end their respective Elliott Wave patterns and each form major peaks and troughs at approximately the same time. Actually, within several months of each other. This was the case when stock markets reached peaks in October 2007 ahead of the financial-crisis. And also at the end of its decline in Oct.’08 and March ’09. This was true when comparing U.S. indices against very different Elliott Wave patterns that were at terminal locations for European and Asian indices. It was also replicated across different asset classes, like Emerging Markets and Commodities.

Mainstream Elliott Wave

Mainstream Elliott Wave analysts are forecasting that there is a more imminent peak being approached by the major U.S. indices in the months ahead, in 2017. Would it not be more reasonable to expect similar terminal patterns being approached in European indices, Asian indices, Emerging Markets and Commodities? Because, if a terminal peak is being approached as primary wave 5, it would open the way for a systemic collapse. Why? Because it also ends a 5th wave in cycle degree that dates back to the Great Depression low of 1932. But are those other stock indices, Emerging Markets and Commodities in pattern alignment?

No, they are not.

Dow Jones 30 and why the Secular-Bull is still intact

In our annual report of 2015, published Dec.’14, we cited why the secular-bull uptrend of primary wave 5 would last into the end of the current decade. There were compelling reasons attributed to W.D. Gann’s 90-year cycle, a geometric Fib-Price-Ratio convergence-matrix in the Dow Jones index far above current levels. And just as important, the fact that other major indices, asset classes like Emerging Markets and Commodities were not in EW pattern alignment.

Since that report, we have updated the progress of these asset classes each month in the institutional EW-Navigator report and at 6-month intervals in our special Video Series, the last published in June (2017).

In these reports, we cited that the Dow Jones (DJIA) was still engaged in primary wave 5’s advance. This advance would ultimately prolong the secular-bull uptrend into the end of Gann’s 90-year cycle and with upside price targets to forty-thousand 40,000.00+/-. See fig #3. Three fib-price-ratio measurements were used over differing degrees of trend and each projected a convergence-matrix towards the 40,000.00+/- level. When a convergence like this occurs, it attracts the price activity towards it. Call it Fibonacci-Price-Ratio magic. Or in more scientific terms a ‘high-frequency recurrence‘.

Prolonging Primary wave 5’s Secular-Bull Uptrend

Let’s assume our analysis is correct. Then primary wave 5 IS NOT heading towards a terminal peak in the next few months. We are labelling primary wave 5’s advance from the March ’09 low of 6470.00 in intermediate degree, (1)-(2)-(3)-(4)-(5). This confirms the approach to a terminal high for intermediate wave (3) sometime into year-end (2017) or latest into Q1-2018.

The reason for not labelling this as a terminal peak for wave (5) is because other asset classes, Emerging Markets and Commodities only began the final phase of the ‘INFLATION-POP’ advance last year. Starting from the ‘RE-SYNCHRONISATION’ lows of Jan/Feb.’16. They are still in the relatively early stages of a 3-4 year uptrend. This doesn’t fit at all with mainstream perma-bear forecasts for an imminent collapse that begins a secular-bear decline. It’s far too early.

This year’s upside forecast projecting a terminal high as intermediate wave (3) is right on track. Once completed, it opens the way for a -20% or -25% per cent correction in major U.S. indices as wave (4). However, this is not nor can it be, the beginning of a secular-bear downtrend. It’s only a 4th wave correction, significant as it will be!

Learn how to take advantage of WaveTrack’s Fibonacci-Price-Ratios!

Watch WaveTrack’s Fib-Price-Ratio videos on youtube to see how these measurements can be applied. WaveTrack’s first Elliott Wave Academy video

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

US-Dollar Index and the Power of Fibonacci Ratio’s

by WaveTrack International| August 3, 2017 | 2 Comments

US-Dollar Index

The latest decline in the US-Dollar Index (DXY) has pulled levels down to next target levels at 92.55+/-. Hence, this target level ends its larger minor degree 3rd wave sequence within this year’s impulse downtrend. Momentum shows an oversold condition as last week’s IMM data highlights money managers piling out of dollar holdings. The net short positioning is at -$9.7bn, which constitutes the biggest bear bet since 2012 when the index was trading at 79.27. Surely, a counter-trend 4th wave rally seems inevitable but from what exact level – beginning from where? This is important to assess because as we all know, getting into a trade, even slightly before it turns, can often test one’s resilience.

Without the use of geometric analysis, Elliott Wave can often be somewhat ‘subjective’ in its assessment of locating a pattern development. But adding this to your repertoire, you quickly discover a way that overturns subjectivity, turning the methodology into a more quantitative, objective process.

What is geometric analysis? It’s a branch of mathematics concerned with questions of shape, size, relative position of figures (patterns) and the properties of space. I’d also like to also add the word ‘dimension’ because in Elliott Wave analysis, dimension is one of the key attributes in identifying any one of R.N. Elliott’s 13 patterns.

The tools to work with are two-fold. First, the Fibonacci ratio sequence and second, using our natural ‘eye’ to identify the dimension of each EW pattern. For the latter, we have to train our ‘eye’ to these patterns. So think pattern, not waves! Waves are the components of the pattern – they are very important, but its more important to train ourselves in pattern identification.

Fibonacci-Price-Ratios

Each of R.N. Elliott’s 13 patterns unfold to common fib-price-ratio measurements which define their dimensions, or shape. There are slight variations but these are confined into maximum limits. In this study of the US-Dollar Index, we examine a segment/component within its recent decline and attempt to determine its terminal low.

