Stock Indices Video Outlook 2026 – PART I/III

by WaveTrack International| December 31, 2025 | No Comments

Stock Indices Video Outlook 2026

AI (Artificial Intelligence) Roadmap 2026!

AI – Short-term Correction – Upside Continuation

Highlights 2026

and so much more

The Elliott Wave Signal Most Investors Will Miss Before 2026

Every year, markets tell a story. Most investors hear the noise—but only a few understand the plot.

In WaveTrack International’s Elliott Wave Triple Video Outlook 2026, Peter Goodburn and his team step back from headlines and sentiment to reveal the structure beneath the chaos. This three-part annual video series maps the medium- and long-term trajectory of global markets—stock indices, commodities, currencies, and interest rates—using one unifying framework: the Elliott Wave Principle.

Part I: Stock Indices—the focus of this first release—analyses nearly 140 global equity charts across the U.S., Europe, and Asia. But this isn’t just a forecast for next year. It’s a roadmap that stretches into the final stages of the current “Inflation-Pop” cycle, potentially defining how this decade ends. Central to the discussion is one question investors can’t stop asking:

Is AI a bubble—or the engine of the next major wave higher?

This video doesn’t argue opinions. It lets the waves speak.

Why This Outlook Changes How You See 2026

Here’s what makes this outlook different: it doesn’t focus on what might happen—it focuses on when and how markets typically unfold.

A short-term correction appears increasingly likely as 2026 begins, setting the stage for a powerful continuation phase later in the year. This rhythm—pause, then acceleration—is especially important for investors exposed to AI, mega-cap technology, and global indices.

The analysis challenges popular narratives. While mainstream commentary debates whether AI is in a speculative bubble, the wave structure suggests something more nuanced:

a correction, not a collapse—followed by leadership into new highs.

Under the surface, short-term sentiment indicators flash warnings: fund managers holding record-low cash, crowded trades in the MAG-7, margin debt divergences, and option activity at historical extremes.

To provide perspective, the video goes far beyond recent history. You’ll see Elliott Wave patterns applied to the Dow Jones stretching back to the 1700s, revealing recurring long-cycle rhythms that still influence markets today. This historical lens helps explain why short-term volatility may be necessary before the next sustained advance—and why 2026 could be a defining year rather than a final peak.

From U.S. indices and AI leadership, to European relative strength, emerging market rotations, and global synchronisation, the message is clear:

Markets are aligning—but timing will be everything.

And that’s exactly what this video is designed to help you see—before the rest of the crowd does.

The Elliott Wave Triple Video Outlook 2026 isn’t about predictions.

It’s about preparation.

If you want to understand where this cycle may be heading—and how today’s uncertainty fits into a much bigger picture—this is where the story truly begins.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Video Outlook 2026

Charts: 141 | Video: 2 hours 50 mins.

CONTACT US NOW – SELECT YOUR PACKAGE

Single Video – *$66.00 – PART I Stock Indices Video Outlook 2026 (December ’25) or send us an email to services@wavetrack.com

Triple Package offer – *$122.00 (discount)! – PART I – PART II – PART III (January – February ’26)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

ORDER NOW

1. Click on the payment link.

2. Choose your Stock Indices Video Outlook or Triple Video Outlook.

3. Start trading with clear patterns and confidence.

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customer except EU customers click here.

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

– Or opt for the TRIPLE PACKAGE for USD *122.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always interested to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Currencies and Interest Rates Mid-Year Video Update! PART III/III

by WaveTrack International| August 25, 2025 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Mid-Year Update 2025 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES and INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Now, let’s look at some of the Currencies and Interest Rates Mid-Year Video Highlights that are crucial to know during this economic timeline…

Highlights

Currencies and Interest Rates – Turning Point

The financial world is at a turning point. After months of steady US dollar weakness and central banks cutting rates across the globe, sentiment is shifting fast. WaveTrack International’s latest EW-Navigator Video Report – Part III of our Mid-Year Trilogy takes you inside the charts with Elliott Wave analysis across Currencies and Interest Rates, revealing what’s next for the markets.

A Contrarian Dollar Rally?

The US dollar has fallen over -12% since January, and sentiment towards “King Dollar” has collapsed to a 20-year low. On the surface, the story seems simple: debt burdens are mounting, global reserves are diversifying away from the dollar, and traders are overwhelmingly long the euro.

But here’s the twist—such extremes often mark turning points. WaveTrack’s analysis suggests that a contrarian US dollar rally could be right around the corner, lasting several months before the long-term decline resumes.

