Currencies + Interest Rates Mid-Year Video Update available! Part III/III

by WaveTrack International| August 21, 2024 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Mid-Year Update 2024 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES and INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Now, let’s look at some of the Currencies and Interest Rates Mid-Year Video Highlights that are crucial to know during this economic timeline…

Highlights

Currencies and Interest Rates Video Content

WaveTrack’s Currencies and Interest Rates video Part III will delve into the intricate world of currency pair analysis and interest rate development. In this video, we will be exploring over 140 charts of various currency pairs and crosses, alongside examining the interest rate trends of major economies such as the U.S., Europe, U.K., Australia, Canada, and Japan.

Looming Recession Risk?!

One of the central themes of this video is the looming recession risks that have been sparked by persistently high interest rates in the current cycle. While inflationary pressures are beginning to ease, the reluctance of Central Banks to initiate rate cuts could potentially lead to an economic downturn.

Will a move into Safe-Haven Currencies be safe?

This, in turn, may trigger a sell-off in risk assets, prompting investors to flock towards safe-haven currencies such as the Swiss Franc and the Yen.

However, this scenario could spell trouble for the US dollar, as dwindling interest rate differentials may weaken its position once the Federal Reserve is forced to lower rates.

Global Interest Rates and what Impact Central Banks might have

In the interest rate section of our analysis, we will take a deep dive into the long-term trends of treasuries and the impact that central banks are having on these trends and cycles. The video will also shed light on the analysis of European interest rates and spreads, as well as yields from the U.K., Australia, Canada, and Japan.

As we navigate through the complex web of currency pair analysis and interest rate development, we invite you to join us on this enlightening journey of unraveling the intricacies of the global financial landscape.

Get ready to gain a fresh perspective, delivered right to your screen. Prepare for enlightening discussions, visual breakdowns, and the latest market insights based on Elliott Wave, Fibonacci-Price Ratio’s and Cycle work – all in one place.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 140+ charts | VIDEO DURATION: nearly 2 hours 13 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (95 charts):

• US FED Rate & Inflation

• US Yield Curve

• G10 Interest Rates

• US$ Index + Cycles

• USD COT

• EuroZone Inflation + Interest Rates

• Euro/US$

• EUR COT

• Stlg/US$

• STLG COT

• US$/Yen

• YEN COT

• CHF COT

• US$/CHF

• US$/NOK

• US$/SEK

• US$/CAD

• CAD COT

• NZD/US$

• AUD/US$

• AUD COT

• NZD COT

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• STLG/Yen

• AUD/Yen

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• USD/ILS

• US$/TRY

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

Interest Rates (45 charts):

• History of Interest Rates

• US FED Higher Rates for longer

• US TIPs

• US30yr Yield + Cycle

• US10yr Yield + Cycle

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• US10-DE10yr Yield Spread

• DE10yr Yield

• DE2yr Yield

• DE2-DE10yr Yield Spread

• UK10yr Yield

• ITY10yr Yield

• Italy10-DE10yr Yield Spread

• Australia 10yr Yield

• Canada 10yr Yield

• Japan 10yr Yield

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

Simply click on this PayPal Payment link to purchase the CURRENCIES + INTEREST RATES Video Outlook 2024 for USD 49.00 (+ VAT where applicable – see below note for EU clients. Thank you!) or alternatively our Triple Video Offer for USD 99.00 (+ VAT where applicable)

– Review the content of WaveTrack Stock Indices Video PART I here and

– the Commodities Video PART II here.

If you prefer to pay via a secure Credit Card payment link please contact us @ services@wavetrack.com ! Many thanks.

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the European Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Commodities Mid-Year Video Update! Part II/III

by WaveTrack International| July 26, 2024 | No Comments

Commodities Mid-Year Video Update 2024!

We’re pleased to announce the publication of WaveTrack’s Mid-Year Triple Video Update 2024 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART II, COMMODITIES – Part I was released last month and Part III will be published in late-July / beginning of August 2024…

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Commodities Forecast Highlights 2024 and beyond!

Commodities Mid-Year Video Content

Are you ready to dive into the world of the Inflation-Pop cycle and the impact it has on commodity prices? The Financial Crisis may have been the catalyst, but the effects are still being felt today, with prices soaring and economies feeling the pressure.

The Past

Over the past fifteen years, we have seen incredible gains in commodity prices, spreading from risk-assets to stocks and beyond. Inflation has seeped into the global economy, affecting everything from food prices to job wages. Central banks have been forced to respond, with interest rates on the rise and quantitative tightening being reversed.