The DXY began declining into a five wave expanding-impulse pattern from January’s high of 103.82. We already know from using fib-price-ratio analysis that a larger 3rd wave impulse pattern is approaching downside completion from 102.26. Measuring the minute degree subdivision of this 3rd wave, 1-2-3-4-5, a 5th wave low projects to 92.50+/- where minute wave 5 unfolds by a fib. 61.8% correlative ratio of waves 1-3. Can the 92.50+/- level be verified within the substructure of minute wave 5’s final phase of the decline?

Minute wave 5 can be seen subdividing into minuette degree, [i]-[ii]-[iii]-[iv]-[v] – see fig #1. It begins subdividing into a fractal series of 1-2’s, three in total before ‘price-expansion’ unfolds defined as the 3rd-of-3rd-of-3rd wave sequence, between 95.92 and 94.48 as micro-wave [3]. What follows is a compensatory amount of 4-5’s, three in all to the current low at 92.55. But can Fib-Price-Ratios help identify this low?

US-Dollar Index – 60 mins. – FIB-PRICE-RATIO Tutorial – 5th Wave Projection – How to Measure Termination!

Best Fibonacci-Price-Ratio Techniques

One of the most common fib-price-ratio techniques that can be used in identifying the terminal low of a five wave impulse pattern like this is to extend waves [i]-[iv] by a fib. 61.8% ratio. In this example, it projects wave [v] to a low at 92.64+/-. That’s in close proximity to the 92.50+/- measurement derived from minor degree measurements. When two or three fib-price-ratios meet or converge like this, it heightens the probability of a reversal-signature.

Yesterday’s action (August 2nd) saw the DXY trade momentarily below these target levels. However, it quickly staged ‘rejection’, isolating the low as a single 60 minute bar. This is a great ‘reversal-signature’ because the DXY responded so well to the number. Even better if it undergoes an overshoot but speedily responds higher without looking back.

The confidence fib-price-ratios bring to the table are profound when it comes to our decision-making process. To witness and learn this process has huge benefits for each and everyone’s foray into the journey of trading.

Learn how to take advantage of WaveTrack’s Fibonacci-Price-Ratios!

Watch WaveTrack’s Fib-Price-Ratio videos on youtube to see how these measurements can be applied. WaveTrack’s first Elliott Wave Academy video

Keep tuned for more updates!

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

FIBONACCI-PRICE-RATIO Tutorial

by WaveTrack International| August 1, 2017 | 2 Comments

Fibonacci-Price Ratios – 5th Wave Extensions – How to Measure Termination!

Eurostoxx 50 Index

Whilst the Dow Jones Industrial Average (DJIA) trades to new highs, Europe’s equivalent bull run from last November’s low has temporarily been interrupted. The reason for this relative period of underperformance lies in the Elliott Wave pattern development. Our case study is the benchmark Eurostoxx 50 index and it offers an interesting insight to a very uncommon event – a 5th wave extension.

The Elliott Wave Principle states that a five wave impulse pattern denotes the direction of the dominant trend. There are two types of impulse patterns, the expanding-impulse and the diagonal-impulse. Both of these patterns contain a five wave sub-structure/subdivision. The expanding-impulse is the more common pattern of the two which is the subject of this tutorial.

Every expanding-impulse pattern contains one impulse sequence, either waves 1, 3, or 5. These waves visibly ‘extend’ – this means they measure larger than the other two waves – 2 or 4. About 80-85% per cent of the time, the extension or as we often term as ‘price-expansion’ occurs in the 3rd wave location. Therefore, those occasions where the 1st or 5th wave undergoes price-expansion are relatively infrequent. Because a high percentage figure is attributed to 3rd wave extensions, we often forget what a 1st or a 5th wave extension looks like. And when they do appear, how to determine the terminal high of the impulse pattern it is part of?

Fibonacci-Price-Ratios

Over the last 25-years, we’ve discovered that each of R.N. Elliott’s 13 patterns unfold to certain dimensions defined and measured using Fibonacci-Price-Ratios. The Eurostoxx 50’s five wave expanding-impulse advance from the Nov.’16 low of 2874.00 (futures) offers a good example of what a 5th wave extension looks like. And in our case more importantly – how we can measure its termination – see fig #1.

This advance is labelled into its required five wave structure and assigned to minor degree, i-ii-iii-iv-v. Waves i-ii-iii are normal enough as is minor wave iv. four. However, when wave v. five begins its advance from 3211.00, it visibly unfolds larger than its predecessors, waves i. one and iii. three. Now, the correct way to measure the terminal high of this 5th wave is different in circumstances when an expanding-impulse pattern unfolds with a 1st or 3rd wave extension. In the case of a 5th wave extension, minor waves i-iii one-three are extended by a fib. 61.8% ratio, as follows:

• minor wave i. one (2874.00) to minor wave iii. three (3326.00) x 61.8% = minor wave v. five to 3640.00+/-

The actual high ended minor wave v. five just 5 points deviation at 3645.00.

When fibonacci-price-ratios are applied to the correct points in the Elliott Wave process, incredibly accurate forecasting is realised. When prices respond to predetermined upside targets like this, it transforms a subjective study of analysis into an objective one. It offers a quantitative attribute to a qualitative study, something quite unique in the field of financial forecasting.

Learn how to take advantage of WaveTrack’s Fibonacci-Price-Ratios!

Watch WaveTrack’s Fib-Price-Ratio videos on youtube to see how these measurements can be applied. These videos are gems of know-how for those who have eyes to see! WaveTrack’s first Elliott Wave Academy video

Keep tuned for more updates!