Key signals include:

Interest Rates – The Decline After the Surge

Central banks worldwide have been trimming rates, but the US Federal Reserve has been dragging its feet. Markets now price in at least two rate cuts from the Fed, while long-term bond yields are preparing for their next big move.

WaveTrack’s forecasts highlight:

Crypto Joins the Story

While traditional markets wrestle with currencies and yields, the crypto space looks far more bullish. WaveTrack projects long-term upside targets of:

These cycles position cryptocurrencies as a dynamic counterweight to fiat and bonds, particularly during downturns in risk assets.

Why This Matters Now

The US dollar’s positioning at a 20-year underweight and the historic scale of US national debt ($36.2 trillion and rising) set the stage for volatile, market-defining moves. The interplay between tariffs, trade wars, and central bank policy means traders and investors cannot afford to rely on old narratives.

WaveTrack’s Elliott Wave roadmap provides clarity in the chaos, revealing how currencies and yields are likely to unfold—not just over the next few months, but deep into the next few years.

Get ready to gain a fresh perspective, delivered right to your screen. Prepare for enlightening discussions, visual breakdowns, and the latest market insights based on Elliott Wave, Fibonacci-Price Ratio’s and Cycle work – all in one place.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 132+ charts | VIDEO DURATION: nearly 2 hours 28 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (92 charts):

• US Effective Tariff Rate

• National Debt, USD, EUR Sentiment, Fed Rates, CPI an more

• US Yield Curve

• G10 Interest Rates

• US$ Index

• USD COT

• Euro/US$

• EUR COT

• Stlg/US$

• STLG COT

• US$/Yen

• YEN COT

• CHF COT

• US$/CHF

• US$/NOK

• US$/SEK

• US$/CAD

• CAD COT

• NZD/US$

• AUD/US$

• AUD COT

• NZD COT

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• STLG/Yen

• AUD/Yen

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• USD/ILS

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

• XRP Ripple

Interest Rates (40 charts):

• History of Interest Rates

• US FED Funds

• US Fed Rate Cuts, Global Sentiment, Trade War…

• US30yr Yield + Cycle

• US10yr Yield + Cycle

• US2yr Yield

• US2yr-10yr Yield Spread

• US10-DE10yr Yield Spread

• DE10yr Yield

• DE2yr Yield

• DE2-DE10yr Yield Spread

• UK10yr Yield

• Australia 10yr Yield

• Canada 10yr Yield

• Japan 10yr Yield

BUY NOW! FOR CLIENTS OUTSIDE THE EU (no extra VAT)

Simply click on this PayPal Payment link to purchase the CURRENCIES + INTEREST RATES Mid Year Video Update 2025 for USD 55.00 or alternatively our Triple Video Offer for USD 111.00 NOTE: We offer these videos at lower prices without VAT and no extra fees – but the processing can take up to 6 hours. No instant access.

BUY NOW! FOR CLIENTS within the European Union! (plus VAT)

Simply click on this PayHip Page link to purchase the CURRENCIES + INTEREST RATES Mid Year Video Update 2025 for USD 65.00 (+VAT and processing fees! However, you get immediate access!) or alternatively our Triple Video Offer for USD 122.00 + VAT and processing fees

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Commodities Mid-Year Video Update PART II/III

by WaveTrack International| July 29, 2025 | No Comments

Commodities Mid-Year Video Update 2025!

We’re pleased to announce the publication of WaveTrack’s Mid-Year Triple Video Update 2025 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART II, COMMODITIES – Part I was released last month and Part III will be published in late-July / beginning of August 2025…

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Commodities Forecast Highlights 2025 and beyond!

and so much more…

Commodities Mid-Year Video Update 2025 – Where Are the Markets Headed Next?

Are Commodities Approaching a Tipping Point? The 2025 mid-year landscape is rapidly evolving—and our latest Commodities Video Update (Part II) is here to help you stay ahead of the curve.

This exclusive update dives deep into the forces driving global commodity markets, revealing both risks and opportunities with over 97 expertly analyzed charts. Whether you’re trading, investing, or managing portfolios, this is essential viewing for staying informed and positioning effectively for the months ahead.

Energy & Base Metals – The Downtrend Deepens

A clear theme has emerged: Base Metals and Energy are entering the next phase of multi-month declines.