But is it too little, too late? The European Central Bank has already made moves to combat lower CPI, while the U.S. Federal Reserve is holding steady with high interest rates. With a record amount of commercial real estate up for refinancing this year, the potential for a banking crisis looms large.

Federal Reserve chairman Jerome Powell is sounding the alarm, warning of a possible economic downturn if rate cuts are not made soon. And with China facing its own property crisis, the ripple effects on commodity prices could be significant.

The possible Future?

Elliott Wave analysis suggests that Base Metals and Energy will continue to trend lower over the next year, while precious metals like gold and silver remain in bull markets. Even precious metal miners are expected to see corrections before resuming their upward trajectory.

Don’t miss out on this critical juncture in the market. Stay informed, stay ahead, and be ready for whatever the future holds in this ever-changing economic landscape. The Inflation-Pop cycle is far from over – are you prepared for what comes next?

Commodities Video Outlook 2024

With this new Commodities video you will review over 85 individual commodity contracts and Fibonacci Price Ratios within three main sub-sectors, Base Metals, Precious Metals, Precious and Base Metal Miners and Energy.

Don’t miss your chance to access this premium content, meticulously crafted to empower traders like you. Join us as we unveil the latest trends, strategies, and market analyses that will shape your success in the dynamic world of commodities.

Sincerely,

Peter Goodburn & EW-team

Commodities Mid-Year Video Update 2024 Part II/III

Contents: 85 charts

Time: 2 hours 12 mins.

• FED, Yield Curve, Inflation charts…

• US 10yr Yield Cycle

• China’s Property Crisis

• US Dollar index + Cycles

• CRB-Cash index + Cycles

• Food and Agriculture Index

• DB PowerShares Agriculture Fund

• Baltic Dry Index

• Copper

• Aluminium

• Lead

• Zinc

• Nickel

• Tin

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Glencore

• Rio Tinto

• Vale

• Iron Ore

• Uranium

• Rare Earths

• Gold

• Gold-Silver Ratio

• Silver

• Platinum/Silver Ratio

• Platinum

• Palladium/Gold Ratio

• Palladium/Platinum Ratio

• Palladium

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• XAU Gold/Silver Index

• Crude Oil

• Brent Oil

• Gasoline RBOB

• Natural Gas

• TTF Natural Gas

• XLE Energy SPDR

• XOP Oil and Gas Index

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

1. Single Commodities Video! Simply click on this PayPal payment link for the Commodities Mid-Year Video Update 2024 for USD 49.00 (for non-EU clients). Please note that it can take up to 6 hours until you receive this video.

2. Triple Package offer – *$99.00 (saving 33%)! – PART I – PART II – PART III (June – August ’24)

3. Additionally, we now offer as well payment via credit card payment link – For the credit card payment option please Contact us @ services@wavetrack.com and state if you like to purchase the Commodities Single video for USD 49.00 + VAT* or the Triple Video for USD 99.00 +VAT*?. Thank you.

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the European Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customers click here.

– Or opt for the TRIPLE PACKAGE for USD *99.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

Then Final PART III for Currencies and Interest Rates will be available in a few weeks’ time – we’re working on it!

We’re sure you’ll reap the benefits. Don’t forget to contact us with any Elliott Wave questions. Our EW-team is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

STOCK INDICES Mid-Year Video Update! PART I/III

by WaveTrack International| June 28, 2024 | No Comments

Stock Indices Mid-Year Video Update 2024

Includes ECONOMIC INDICATOR & SENTIMENT STUDIES

Stock Market Crash Inevitable

Highlights 2024

Stock Indices – Main Theme

When stock indices overcame the pandemic sell-off with as sharp v-shaped recovery ending into the Nov.’21/Jan.’22 highs, it confirmed the final sequence of the secular-bull market from the financial-crisis lows had begun.

Ordinarily, we’d expect to see this 5th wave unfold into a five wave expanding-impulse pattern but so many indices ran higher into a-b-c zig zags to those Nov.’21/Jan.’22 highs. This was confirming the 5th wave advance from the March 2020 low was taking the form of a five wave diagonal-impulse instead.

Stock Indices – Change is coming!