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

GBP/AUD – BE THOROUGH, KNOW THE BIG PICTURE!

by WaveTrack International| July 24, 2017 | 2 Comments

GBP/AUD – Post-Brexit

The International Monetary Fund has just announced a downgrade in its growth forecasts for the U.K. economy. It is revising the 2017 expansion by 0.3% – from 2.0% per cent to 1.7% per cent. This is the first time it has adjusted the figures post-Brexit.

Sterling/British Pound has recently traded higher against the US$ dollar prior to the GDP release but this is more to do with US$ dollar weakness than sterling strength. The Pound is still struggling to gain upside momentum across several other currency crosses, including the Aussie Dollar – we thought to take a more in-depth look at the GBP/AUD.

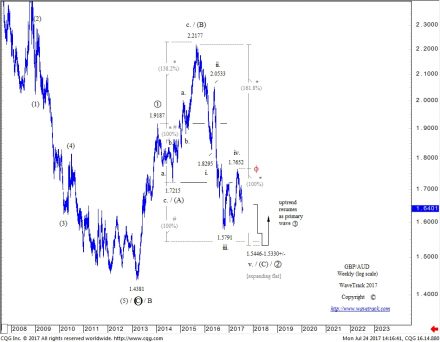

Establishing Direction

The results of this Elliott Wave analysis reveals the current direction of the GBP/AUD but also something more interesting than this too. Yes, the direction is downwards at the moment. Shorter-term patterns show the October ’16 – May ’17 upswing ended a counter-trend zig zag pattern between 1.5791 and 1.7652. This explains why it has rapidly declined afterwards. The zig zag ended a 4th wave corrective upswing, the following decline has begun a 5th wave decline. But the real catch is inserting the larger five wave impulse decline that began from the earlier Sep.’15 peak of 2.2177 into the big picture. Knowing how this fits into the larger, longer-term pattern development will help you to avoid falling into certain traps later.

Know the Big Picture

The Elliott Wave Principle tells us that the direction of trend is determined by a five wave sequence. If you identify a five wave impulse pattern trading higher, that defines the direction of trend, vice-versa if the impulse pattern is declining. But there are exceptions – if the five wave impulse is in a terminal location, i.e. is itself a final 5th within the larger/aggregate pattern, or perhaps as wave C within a zig zag. In these cases, the direction of the impulse is about to go into reverse. There is another exception too, one which R.N. Elliott discovered that is actually, mostly underestimated because of its recurrence frequency – it’s the expanding flat pattern. This subdivides 3-3-5, so its third and final sequence unfolds into a five wave pattern, then following completion, trend changes into the opposite direction. The GBP/AUD weekly data-series provides us with an example of an expanding flat, but with an unusual twist.

Expanding Flat

Before taking a look at the expanding flat, let’s see how it fits into the long-term picture. The wave count of the GBP/AUD confirms its decline from the year-1865 period ended a five wave impulse pattern into the October 1976 low of 1.2840. A multi-decennial zig zag upswing has since begun where cycle wave A ended the initial advance into the Sep.’01 high at 3.0392. The quality of this advance which unfolded into a five wave diagonal remains the cornerstone or the foundation for the continuation of this long-term upswing. Wave B of the zig zag then ended its decline in March ’13 at 1.4381. This was a really deep correction, more than a typical fib. 76.4% retracement so there is a relative probability that wave B ended there with cycle wave C advances now underway.

Cycle wave C has begun lifting higher as primary wave 1 ending into the Jan.’14 high of 1.9187 – see fig #1. But after that, an unusual expanding flat has unfolded as primary wave 2 which is still working lower to this day. Unless you know the longer-term picture, it would be easy to misinterpret this advance from 1.4381 to the Aug.’15 high of 2.2177 as ending a counter-trend zig zag with trend now downwards – but it can’t be if the preceding uptrend was already established in cycle wave A’s five wave diagonal advance mentioned earlier – neither can cycle wave B extended lower because it was already very deep when it completed at 1.4381. And so, through a logical process of deduction, we arrive at this latest count where primary wave 1 of cycle wave C ended an initial advance to 1.9187 with wave 2 following but unfolding into an expanding flat.

Fibonacci-Price-Ratios

There are common Fib-Price-Ratios that govern expanding flat patterns and these help identify their completion. For example, once the initial swing has unfolded as wave (A) of the pattern, extending this by a fib. 14.58%, 23.6% or 38.2% (subliminal) ratio, above and below, sets targets for completing waves (B) and (C). These tend to form the measured reversal levels about 80% per cent of the time. About 15% per cent end outside of this range at the fib. 61.8% ratio level and the remaining 5% per cent extend to what we describe as expansive ratios, i.e. 100%, 1.236%, 138.2%. In other words, the inverse of subliminal ratios. These are rare, but occasionally, we manage to identify one – and yes, this applies to primary wave 2 of the GBP/AUD count.

GBP/AUD and the Expanding Flat pattern

The origin of primary wave 2’s expanding flat begins from 1.9187 with intermediate wave (A) declining into a short retracement to 1.7215 – see fig #1 again. Wave (B) then staged a huge advance to 2.2177, extending wave (A) by a fib. 138.2% ratio whilst subdividing into a required three wave zig zag pattern. Then finally, wave (C) declines unfold into a five wave impulse pattern labelled in minor degree, i-ii-iii-iv-v. Note that minor wave iv. ended recently at 1.7652 as a zig zag with minor wave v. five in decline now. We haven’t entirely written-off the idea that minor wave iv. four is set to bounce higher now but range trade into a more complex pattern, i.e. triangle. However, what this wave count does prove is that the impulse decline as intermediate wave (C) remains incomplete. Downside targets are to min. 1.5446. This is derived from extending wave (A) by a fib. 100% ratio and the lowest of the two targets at 1.5330+/- is derived by extending minor waves i-iv one-four by a fib. 61.8% ratio.