Read more «Commodities Mid-Year Video Update PART II/III»

Stock Indices Mid-Year Video Update PART I/III

by WaveTrack International| June 25, 2025 | No Comments

Stock Indices Mid-Year Video Update 2025

Includes ECONOMIC INDICATOR & SENTIMENT STUDIES

Fang+ 7 Mag-7 Equities to outperform Tech Indices

Analyzing the Markets: Insights from Elliott Wave Theory for Traders and Investors

As investors and traders, staying updated on Stock Indices market trends is crucial for making informed decisions. Earlier this year, we witnessed significant movements in the stock market, particularly around April, which has set the stage for current and future trading opportunities. Many of our subscribers could take advantage of our Elliott Wave Video Outlook 2025 already as we forecasted the SP500, Nasdaq100, Alphabeth/Google amongst others correctly…

As we reach the midpoint of 2025, financial markets are in a continual state of flux, influenced by various sentiment shifts and underlying factors that affect trading strategies. If you’re an investor interested in Elliott Wave analysis and the dynamics of stock indices, you’re in for a treat with WaveTrack’s Stock Indices Mid-Year Video Update.

In this post, we’ll break down the essential insights from the Stock Indices Mid-Year Video Update. We’re covering everything from market corrections to potential future trends, all while ensuring it’s easy to digest for both seasoned investors and the financially curious.

A Quick Look Back: April Low Points

In December, forecasts indicated a potential correction of 20-30% for major indices. Especially those tied to AI technologies. Fast-forwarding to April, those projections materialized as the markets hit key downside targets. This period of uncertainty, however, has laid the groundwork for a new bull market uptrend.

Current Market Sentiment: What the Data Shows

Despite a recovery since April, large asset managers are exhibiting a degree of hesitation. Their equity allocations have only modestly increased, remaining net -38% underweight in U.S. equities. This sentiment is deemed contrarianly positive; when big players show reluctance, it often suggests that a broader market rally could be on the horizon, particularly as hedge funds are demonstrating renewed interest.

MAG7 – FANG+ Technology Sector Spotlight

The video focuses on the performance of major technology stocks, notably the Fang+ and Mag-7 equities. As per Elliott Wave principles, these stocks showcase strong uptrends driven by hedge fund activities. Riding these waves could be beneficial for those looking to capitalize on the tech boom we are witnessing.

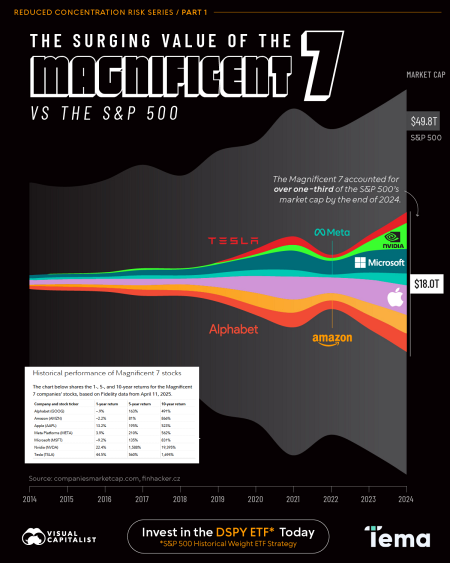

Fig #29 – % Capitalisation of Magnificent 7 Stocks in S&P 500 – WaveTrack International’s Mid-Year Financial Video Forecast 2025

Sector Highlights: Banks and Semiconductors

Following April’s lows, various U.S. sectors are showing signs of recovery. Particularly, banks and semiconductors are seen as having bottomed out and are primed for growth. For instance, the semiconductor sector is positioned to outperform, which can be pivotal as technology continues to be a driver of market momentum.

European Markets: An Attractive Alternative

Interestingly, as U.S. asset managers recalibrate their portfolios, there has been a notable shift towards European equities. Drawn by more attractive valuations compared to the U.S. In contrast, benchmarks like the Eurostoxx 50, Xetra DAX, and FTSE-100 have all bottomed and are entering new bullish uptrends. This could suggest a potential for considerable gains if you have exposure to these markets.

Global Indices: A Mixed Outlook

When examining global indices, the MSCI Emerging Markets index presents a more complex picture. While there’s bullish sentiment for countries like Brazil, Russia, and India, China’s indices are at a crossroads. Above all, the balancing between bearish and bullish scenarios is essential. Monitoring resistance levels in these markets will be vital for determining the next directional movement.

Why You Should Watch WaveTrack’s Mid-Year Update

In conclusion, WaveTrack’s Stock Indices Mid-Year Video Update offers a keen insight into market dynamics and provides practical information that can assist investors in navigating their trading strategies effectively. With the market facing both challenges and opportunities, leveraging Elliott Wave analysis could be your edge in achieving financial success in today’s complex landscape.

Stay ahead of the curve—watch the full video update now and prepare for what’s to come in the second half of 2025!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Mid-Year Video Update 2025

Charts: 110 | Video: 2 hours 30 mins.