That doesn’t sound like much of a change – but it is, it does! It’s the difference between getting caught-up in the AI frenzy or taking a dose of reality and stepping aside for more lucrative investment entry points later. The diagonal-impulse patterns unfolding in the major indices, like the S&P 500, Dow Jones, Nasdaq 100, even those in Europe like the Xetra Dax completed their 1st waves into those Nov.’21/Jan.’22 highs although 2022’s declines were certainly not deep enough to qualify the completion of 2nd wave corrections.

Far deeper corrections are necessary to ensure the boundary lines of the diagonal are correctly proportional to this wedge-shaped pattern. The 2nd waves are actually unfolding into a-b-c expanding flat patterns where 2022’s initial declines were wave a. And of course, wave b’s required attempt to new highs are exactly where prices are trading now.

Beware of the AI Frenzy!

The AI technology frenzy has helped to exaggerate the b wave advances from those 2022 lows whilst underperforming indices like the small-cap Russell 2000 and the small/mid-cap indices traded in Europe are lagging behind, unable to break above those Nov.’21/Jan.’22 highs, setting-up bearish divergences – that in itself is big warning!

Stock Indices – Elliott Wave Conclusion

But that means wave c is about to crash lower into a five wave impulse. And that translates into downside acceleration during the next 9-12 months. And proportional fib-price-ratio measurements depict declines of -40% ahead.

U.S. Stock Indices Outlook

Right now, U.S. indices are still in the midst of counter-trend 2nd wave corrective downswings that began from the Nov.’21/Jan.’22 highs. The outperforming indices, such as the S&P 500, Dow Jones (DJIA), and Nasdaq 100, are unfolding into a-b-c expanding flat patterns, with wave b currently trading to new higher-highs. However, these indices are about to roll over, creating potential risks of -40% to -50% declines in the next 9-12 month period.

On the other hand, the underperforming indices, like the small-cap Russell 2000 and Nasdaq Next-Generation 100 index, are seeing corrections unfold into zig zags or double zig zags. This sets up classic bearish divergence, signaling wave c declines ahead.

Don’t let yourself be caught off guard by these market trends. Stay informed and ahead of the game with WaveTrack’s Stock Indices video. Our expert analysis and insights will help you navigate the market with confidence and make informed trading decisions.

Subscribe today to gain access to this valuable resource and take your stock trading to the next level. Don’t miss out on this opportunity to stay ahead of the curve and maximize your trading success.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Mid-Year Video Update 2024

Charts: 92 | Video: 2 hours 2 mins.

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

Single Video – *$49.00 – PART I Stock Index Mid-Year Video Uptrend 2024 (June ’24) or send us an email to services@wavetrack.com

Triple Package offer – *$99.00 (saving 33%)! – PART I – PART II – PART III (June – August ’24)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the Europeean Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customers click here.

– Or opt for the TRIPLE PACKAGE for USD *99.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Dow Jones – From 18,000 to 40,000!

by WaveTrack International| May 16, 2024 | No Comments

…it took over 8 years to get there!…40,000 Dow Jones!

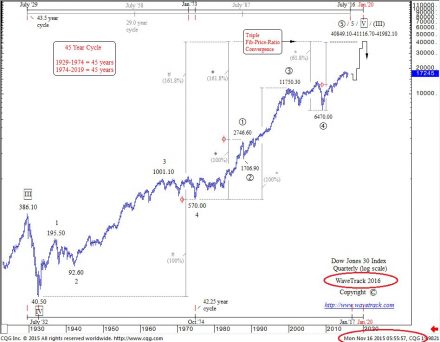

Fig #1 – Dow Jones 30 Index – Quarterly – Forecast published in WaveTrack’s Stock Indices Video Outlook 2016

Fig #2 – Dow Jones 30 Index – Elliott Wave Analysis as published in WaveTrack’s Stock Indices Video Outlook 2016

Get ahead of the game with WaveTrack’s Stock Indices video series. Don’t miss the next edition in June 2024.

Subscribe to the latest EW-Compass bi-weekly short-term report and or wait for our mid-year Stock Indices Video Update in June 2024 with trading insights and much more… Order the EW-Compass now!

EW-Commodities Outlook – Supplemental – March/April 2024

by WaveTrack International| April 18, 2024 | No Comments

EW-Commodities Outlook – Supplement Highlights

EW-Commodities Outlook Supplement

This latest update of the monthly March/April 2024 report is ‘Supplemental’ with key revisions for Copper, Iron Ore and a look at the larger picture of the Rare Earth ETF from VanEck Vectors. Also, updates for the GDX Gold Miners, the Gold/Silver ratio together with modifications for Energy contracts XLE and XOP. For other contracts, please refer to the March/April report published 15th March 2024.