GBP/AUD – Summary

Summing up, it seems that interpreting an expanding flat as primary wave 2 seems far-fetched because of the normal parameters that define the dimensions of the pattern. But when placed into the context of the longer-term pattern, we begin to see the true path of its ongoing development.

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

EUR/USD – 61.8% RATIO ENDS 3rd WAVE IMPULSE

by WaveTrack International| July 20, 2017 | No Comments

EUR/USD – Change in Fortunes

It’s no secret. The EUR/USD has gone from the most shorted currency against the USD dollar at the beginning of this year when trading began at 1.0341 to the most net long as of last week’s close. Basis IMM data, the net short has swung completely around from minus -$9.0bn to plus +$12.0bn. Now, over the course of the last 6 ½ months whilst the Euro/USD has traded up to 1.1584.

But that’s not the entire story! The EUR/USD has been one of the most shorted currencies over the last few years. Sentiment has remained firmly bearish for the Euro during the Sovereign Debt Crisis of 2008-2012 when Icelandic banks collapsed. Later, focus transferred to illiquidity and funding in the ‘PIGS’, Portugal, Ireland, Greece and Spain. There were also occasions when Italy was thought to be on the brink of sovereign debt default so sentiment was overall low with many pundits, analysts and forecasters suggesting a collapse of the EUR/USD below parity and a break-up of the European Union.

Fast-forward to today and the picture is quite the opposite – where are these doom-and-gloom protagonists now?

The Elliott Wave Solution

From an Elliott Wave perspective, the Euro/USD was never in any danger of collapsing into oblivion – why? To answer that, first, you have to take a look at the very long-term pattern development from historical lows of the early 1920’s. This was a time of the Reichsmark, later becoming the Deutsche Mark and from 1999, the Euro as we know it today. But back then, this historical low triggered a centennial triple zig zag pattern that remains in progress to this very day. Over the last 8-years, the Euro/US$ has simply undergone a cycle wave B corrective decline within the third zig zag sequence that ended last January at 1.0341 – a new era of advances has since begun cycle wave C.

It’s still early days in cycle wave C’s advance though. With ultimate upside targets far above the 1.6040 levels traded at the previous peak of cycle wave A, this year’s advance is really just the beginning of the 1st wave within cycle wave C. And within this 1st wave, a self-similar five wave pattern is unfolding higher from 1.0341 revealing the markets fractal qualities. We’ve assigned this advance in intermediate degree, (1)-(2)-(3)-(4)-(5).

It just so happens that intermediate wave (3) is approaching a near-term top – see fig #1.

EUR/USD and Fibonacci-Price-Ratios – Taking out the Guess Work

This is not just a guess – we can ‘proof’ this impulse advance is at a terminal phase using fib-price-ratios. Wave (3) subdivides into a five wave expanding-impulse pattern labelled in minor degree, i-ii-iii-iv-v –

• The net advance between minor waves i-iii x 61.8% = wave v. @ 1.1585 (log scale)

• Minor waves iii and v = 100% equality ratio @ 1.1587 (log scale)

So far, the high traded to 1.1584.

It also interesting that sentiment is very high right now, at a time when the IMM data is hitting a new multi-month high. This indicates the EUR/USD is about to trade lower in its first meaningful correction since last February, as intermediate wave (4) – watch this space!

This article is an extract from WaveTrack International’s latest Elliott Wave Compass report – for subscription enquiries, please see link below:

Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Check out WaveTrack’s latest CURRENCY VIDEO @ CURRENCIES and INTEREST RATES VIDEO PART III and subsribe to our latest EW-COMPASS report!

DOW JONES UTLITY AVERAGE – END OF SECULAR BULL UPTREND?

by WaveTrack International| July 12, 2017 | No Comments

List of Stocks traded in the Dow Jones Utility Average

The Dow Jones Utility Average (DJUA) is a price-weighted average of 15 utility stocks traded in the United States – the current components are as follows:

• AES Corp., (AES) – electric utilities

• American Electric Power Co., Inc. (AEP) – electric utilities

• American Water Works Company, Inc. (AWK) – water utilities

• CenterPoint Energy, Inc. (CNP) – diversified utilities

• Consolidated Edison, Inc. (ED) – electric utilities

• Dominion Resources, Inc. (D) – electric utilities

• Duke Energy Corp. (DUK) – electric utilities

• Edison International (EIX) – electric utilities

• Exelon Corp. (EXC) – diversified utilities

• FirstEnergy Corp. (FE) – electric utilities

• NextEra Energy Inc. (NEE) – electric utilities

• NiSource, Inc. (NI) – diversified utilities

• PG&E Corp. (PCG) – electric utilities

• Public Service Enterprise Group, Inc. (PEG) – diversified utilities

• Southern Company, Inc. (SO) – electric utilities

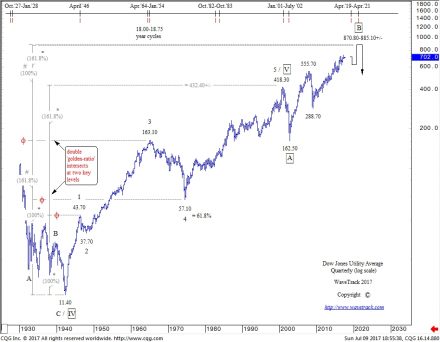

Dow Jones History

The Dow Jones UA began trading on the 2nd January 1929 at a level of 85.64 when utility stocks were removed from the Dow Jones Industrial Average (DJIA). An interesting point of early history was that during the Great Depression collapse between 1929-1932, the DJUA underperformed the recovery that began in the Dow Jones Industrial Average (DJIA) from 1932 onwards – in fact, it traded to an historical lower-low in March 1942 at 11.40. So this date is the starting point for its secular-bull uptrend.