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

Single Video – *$55.00 – PART I Stock Index Mid-Year Video Uptrend 2025 (June ’25) or send us an email to services@wavetrack.com

Triple Package offer – *$111.00 (saving!)! – PART I – PART II – PART III (June – August ’25)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the Europeean Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customers click here.

– Or opt for the TRIPLE PACKAGE for USD *111.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Currencies + Interest Rates Outlook 2025 PART III/III

by WaveTrack International| March 3, 2025 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Outlook 2025 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES + INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES + INTEREST RATES – out now!

Now, let’s look at some of the Currencies + Interest Rates Outlook Highlights that are crucial to know during this economic timeline…

Currencies + Interest Rates Highlights

…

The Rise & Fall of King Dollar – Major Market Shifts Ahead

For decades, the U.S. dollar has reigned supreme as the world’s dominant currency. However, significant macroeconomic and geopolitical shifts are now setting the stage for a potential decline. Our latest Currencies & Interest Rates Video provides a comprehensive analysis of this unfolding trend, offering key insights into global markets, currency movements, and interest rate expectations for 2025 and beyond.

Is the Dollar’s Dominance Coming to an End?

The Federal Reserve’s interest rate policy has long played a crucial role in supporting the strength of the U.S. dollar. However, as G10 central banks resume their rate-cutting cycles while the Fed hesitates, the balance of power is shifting. With U.S. debt spiraling out of control and growing concerns about de-dollarization, confidence in the greenback is waning. Will the Federal Reserve be forced into action? Our analysis highlights the key scenarios that could unfold.

Recession Risks vs. Inflation Pressures – What Comes Next?

The global economy stands at a crossroads. While recession risks remain high following the yield curve inversions of 2022-23, inflationary pressures could resurface due to new tariff policies under the Trump administration. This presents a major dilemma for the Fed: cut rates to support growth, or hold firm to prevent inflation from reigniting? Meanwhile, central banks worldwide are adjusting their policies in response to shifting economic conditions.

Our video explores:

✔️ US Interest Rates & Federal Reserve Policy – Where are rates heading next?

✔️ Stagflation or Recession? – Key indicators to watch.

✔️ Global Debt Concerns – How rising debt levels could reshape monetary policy.

Currency Markets: A Major Realignment is Underway

A weakening dollar doesn’t just impact the U.S. economy—it has far-reaching implications for global currency markets. Our Elliott Wave analysis indicates that the US dollar index is entering a long-term corrective decline, setting the stage for:

✔️ Stronger Euro & Japanese Yen – Key technical patterns indicate major upside potential.

✔️ BRIC Currencies on the Rise – Emerging markets are gaining strength against the USD.

✔️ Major Currency Crosses in Focus – Euro/GBP, Euro/JPY, and more.

Bitcoin & Cryptos: The Next Big Move

The crypto market continues to evolve, with Bitcoin’s long-term uptrend intact and price targets extending towards 929k. Our detailed charts highlight the next key levels for Bitcoin, Ethereum, and other major digital assets. Could Ethereum soon outperform Bitcoin? Our Elliott Wave projections reveal critical insights for traders and investors.

A Must-Watch for Traders & Investors

Understanding the larger macro trends is essential for making informed trading and investment decisions. Our Currencies + Interest Rates Video Outlook 2025 provides an unparalleled perspective on the markets, combining Elliott Wave Theory, Fibonacci-Price Ratios, and Cyclical Analysis to forecast major moves across asset classes.

Gain expert insights on:

✔️ The evolving US Dollar cycle and its impact on global currencies.

✔️ Interest rate trends and what central banks are likely to do next.

✔️ Opportunities in crypto markets as Bitcoin and Ethereum set up for their next moves.

Stay ahead of the markets with WaveTrack’s cutting-edge analysis. Join us today and gain the insights you need for 2025 and beyond!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 142 charts | VIDEO DURATION: nearly 2 hours 39 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (96 charts):

• Developed Market Interest Rates

• G10 Central Bank Policy

• Scenarios for the US Economy…

• US Yield Curve

• De-Dollarisation

• US$ Index + Cycles

• USD COT

• Euro/US$

• EUR COT

• Stlg/US$

• STLG COT

• US$/Yen

• YEN COT

• CHF COT

• US$/CHF

• US$/NOK

• US$/SEK

• AUD/US$

• AUD COT

• US$/CAD

• CAD COT

• NZD/US$

• NZD COT

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• AUD/YEN

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• USD/ILS

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

Interest Rates (46 charts):

• US10yr Yield + Cycle

• US2yr Yield

• US30yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• US10-DE10yr Yield Spread

• DE10yr Yield

• DE2yr Yield

• UK10yr Yield

• Australia 10yr Yield

• Canada 10yr Yield

• Japan 10yr Yield

How to buy the Currencies + Interest Rates Video Outlook 2025

Simply click on this PayPal Payment link to purchase the CURRENCIES + INTEREST RATES Video Outlook 2025 for USD 55.00 (+ VAT where applicable) or alternatively our Triple Video Offer for USD 111.00 (+ VAT where applicable) – Get WaveTrack’s Stock Indices Video PART I here and the Commodities Video PART II here.