Subscribe to the latest EW-Commodities Outlook report and get trading insights and much more… Note the EW-Commodities Outlook includes a report and video update!

Currencies and Interest Rates Video Outlook 2024

by WaveTrack International| February 28, 2024 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Mid-Year Update 2023 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES and INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Now, let’s look at some of the Currencies and Interest Rates Mid-Year Video Highlights that are crucial to know during this economic timeline…

Highlights

…

Currencies and Interest Rates Preview

Are you ready for what’s next in the financial world? Our latest analysis reveals critical trends shaping the markets:

Higher Rates for Longer: Despite expectations of an end to interest rate hikes, countries like Japan, the U.K., and Germany are already in recession. Are we heading for a global slowdown? Discover the surprising truth in fig’s #186-187.

Recession Risks Looming: The U.S. yield curve inversion spells trouble, historically signaling a recession within 15 months. With 66% of fund managers expecting a ‘soft-landing’, are they right? Dive into the data in fig’s #188-189.

Commercial Real Estate (CRE) Concerns: $117bn in U.S. CRE refinancing this year alone, and European banks facing €1.4 trillion Euros in refinancing needs. Could this lead to another banking crisis? Find out more in fig #191.

Second Regional Banking Crisis: After 2022/23’s bank failures, signs point to more trouble. Banks like Deutsche Bank are raising provisions, signaling potential defaults. Learn about the risks in fig’s #192-193.

U.S. Debt Soars: With U.S. debt hitting $34.15 trillion, higher rates mean higher costs. Could this lead to a decline in the US$ dollar? Explore the implications in fig #194.

De-Dollarisation Trends: Global economies hold fewer US$ reserves, opting for partner currencies. Is the US$ losing its stronghold? Discover the potential impact in fig #195.

Currency Trends Unveiled: From G10 pairs to currency crosses, our analysis predicts major movements. See what’s ahead for Euro/US$, Stlg/US$, US$/CHF, and more in fig’s #196-238.

Fig #202 – USD Index – Daily – by WaveTrack International – Currencies and Interest Rates Video Outlook 2024

Unlocking Financial Insights: What’s Ahead for Interest Rates?

The 60-Year Cycle Unveiled: Corporate AAA Bond Yields hit a turning point in 2011, marking the start of a new 30+ year uptrend for interest rates. Despite COVID-19 disruptions, March ’20 lows confirm this upward trajectory. Discover more in fig’s #288-289.

Inflation Trends and Contrarian Risks: Real Interest Rates remain negative, even with central bank hikes. Bank of America’s survey reveals a record 91% expecting lower short-term rates, highlighting the contrarian risk of rising rates this year. Explore insights in fig’s #290-294.

U.S. Debt at Record Highs: With U.S. debt soaring to $34.15 trillion, higher rates will impact financing. A credit crunch looms, potentially spiking long-dated treasury yields to post-pandemic highs. Get details in fig’s #295-296.

US Interest Rates Outlook: Federal Funds rate nears its peak, poised to remain ‘higher-for-longer’ due to CPI upticks and risks like CRE and bank deposit runs. Are US30yr and US10yr yields set for more highs? Dive into the analysis in fig’s #297-307.

Figures refer to data points in our analysis.

Ready to unlock a whole new dimension of financial insights? 📈 We’re thrilled to invite you to the next chapter of our financial journey through an exciting video experience.

What Awaits You?

Get ready to gain a fresh perspective, delivered right to your screen. Prepare for enlightening discussions, visual breakdowns, and the latest market insights based on Elliott Wave, Fibonacci-Price Ratio’s and Cycle work – all in one place.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 156 charts | VIDEO DURATION: nearly 3 hours 4 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (99 charts):

• US FED Rate & PCE Inflation

• US Yield Curve

• CRE Commercial Real Estate

• US Treasury Fiscal Data

• US$ Index + Cycles

• USD COT

• Euro/US$

• EUR COT

• Stlg/US$

• STLG COT

• US$/Yen

• YEN COT

• CHF COT

• US$/CHF

• US$/NOK

• US$/SEK

• AUD/US$

• AUD COT

• US$/CAD

• CAD COT

• NZD/US$

• NZD COT

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• EUR/AUD

• Stlg/AUD

• CAD/NOK

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• USD/ILS

• US$/TRY

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

Interest Rates (57 charts):