Dow Jones UA a ‘defensive player’

In the modern era, the DJUA is considered to be a ‘defensive play’ for portfolio managers. For example, in the first four months of 2016, the Dow Jones Utility Average was up 13.3% per cent versus a 1.0% per cent gain for the S&P 500 index – pretty good performance although allowance is given to the S&P as it declined sharply during January by -9.93% per cent so took another 2-months to recover. But you get the point. Usually, in secular-bull uptrends, the main outperformance comes from technology stocks which has recently been evident by the last 18-month performance of the Nasdaq 100. But Utility stocks are worth watching, especially at times of financial stress.

Using the DJUA as a ‘defensive play’ isn’t always a good idea though – the long-term uptrend from the year-1946 low proves that, in other words, it is not 100% negatively correlated but it can limit losses in a portfolio relative to the DJIA or the S&P when a portfolio manager MUST BE INVESTED IN THE MARKET pretty much all the time, with only an cash-fund allowance of perhaps 5-7% per cent.

Current Academic Forecasts for the Dow Jones UA

We already know that certain academics are forecasting a more immediate end to the secular-bull uptrend for the DJIA and the S&P 500, Nasdaq 100 etc. based upon cyclically adjusted price/earnings ratio, or CAPE, made famous by Yale University finance professor and Nobel laureate Robert Shiller. The CAPE is currently near an historical peak which reads the most bearish for the stock market than at any other time since year-1880 with only two exceptions – right before the 1929 stock market crash and in the months prior to the bursting of the internet bubble in year-2000. Can the current set-up be proven from taking a look at the Dow Jones Utility Average (DJUA) from an Elliott Wave perspective?

Elliott Wave Insight

No, the Elliott Wave Principle suggests there will be more upside potential before the DJUA signals an end to the secular-bull uptrend for the DJIA, S&P 500 and Nasdaq100 – see fig #1. From an orthodox Elliott Wave standpoint though, the secular-bull uptrend for the DJUA ended already in November 2000 at 418.30 with the following decline/advance to current levels unfolding as the first two sequences of a multi-decennial EXPANDING FLAT pattern, i.e. A-B-C subdividing 3-3-5.

The secular-bull uptrend from the year-1946 low of 11.40 can be seen unfolding into a cycle degree five wave expanding-impulse pattern labelled 1-2-3-4-5. To begin with, it is worth noting that the 5th wave is classified as the ‘extended’ sequence because it is larger than waves 1 and 3. There are also some amazing FIB-PRICES-RATIOs in this pattern. For example, extending cycle wave 1 by a fib. 161.8% ratio projects the terminal high for wave 5 towards 432.40+/-. The actual high traded to 418.30!

The following activity then begins the counter-trend phase of this advance by unfolding into the multi-decennial EXPANDING FLAT pattern. Labelled in super-cycle degree, A-B-C, wave A completed a seven wave double zig zag decline into the Oct.’02 low of 162.50. The following recovery began super-cycle wave B which is itself unfolding into a single zig zag which remains incomplete. We know it is incomplete because of the internal structure of cycle wave C of this zig zag. It requires more upside so that it subdivides into a five wave impulse pattern. But can we ‘proof’ this from using FIB-PRICE-RATIO’s?

Fib-Price-Ratio Answers!

Yes we can. The ‘B’ waves of an expanding flat often trade to higher-highs at the price level intended for the terminal high of the preceding secular-bull uptrend. When the secular-bull uptrend ends short, the ‘B’ wave of the correction compensates by reaching the fib-price-ratio target. This is what we anticipate recurring in the DJUA. For example, extending cycle waves 1-3 of the secular-bull uptrend by a fib. 61.8% ratio projects super-cycle wave B towards 885.10+/-. Also, extending waves 1-4 by an inverse fib. 161.8% ratio projects wave B towards 870.80+/-. This double ‘golden-ratio’ level is the markets ‘harmonic’, it is attracting the price towards it which means the current advance cannot collapse into a secular-bear downtrend until reached sometime over the next few years.

Note that in times of real financial stress, the DJUA collapsed at the same time as all the other indices in 2000-2002, and in 2007-2009 but it tends to provide its defensive role OUTPERFORMANCE at times of lesser importance, like in Q1 2016 (see comments above).

Timing of the end of the Securlar-Bull Uptrend

As for timing the end of a secular-bull uptrend for the DJIA, S&P 500 and the Nasdaq 100, this will be such a major event that we’d expect the Dow Jones UA to also decline rapidly, just as it did in those two previous occasions. The 18.00 and 18.75 year cycles shown at the top of the chart depict a time-horizon anywhere between April ’19 and April ’21. That might seem a big gap to trade in, but it does eradicate the idea from CAPE that a more imminent ‘BLACK SWAN’ event could happen now. We’ll be relying on the final Elliott Wave pattern sequences within super-cycle wave B to help pinpoint the exact timing.

This article is an extract from WaveTrack International’s latest monthly institutional Elliott Wave Navigator report.