If you prefer to pay via a secure Credit Card payment link please contact us @ services@wavetrack.com ! Many thanks.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Elliott Wave Hub Event Invitation!

by WaveTrack International| February 20, 2025 | No Comments

Elliott Wave Hub Event

Elliott Wave analysis is possibly THE most powerful means of predicting market movement. The question is, are you harnessing that power?

Join Peter Goodburn and 15 other Elliott Wave, Fibonacci and Gann experts on Tuesday, February 25th and Wednesday, February 26th from 10am-6pm ET for the Elliott Wave Hub Forecasting event, a unique market analysis event.

This event has come a long way since we started in 2020, and for this milestone, we’re expanding it to a 2-day event and incorporating the incredible power of Fibonacci and Gann analysis!

We’ll show you exactly how you can use the same type of Elliott Wave analysis that is used by most big banks and institutions to profit consistently in your account. We’ll be looking at LIVE MARKETS on Stocks and Options, Forex, Futures and Cryptos…

Why join this workshop?

• Top Experts: Learn directly from world-renowned Elliott Wave, Fibonacci and Gann professionals. See their long-term perspectives on the markets you watch and trade.

• Live Market Analysis: We’ll explore the hottest markets (Stocks and Options, Forex, Futures and Cryptos) in real-time to uncover actionable trade opportunities.

• Practical Trade Ideas: Gain strategies and techniques you can use immediately to enhance your trading.

• Entries & Exits: Discover reliable methods to find the best trade setups, including entries, stop losses, and profit targets.

• Simplified Wave Counting: Learn an easy, effective way to count waves and simplify your trading.

• Cutting-Edge Tools: Experience the latest innovations in Elliott Wave software for faster, more efficient analysis.

BONUS: Space is limited, and we’ll also be giving away FREE GIFTS during the event—but you have to attend to qualify!

Let’s make this 10th Elliott Wave Hub an unforgettable experience.

I’ll see you there!

Commodities Video Outlook 2025 PART II/III

by WaveTrack International| January 28, 2025 | No Comments

Commodities Video Outlook 2025

Expert Financial Forecasts for Market Success

WaveTrack International is proud to present the latest installment of our Annual Trilogy Video Series, an in-depth analysis of financial markets using the renowned Elliott Wave Principle. This comprehensive video series provides price forecasts for 2025 and extends into the culmination of the current ‘Inflation-Pop’ Cycle, expected to complete around 2027-2030. Divided into three insightful parts, the series covers:

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now! Buy here

• PART III – CURRENCIES & INTEREST RATES – coming soon!

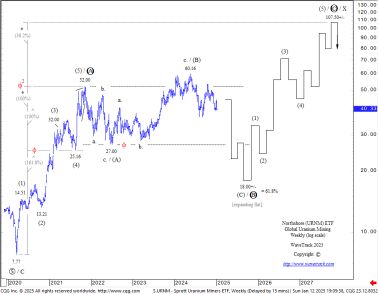

A Deep Dive Into Commodities – Part II

In Part II, we examine over 79 Elliott Wave charts and cycles across the Commodities sector, encompassing Base Metals, Precious Metals, and Energy. This year’s analysis takes a meticulous look at key market drivers, significant price trends, and sector-specific dynamics.

What’s Inside?

Base & Precious Metals

We dive into leading Base Metal and Precious Metal Miners, providing Elliott Wave-based price forecasts and critical levels to watch. Strategic metals like Iron Ore, Uranium, and Rare Earths ETFs also feature prominently in this year’s report, reflecting their growing importance in global markets.

Energy & Inflation-Sensitive Commodities

Our analysis extends to inflation-sensitive assets such as Energy and Food, offering insights into ETFs like the DB Agriculture Fund.

Fibonacci-Price-Ratio Analysis

WaveTrack’s proprietary techniques blend Elliott Wave patterns with geometric principles of ratio and proportion, illustrating price convergence points through Fibonacci-based matrices. This method provides a detailed road map for traders and investors alike.