• US10yr Real Yield

• US TIPs

• US30yr Yield

• US10yr Yield + Cycle

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• US10-DE10yr Yield Spread

• DE10yr Yield

• DE2yr Yield

• UK10yr Yield

• ITY10yr Yield

• Italy10-DE10yr Yield Spread

• Australia 10yr Yield

• Canada 10yr Yield

• Japan 10yr Yield

How to buy the Currencies and Interest Rates Video Outlook 2024

Simply click on this PayPal Payment link to purchase the CURRENCIES + INTEREST RATES Video Outlook 2024 for USD 49.00 (+ VAT where applicable) or alternatively our Triple Video Offer for USD 99.00 (+ VAT where applicable) – Review the content of WaveTrack Stock Indices Video PART I here and the Commodities Video PART II here.

If you prefer to pay via a secure Credit Card payment link please contact us @ services@wavetrack.com ! Many thanks.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Tags: Currencies and Interest Rates Video Outlook

Commodities Outlook 2024 Video is now available!

by WaveTrack International| January 24, 2024 | No Comments

Commodities Video Outlook 2024

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Outlook 2024 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART II, COMMODITIES – Part I was released last month and Part III will be published in late-February / beginning of March 2024…

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Commodities Forecast Highlights 2024!

Commodities – Head and Tail Winds for 2024

In the ever-evolving landscape, our 2024 analysis begins by scrutinizing the main drivers shaping COMMODITY prices. Uncover potential headwinds, including the impact of prolonged higher interest rates, a looming commercial real estate refinancing wave exceeding $117 billion, and the repercussions of China’s economic stagnation linked to property sector loan backlogs. A silver lining emerges with a declining dollar, offering introspective opportunities, particularly for precious metals.

Venture into our analysis on Commodity vs. Equity valuations, addressing the pertinent question of undervalued commodities or overinflated equity valuations—or perhaps both!

Anticipating Market Movements: A Glimpse into the Future

Our unique perspective on the evolution of commodity prices from the financial-crisis lows reveals a divergence from the ELLIOTT WAVE pattern within the SECULAR-BULL uptrend for global STOCK MARKETS. The birth of the term INFLATION-POP signals a cycle driving inflation to levels not seen since the 1970s, presenting an unprecedented opportunity for traders in the 21st century.

For those with memories of the late-1970s inflation surge, the current scenario seems like a cyclical repetition, offering a degree of predictability. Despite commodities surging post-pandemic, the past 18-24 months have witnessed corrections within the upward cycle. Brace yourselves for potential downside pressure this year. Now, setting the stage for a resilient bottom and another significant price rise into 2025/27.

Commodities Video Outlook 2024

With this new Commodities video you will review over 87 individual commodity contracts and Fibonacci Price Ratios within three main sub-sectors, Base Metals, Precious Metals, Precious and Base Metal Miners and Energy.

Don’t miss your chance to access this premium content, meticulously crafted to empower traders like you. Join us as we unveil the latest trends, strategies, and market analyses that will shape your success in the dynamic world of commodities.

Sincerely,

Peter Goodburn & EW-team

Commodities Video Outlook 2024 Part II/III

Contents: 87 charts

Time: 2 hours 13 mins.

• FED, Interest Rate, Inflation charts

• US 10yr Yield Cycle

• Commercial Real Estate Collapse

• US Dollar index + Cycles

• CRB-Cash index + Cycles

• Food and Agriculture Index

• DB PowerShares Agriculture Fund

• Copper

• Aluminium

• Lead

• Zinc

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Glencore

• Rio Tinto

• Vale

• Iron Ore

• Uranium

• Rare Earths

• Gold

• Gold-Silver Ratio

• Silver

• Platinum/Silver Ratio

• Platinum

• Palladium/SP500 Ratio

• Palladium/Gold Ratio

• Palladium/Platinum Ratio

• Palladium

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• XAU Gold/Silver Index

• Crude Oil

• Brent Oil

• Gasoline RBOB

• Natural Gas

• TTF Natural Gas

• XLE Energy SPDR

• XOP Oil and Gas Index

How can you purchase the video?

1. Single Commodities Video! Simply click on this PayPal payment link for the Commodities Video Outlook 2024 for USD 49.00 (for non-EU clients). Please note that it can take up to 6 hours until you receive this video.

2. Triple Video! Simply click on this PayPal payment link for the Triple Video Outlook 2024 for USD 99.00 (for non-EU clients). This covers Stock Indices, Commodities and Currencies + Interest Rates. Please note that it can take up to 6 hours until you receive this video.