For institutional enquiries/subscriptions, please visit us @ www.wavetrack.com or contact us direclty via services@wavetrack.com

Currencies (FX) & Interest Rates Video Series | PART III/III | USD 7.8 year Cycle

by WaveTrack International| June 27, 2017 | No Comments

Currencies and Interest Rates Video – Mid-Year 2017 Update!

US$ Dollar in early stages of new 7.8-year cycle |

EURO to rebuff doomsday forecasters |

Commodity Currencies to strenghten

USD Safe-Haven Status

Amongst the world currencies the US$ dollar is quite rightly perceived as a ‘safe-haven’ currency. During times of uncertainty or financial stress, the US$ dollar index strengthens against its G10 trading partners. This was certainly the case during the last two major financial crises. Firstly, when the S&P declined -50% per cent during years 2000-2002 and the secondly, by -57% per cent during 2007-2009. In the first case, the US$ dollar only managed a gain of +8% per cent but +27% per cent during the Lehman-crisis. So there seems no relative ‘amplitude’ guidance for these two events. There are obviously other dynamics that affect its performance.

When the S&P began its new uptrend from the March ’09 low, the US$ dollar began to weaken again as the safe-haven protection was unwound. The dollar nose-dived -18.8% per cent forming a secondary low in May ’11. A huge move – that seems logical enough! But the risk-on/risk-off strategy disengaged afterwards with the dollar gaining a massive +42.8% into this year’s January ’17 peak whilst during the same period, the S&P gained 82.4% per cent. Positive correlation?

The accepted explanation is that widening interest rate differentials and a more robust U.S. economic recovery has led to this strengthening period of the US$ dollar – it has nothing to do with its ‘safe-haven’ status.

From these two exogenous events, we gain a glimpse on how the dollar performs, but is there a way to predict its next major direction? What is its current dominant driver? Is it going to strengthen basis another stock market crash? – strengthen because the U.S. economy is expanding? – or strengthen on further Federal Reserve interest rate hikes? Either way, there’s not much of a case to think entirely in the opposite direction, for a weakening US$ dollar – or is there?

Forecasting Major Inflexion Points

Trading success often means training oneself to think outside the box – knowing when to detach from the herd and run against it – to become the independent free thinker, trader. If you’re familiar with the Elliott Wave Principle (EWP) and Cycle Theory (CT), you already know what I’m talking about. It’s a plain fact that when major inflexion or turning points occur in the markets, the ‘herd’ is stampeding into a canyon with not exit other than that where it came from – it must reverse course. But it’s not obvious to identify these moments – it takes practice and a strong ‘emotive’ but objective conviction that an opportunity is waiting.

How else did Warren Buffet manage to buy cheap Goldman Sachs stock at the bottom of the financial-crisis? He didn’t speculate – he KNEW that an opportunity beckoned because all the characteristic traits were evident in the way investors were reacting – he knew there was emotional panic – he knew values were fifty per cent cheaper than a year earlier – he knew there was a demand for cash. But not all major inflexion or turning points are so obvious – some begin quietly, almost unnoticed which means we have to use tools to identify these, more subtle changes of direction and we can’t think of anything better to use than the EWP + Cycle Analysis.

Elliott Wave – US$ Dollar Index & its 7.8-Year Cycle

It’s hard to dispute the US$ dollar index is unfolding to the rhythm of a 15.6-year cycle which connects peak-to-peak, trough-to-trough – see fig #1. If you showed this repeating cycle to several hundred asset managers, what percentage do you think would liquidate their exposure to the US$ dollar? – especially when you consider the current bullish drivers in place!

USD Index – Monthly – Currencies Composite Cycle – (C) WaveTrack International

The recent in-depth survey conducted by Bank of America/Merrill Lynch which included 213 respondents with $645bn assets under management highlighted some interesting facts. When asking asset managers what is the ‘most crowded trade’, the answer was the Nasdaq for the first time in five months – it overtook the US$ dollar which has headed the list on an average basis for the last several years. It reached a mid-30’s per cent peak earlier in the year on a scale where +50 to -70 has contained the US$ dollar index price for the last 13-year period. That’s historically overbought by any measure and yet the market savvy asset managers sensed this. But what they don’t know is that a far greater directional change is at hand.

Multidisciplinarity – Elliott Wave and Cycle Theory

The alternating 15.6-year cycle is composed of a near-centrally translated 7.8-year interval from peak-to-trough-to-peak etc. That means the last cycle-trough traded in March ’08 was due to peak next in Q1/Q2 2016. It was a little late which is due to the fact that the centrally translated rhythm is not exact but its close enough if backed up by Elliott Wave analysis. The March ’08 advance is labelled as a corrective upswing, a zig zag or double zig zag pattern. Using WaveTrack’s proprietary fib-price-ratio model for this pattern, extending the first zig zag into the March ’09 peak at 89.62 by a fib. 61.8% ratio projects a terminal high for the secondary zig zag to 103.77+/-. January ‘17’s high at 103.82+/- traded within 5 pips of this number, then responded lower afterwards. It has been declining since. See fig #2.

USD Index – Weekly

These two disciplines, Elliott Wave and Cycle Theory are confirming the US$ dollar ended its 7.8-year advance which encompassed the financial-crisis and U.S. economic expansion. But this is changing now. We (unfortunately) don’t have a crystal ball to determine why the US$ dollar should begin a new 7.8-year cycle decline – we can, of course, hypothesise, just as you can too, but from my experience, the outcome can often be totally different. So many times in the past have we saw a different fundamental/economic reason unfold than we thought and yet still validating the Elliott Wave analysis. One thing for sure though, there’s plenty of room for fund managers to catch up on the larger downtrend later, even if their current outlook is somewhat restricted.