Intermarket Relationships

Commodities do not operate in isolation. Our analysis emphasizes the interconnectedness of various asset classes, highlighting the importance of viewing the broader market matrix, even if you trade a single asset.

Commodities Key Market Drivers for 2025

This year’s report begins with an overview of the major forces shaping commodity markets in 2025. Key drivers include:

Inflationary Expectations: As the 2024 U.S. presidential election approaches, markets are pricing in rising inflation due to potential increases in trade tariffs and protectionist policies.

Geopolitical Risks: Ongoing conflicts, such as Ukraine/Russia and tensions in the Middle East, continue to create volatility in commodity prices.

Recession Risks & the U.S. Dollar: While recession fears linger following the U.S. yield curve inversion in 2022, a potential decline in the U.S. dollar—expected through Elliott Wave analysis—could mitigate these risks and support commodity prices.

Why This Report Matters

Whether you’re a trader, investor, or market enthusiast, this year’s Commodities Video Outlook offers actionable insights and detailed analysis to help navigate the complexities of global markets. The Elliott Wave Principle, combined with Fibonacci-Price-Ratio projections, offers unparalleled clarity on future price developments.

Get Started

This is your opportunity to gain exclusive access to the latest insights from WaveTrack International. With the growing importance of commodities in a world shaped by inflationary pressures and geopolitical risks, this report is a must-have resource for anyone seeking to stay ahead in today’s markets.

Sincerely,

Peter Goodburn & EW-team

Commodities Video Outlook 2025 Part II/III

Contents: 79 charts

Time: 2 hours 16 mins.

• FED, Interest Rate, Inflation charts

• US 10yr Yield Cycle

• China Growth

• Commodities Headwinds + Tailwinds

• US Dollar index

• CRB-Cash index

• Food and Agriculture Index

• DB PowerShares Agriculture Fund

• Baltic Dry Index

• Copper

• Aluminium

• Lead

• Zinc

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Glencore

• Rio Tinto

• Vale

• Iron Ore

• Uranium

• Rare Earths

• Gold

• Gold-Silver Ratio

• Silver

• Gold/Platinum Ratio

• Platinum

• Palladium

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• XAU Gold/Silver Index

• Crude Oil

• Brent Oil

• Natural Gas

• TTF Natural Gas

• XLE Energy SPDR

• XOP Oil and Gas Index

How can you purchase the video?

1. Single Commodities Video! Simply click on this PayPal payment link for the Commodities Video Outlook 2025 for USD 55.00 (for non-EU clients). Please note that it can take up to 6 hours until you receive this video.

2. Triple Video! Simply click on this PayPal payment link for the Triple Video Outlook 2025 for USD 111.00 (for non-EU clients). This covers Stock Indices, Commodities and Currencies + Interest Rates. Please note that it can take up to 6 hours until you receive this video.

3. Additionally, we now offer as well payment via credit card payment link – For the credit card payment option please Contact us @ services@wavetrack.com and state if you like to purchase the Commodities Single video for USD 55.00 + VAT* or the Triple Video for USD 111.00 +VAT*?. Thank you.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Stock Indices Video Outlook 2025

by WaveTrack International| December 29, 2024 | No Comments

Stock Indices Video Outlook 2025

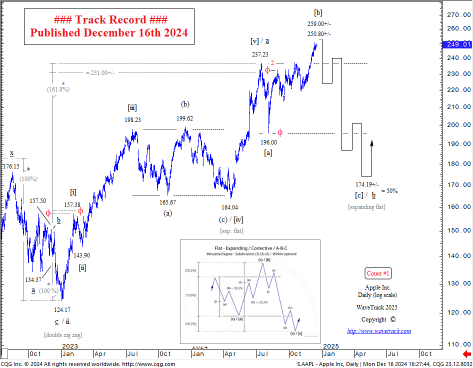

Tough Start for President Trump! – Technology Sell-Off – AI Correction in 2025!!

FANG+ Returns to August ’24 Lows

Highlights 2025

Unlocking Market Insights for 2025 – Exclusive Report and Video Release

As we navigate the complexities of a rapidly evolving financial landscape, WaveTrack International is thrilled to announce the release of our 2-hour and 38-minute video analysis and PDF report—a comprehensive resource that unpacks the trends shaping equity markets worldwide.

The Bigger Picture – U.S. Indices and Secular-Bull Trends

From the financial crisis lows of 2009, U.S. indices have been carving out an extraordinary secular-bull uptrend. Current benchmarks, like the S&P 500 and Nasdaq 100, are positioned within the third wave of a 5th wave ending-diagonal pattern. While medium-term outlooks remain bullish, short-term corrections of up to -30% are anticipated for the first half of 2025.