The Next 6-Months – New CURRENCIES & INTEREST RATE Mid-Year Video

In the meantime, the US$ dollar’s medium-term trend along with many other major crosses and pairs are updated in our latest MID-YEAR CURRENCIES and INTEREST RATE video. This is the 3rd and final video in this TRILOGY series which includes Stock Indices/Equities and Commodities. This PART III video commentary examines the major US$ dollar crosses including cycles for the EURO/US$, Elliott Wave analysis for STLG/BRITISH POUND against the DOLLAR, the EURO and the YEN, how the commodity currencies are set to continue like the AUSSIE DOLLAR and its performance against the KIWI – the CANADIAN DOLLAR and several ASIAN FX pairs that make up the ASIAN DOLLAR INDEX. The video also updates the MEXICAN PESO, BRAZILIAN REAL, SOUTH AFRICAN RAND, RUSSIAN ROUBLE, POLISH ZLOTY and CHINA’S RENMINBI/YUAN.

This is probably the most comprehensive, most accurate ELLIOTT WAVE FX analysis ever conceived – there are 56 charts and tables + a downloadable .pdf. Even if you’re trading short-term CURRENCY set-ups, this video is an ‘absolute-must’ in giving perspective to your existing strategies. Don’t delay, order you video and accompanying .pdf charts NOW! Just follow the links below and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Head Elliott Wave Analyst

WaveTrack International

CURRENCIES and INTEREST RATES Table of Contents: 56 charts

• US$ Index and Cycles

• Euro/US$ and Cycles

• Stlg/US$

• US$/Yen

• US$/CHF

• AUD/US$

• NZD/US$

• US$/CAD

• Euro/Stlg

• STLG/Yen

• Euro/Yen

• Asian ADXY

• US$/IDR

• US$/ZAR

• US$/BRL

• US$/RUB

• US$/CNY

• USD/MXN

• ZAR/US$

• GBP/ZAR

• US$/BRL

• US$/RUB

• US$/PLZ

• US 30yr Yield

• US 10yr Yield

• US 10yr TIPS Break Even Inflation Rate

• DE 10yr Yield

• JPY 10yr Yield

How can you order the new CURRENCIES and INTEREST RATES video forecast?

PART III CURRENCIES and INTEREST RATES VIDEO is available now, at only $48.00! (1 hour 50 mins long)

We’ll send you a personal link so that you can watch the video, anytime at your convenience.

And if you’d like to subscribe to the CURRENCIES and INTEREST RATES VIDEO offer, you can receive ALL THREE for $96.00! – that’s a saving of 33% per cent!

• Single Video – $48.00

• Triple Package offer – $96.00 (saving 33%)!

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00 – PART III CURRENCIES and FIXED INCOME (June ’17)

Triple Package offer – $96.00 (saving 33%)! – PART I – PART II – PART III (June ’17)

PART I – the latest STOCK INDICES video runs for 1 h 50 minutes featuring 46 charts – click here

PART II – the latest COMMODITIES video runs for 1 h 30 minutes featuring 52 charts – click here

To receive your VIDEO UPDATE please click here to contact us.

– Please state if you wish to purchase the SINGLE VIDEO for CURRENCIES and INTEREST RATES for USD 48.00?

– Or opt for the TRIPLE PACKAGE for USD 96.00 in total?

– Next we will send you a PayPal payment request and provide you with the video link & PDF report once confirmed.

Havn’t got a a PayPal account? We accept all major credit cards – just tell us your preferred payment method in your email and we’ll send you instructions.

Visit us @ www.wavetrack.com

COMMODITIES VIDEO – Precious Metals Soar!

by WaveTrack International| June 19, 2017 | No Comments

Commodities Video Series | PART II/III

INDUSTRIALS, ENERGY SET TO RESUME HIGHER – PRECIOUS METALS TO SOAR!

Includes new 6-MONTH OUTLOOK FORECASTS

The grand ‘RE-SYNCHRONISATION’ process of 2016 produced a realignment of major asset classes following divergences over the preceding years from the 2011 peaks. Developed and Emerging market indices synchronised in January/February 2016 by ending major corrections into the lows, then resuming secular-bull uptrend thereafter. But it wasn’t just stock markets that underwent this recycling. Commodities also formed major corrective lows into the exact same time zone which was the reason behind such huge percentage gains that were recorded into the first half of last year.

The grand re-synchronisation was probably the most important even of last year but it was largely unrecognised by the financial community. Mainly, because asset managers are mostly specialising in individual asset classes rather than taking a macro-holistic approach to investment.

Not only that, but when these different asset classes are lined-up together with the help of viewing them through the lens of the Elliott Wave Principle, suddenly we see a glimpse into the future. That realisation is very profound because ‘seeing’ into the future price development of markets can be, is a humbling experience. I’ve witnessed this so many times during my 40-years in trading and yet each new glimpse is as special as all those of the past.

Impulses, Zig Zags & Expanding Flats

What makes the ‘RE-SYNCHRONISATION’ process special is the way it aligns disparate Elliott Wave pattern development into an alignment of ‘POSITIVE-CORRELATION’.

When stock markets peaked in 2007/08, so did commodity markets and when prices collapsed during the 2008/09 financial-crisis, both asset classes formed major lows within just a few months of each other. The recovery phase also saw both trend higher afterwards and that’s where the great puzzle begins.