Global Insights – From Europe to Emerging Markets

Sector-Specific Trends

Technology giants such as Amazon, Apple, and Nvidia, fueled by the AI frenzy, are projected to underperform, with corrections breaking below their August 2024 lows. Meanwhile, sectors like Financials, Technology, and Healthcare could see declines ranging from -18% to -30%.

Why This Report Matters

What’s Inside the Video and Report?

Get Ahead of the Curve

Whether you’re a seasoned trader or a market enthusiast, this report and video are invaluable tools to understand the opportunities and risks ahead in 2025.

Stay informed. Stay prepared. Let WaveTrack guide you through 2025 with confidence.

This STOCK INDICES Video Outlook 2025 is like nothing you’ve seen anywhere else in the world. It’s unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Fibonacci Price Ratios, Sentiment extremes and Economic data trends.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Video Outlook 2025

Charts: 113 | Video: 2 hours 38 mins.

CONTACT US NOW – SELECT YOUR PACKAGE

Single Video – *$55.00 – PART I Stock Indices Video Outlook 2025 (December ’24) or send us an email to services@wavetrack.com

Triple Package offer – *$111.00 (discount)! – PART I – PART II – PART III (January – February ’25)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

ORDER NOW

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customer except EU customers click here.

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

– Or opt for the TRIPLE PACKAGE for USD *111.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always interested to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Tags: Stock Indices Video Outlook 2025

Currencies + Interest Rates Mid-Year Video Update available! Part III/III

by WaveTrack International| August 21, 2024 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Mid-Year Update 2024 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES and INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Now, let’s look at some of the Currencies and Interest Rates Mid-Year Video Highlights that are crucial to know during this economic timeline…

Highlights

Currencies and Interest Rates Video Content

WaveTrack’s Currencies and Interest Rates video Part III will delve into the intricate world of currency pair analysis and interest rate development. In this video, we will be exploring over 140 charts of various currency pairs and crosses, alongside examining the interest rate trends of major economies such as the U.S., Europe, U.K., Australia, Canada, and Japan.

Looming Recession Risk?!

One of the central themes of this video is the looming recession risks that have been sparked by persistently high interest rates in the current cycle. While inflationary pressures are beginning to ease, the reluctance of Central Banks to initiate rate cuts could potentially lead to an economic downturn.

Will a move into Safe-Haven Currencies be safe?

This, in turn, may trigger a sell-off in risk assets, prompting investors to flock towards safe-haven currencies such as the Swiss Franc and the Yen.

However, this scenario could spell trouble for the US dollar, as dwindling interest rate differentials may weaken its position once the Federal Reserve is forced to lower rates.

Global Interest Rates and what Impact Central Banks might have

In the interest rate section of our analysis, we will take a deep dive into the long-term trends of treasuries and the impact that central banks are having on these trends and cycles. The video will also shed light on the analysis of European interest rates and spreads, as well as yields from the U.K., Australia, Canada, and Japan.

As we navigate through the complex web of currency pair analysis and interest rate development, we invite you to join us on this enlightening journey of unraveling the intricacies of the global financial landscape.

Get ready to gain a fresh perspective, delivered right to your screen. Prepare for enlightening discussions, visual breakdowns, and the latest market insights based on Elliott Wave, Fibonacci-Price Ratio’s and Cycle work – all in one place.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 140+ charts | VIDEO DURATION: nearly 2 hours 13 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (95 charts):

• US FED Rate & Inflation

• US Yield Curve

• G10 Interest Rates

• US$ Index + Cycles

• USD COT

• EuroZone Inflation + Interest Rates

• Euro/US$

• EUR COT

• Stlg/US$

• STLG COT

• US$/Yen

• YEN COT

• CHF COT

• US$/CHF

• US$/NOK

• US$/SEK

• US$/CAD

• CAD COT

• NZD/US$

• AUD/US$

• AUD COT

• NZD COT

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• STLG/Yen

• AUD/Yen

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• USD/ILS

• US$/TRY

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

Interest Rates (45 charts):

• History of Interest Rates

• US FED Higher Rates for longer

• US TIPs

• US30yr Yield + Cycle

• US10yr Yield + Cycle

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• US10-DE10yr Yield Spread

• DE10yr Yield

• DE2yr Yield

• DE2-DE10yr Yield Spread

• UK10yr Yield

• ITY10yr Yield

• Italy10-DE10yr Yield Spread

• Australia 10yr Yield

• Canada 10yr Yield

• Japan 10yr Yield

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

Simply click on this PayPal Payment link to purchase the CURRENCIES + INTEREST RATES Video Outlook 2024 for USD 49.00 (+ VAT where applicable – see below note for EU clients. Thank you!) or alternatively our Triple Video Offer for USD 99.00 (+ VAT where applicable)

– Review the content of WaveTrack Stock Indices Video PART I here and

– the Commodities Video PART II here.

If you prefer to pay via a secure Credit Card payment link please contact us @ services@wavetrack.com ! Many thanks.

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the European Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Commodities Mid-Year Video Update! Part II/III

by WaveTrack International| July 26, 2024 | No Comments

Commodities Mid-Year Video Update 2024!

We’re pleased to announce the publication of WaveTrack’s Mid-Year Triple Video Update 2024 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART II, COMMODITIES – Part I was released last month and Part III will be published in late-July / beginning of August 2024…

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Commodities Forecast Highlights 2024 and beyond!

Commodities Mid-Year Video Content

Are you ready to dive into the world of the Inflation-Pop cycle and the impact it has on commodity prices? The Financial Crisis may have been the catalyst, but the effects are still being felt today, with prices soaring and economies feeling the pressure.

The Past

Over the past fifteen years, we have seen incredible gains in commodity prices, spreading from risk-assets to stocks and beyond. Inflation has seeped into the global economy, affecting everything from food prices to job wages. Central banks have been forced to respond, with interest rates on the rise and quantitative tightening being reversed.

But is it too little, too late? The European Central Bank has already made moves to combat lower CPI, while the U.S. Federal Reserve is holding steady with high interest rates. With a record amount of commercial real estate up for refinancing this year, the potential for a banking crisis looms large.

Federal Reserve chairman Jerome Powell is sounding the alarm, warning of a possible economic downturn if rate cuts are not made soon. And with China facing its own property crisis, the ripple effects on commodity prices could be significant.

The possible Future?

Elliott Wave analysis suggests that Base Metals and Energy will continue to trend lower over the next year, while precious metals like gold and silver remain in bull markets. Even precious metal miners are expected to see corrections before resuming their upward trajectory.

Don’t miss out on this critical juncture in the market. Stay informed, stay ahead, and be ready for whatever the future holds in this ever-changing economic landscape. The Inflation-Pop cycle is far from over – are you prepared for what comes next?

Commodities Video Outlook 2024

With this new Commodities video you will review over 85 individual commodity contracts and Fibonacci Price Ratios within three main sub-sectors, Base Metals, Precious Metals, Precious and Base Metal Miners and Energy.

Don’t miss your chance to access this premium content, meticulously crafted to empower traders like you. Join us as we unveil the latest trends, strategies, and market analyses that will shape your success in the dynamic world of commodities.

Sincerely,

Peter Goodburn & EW-team

Commodities Mid-Year Video Update 2024 Part II/III

Contents: 85 charts

Time: 2 hours 12 mins.

• FED, Yield Curve, Inflation charts…

• US 10yr Yield Cycle

• China’s Property Crisis

• US Dollar index + Cycles

• CRB-Cash index + Cycles

• Food and Agriculture Index

• DB PowerShares Agriculture Fund

• Baltic Dry Index

• Copper

• Aluminium

• Lead

• Zinc

• Nickel

• Tin

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Glencore

• Rio Tinto

• Vale

• Iron Ore

• Uranium

• Rare Earths

• Gold

• Gold-Silver Ratio

• Silver

• Platinum/Silver Ratio

• Platinum

• Palladium/Gold Ratio

• Palladium/Platinum Ratio

• Palladium

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• XAU Gold/Silver Index

• Crude Oil

• Brent Oil

• Gasoline RBOB

• Natural Gas

• TTF Natural Gas

• XLE Energy SPDR

• XOP Oil and Gas Index

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

1. Single Commodities Video! Simply click on this PayPal payment link for the Commodities Mid-Year Video Update 2024 for USD 49.00 (for non-EU clients). Please note that it can take up to 6 hours until you receive this video.

2. Triple Package offer – *$99.00 (saving 33%)! – PART I – PART II – PART III (June – August ’24)

3. Additionally, we now offer as well payment via credit card payment link – For the credit card payment option please Contact us @ services@wavetrack.com and state if you like to purchase the Commodities Single video for USD 49.00 + VAT* or the Triple Video for USD 99.00 +VAT*?. Thank you.

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the European Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customers click here.

– Or opt for the TRIPLE PACKAGE for USD *99.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

Then Final PART III for Currencies and Interest Rates will be available in a few weeks’ time – we’re working on it!

We’re sure you’ll reap the benefits. Don’t forget to contact us with any Elliott Wave questions. Our EW-team is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com