Whilst U.S. stock markets began new secular-bull 5-wave impulse uptrends, many commodity markets began the same advance but as 3-wave zig zags, or in some cases double zig zags. And these zig zags are simply the second sequence within even larger, multi-decennial expanding flat patterns – yes it all gets a little complicated. But herein lies the hidden path that future price development is taking.

It’s no wonder that during 2011-2016, commodity prices declined rapidly whilst U.S. stock markets trended higher because it was a necessary function in order to allow the 5-wave development of one to play out whilst allowing a 3-wave pattern unfold in the other. In fact, the commodity correction in 2011-2016 realised wave ‘B’ within the zig zag upswing unfolding from the financial-crisis lows whilst the 3rd wave uptrend continued in stocks. The resynchronisation occurred when wave ‘B’ ended last January/February at the same time a minor fourth wave correction completed in stocks.

From an Elliott Wave pattern perspective, they were now realigned in positive-correlation and can both head higher in the next major phase of their respective patterns. But what of 2017?

The Next 6-Months

So far, this year has delivered different performances following last year’s impressive commodity gains. Base Metals have undergone counter-trend retracements as has the Energy sector. These are seen co-existing in a shorter-term positive-correlation environment which is largely dependent on how supply imbalances are being worked off. Precious metals ended their corrective declines earlier, last December (2016) and are already resuming larger uptrends established from last year’s lows as geopolitical events have a positive impact.

Just recently however, the Base Metals and Energy sectors have or are approaching the end of these shorter-term corrective phases that began from last year’s peaks. This is happening at the same time that Precious Metals are building a strong platform of support in preparation for the next stage of accelerative advances. From this we can determine that all three commodity sectors are poised to surge higher for the remainder of 2017!

New Commodities Mid-Year Video Forecast

This MID-YEAR 2017 COMMODITIES video takes a look at how these shorter-term realignments fit together across Base Metals, Precious Metals and the Energy complex for Crude and Brent Oil. We show how the ‘RE-SYNCHRONISATION’ process of 2016 dovetails with ‘POSITIVE-CORRELATION’ studies, how these interact and combine to reveal this next stage of major price advances into the second-half of this year, 2017.

We invite you to take this next part of our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Head Elliott Wave Analyst

WaveTrack International

COMMODITIES VIDEO Table of Contents: 52 charts

• S&P- Hang Seng-MSCI Emerging Markets-Singapore Straits – Correlation

• S&P 500 - Crude Oil- Copper – Correlation

• MSCI EM vs. Copper – Correlation

• Palladium vs. Nasdaq 100 – Correlation

• Crude Oil vs. Copper – Correlation

• Copper/EM – EW Pattern

• Base Metals Miners – EW Pattern

• Precious Metal Miners – EW Pattern

• Crude Oil – EW Pattern

• AUD vs. CRB Cash Index – Correlation

• CRB Cash Index – Weekly – Cycle

BASE METALS

• Copper vs. AUD – Weekly – Correlation

• Copper – Weekly – Composite Cycle

• Aluminium – Daily

• Lead – Weekly

• Zinc – Daily

• Nickel – Daily

• XME – Metals Mining – Daily

• BHP Billiton – Weekly

• Freeport McMoran – Weekly

• Antofagasta PLC – Weekly

• Anglo American – Weekly

PRECIOUS METALS

• Silver vs. Copper – Weekly – Correlation

• Gold – Monthly – Composite Cycle

• Gold – Count #1 and #2

• GDX – Gold Miners Index – Weekly

• Newmont Mining – Weekly

• GoldCorp Inc. – Weekly

• Amer Barrick – Weekly

• Agnico-Eagle Miners – Weekly

• AngloGold Ashanti – Weekly

• Silver – Composite Cycle and Count #1 and #2

• XAU – Gold/Silver Miners – Weekly

• Gold/Silver Ratio vs. Silver – Correlation

• Gold/Silver Ratio – Weekly

• Palladium vs. Silver – Correlation

• Palladium – Monthly

• Palladium vs. Silver – Correlation

• Platinum – Weekly

ENERGY / CRUDE OIL

• Crude Oil – Weekly – Composite Cycle

• Crude Oil – Count #1 and #2

• Brent Oil – Weekly

How can you order the new COMMODITIES video forecast?

PART II COMMODITIES VIDEO is available now, at only $48.00! (1 hour 30 mins long)

We’ll send you a personal link so that you can watch the video, anytime at your convenience.

And if you’d like to subscribe to the STOCK INDICES video PART I and up-coming CURRENCIES videos PART III, you can receive ALL THREE for $96.00! – that’s a saving of 33% per cent!

• Single Video – $48.00

• Triple Package offer – $96.00 (saving 33%)!

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00 – PART II COMMODITIES (June ’17)

Triple Package offer – $96.00 (saving 33%)! – PART I – PART II – PART III (June – July ’17)

The latest STOCK INDICES video runs for 1 h 50 minutes featuring 46 charts – click here

PART III for Currencies and Interest Rates will be available in a few weeks’ time (June/July 2017!) – we’re working on it!

To receive your VIDEO UPDATE please click here to contact us.

– Please state if you wish to purchase the SINGLE VIDEO for COMMODITIES for USD 48.00?

– Or opt for the TRIPLE PACKAGE for USD 96.00 in total?

– Next we will send you a PayPal payment request and provide you with the video link & PDF report once confirmed.

Havn’t got a a PayPal account? We accept all major credit cards – just tell us your preferred payment method in your email and we’ll send you instructions.

Visit us @ www.wavetrack.com