3. Additionally, we now offer as well payment via credit card payment link – For the credit card payment option please Contact us @ services@wavetrack.com and state if you like to purchase the Commodities Single video for USD 49.00 + VAT* or the Triple Video for USD 99.00 +VAT*?. Thank you.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

We’re sure you’ll reap the benefits. Don’t forget to contact us with any Elliott Wave questions. Our EW-team is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Stock Indices Video Outlook 2024 – PART I/III

by WaveTrack International| December 30, 2023 | No Comments

Stock Indices Video Outlook 2024

Recession Alert! – Heightened Risk of a Hard Landing in 2024!!

FANG+ & Mag-7 Slide Lower in 2024

Highlights 2024

TAIL RISK IN 2024!!

A yield curve inversion almost always occurs before a recession although its effects can begin up to 15 months later. The more recent inversion began in July ’22. And we’re now 17 months later. This is clearly highlighting the probability a recession is just ahead. Bank of America analysts show the S&P 500 begins a decline of up to -40% once the curve begins to steepen again.

The decline accelerates as the Federal Reserve begins to tighten credit and the market collapses following the first rate cut. It then forms a trough/low 9 months later. This synopsis tallies with our bearish Elliott Wave outlook for the S&P 500 for the coming year, 2024. We’re expecting a decline of -38% per cent. Contrastingly, Goldman Sachs forecasts a limited risk of recession with a year-end target of 4700.00+/- (-2%), Deutsche Bank a mild recession, 5100.00+/- (+8%), JP Morgan a risk of recession, 4200.00+/- (-12%) and Societe Generale a mild recession, 4750.00+/- (-1%).

However, the U.S. Banking sector is particularly vulnerable to a strong downturn should interest rates remain higher-for-longer with commercial real estate defaults likely to accelerate.

SPOTLIGHT – Technology!

This is a must have video for those who invested in the Magnificent 7 Stocks! We believe that Fang+ Technology are particularly vulnerable to Tail-Risk factor mentioned above. Moreover, there will be large counter-trend declines for Amazon Inc., Alphabet/Google, Apple Inc., Meta/Facebook, Microsoft, Netflix, Nvidia & Tesla. Get our latest video and be prepared.

New Stock Indices Video Outlook 2024 – PART I/III

The central themes we’ll be discussing in this video include Interest Rate trends and expectations, inflation and what happens should Central Banks keep interest rates higher-for-longer.

We’re examining clues in the last year’s yield curve inversion and later. Moreover, systemic financial credit risks showing-up in the U.S. and European banking sector.

We’re taking an updated look at the final stage of the inflation-pop cycle which is propelling stock indices higher from the pandemic lows. Many are unfolding into ending-type diagonal patterns but are missing the required 2nd wave downside sell-offs that only partially materialised in 2022. 2023’s rallies are unlikely to be sustained. European indices staged relative outperformance since lows in September 2022 but are also expected to generate big declines during the next year ahead of resuming higher afterwards.

MSCI China and the Emerging Market index are both looking positive. At the very least, these outperform Developed Market indices in 2024.

This STOCK INDICES Video Outlook 2024 is like nothing you’ve seen anywhere else in the world. It’s unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Fibonacci Price Ratios, Sentiment extremes and Economic data trends.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Video Outlook 2024

Charts: 97 | Video: 2 hours 29 mins.

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – *$49.00 – PART I Stock Index Video Outlook 2024 (December ’23) or send us an email to services@wavetrack.com

Triple Package offer – *$99.00 (saving 33%)! – PART I – PART II – PART III (January – February ’24)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST?

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customer except EU customers click here.

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

– Or opt for the TRIPLE PACKAGE for USD *99.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Tags: 2024 Financial Outlook

New EW-Commodities Outlook

by WaveTrack International| August 29, 2023 | No Comments

EW-Commodities Outlook Highlights

EW-Commodities Outlook Major Themes for September 2023

Following-on from our PART II mid-year Commodities report, this month’s update continues with some of the central themes surrounding the macro economy and how that may affect prices going forward. From an Elliott Wave perspective, we will discuss three major risks…

Heightened Risk of Global Recession

This includes a heightened risk of a global recession, caused by central banks’ maintaining their current interest rate cycle. The theme is ‘higher-for-longer’. A withdrawal of liquidity as the Federal Reserve together with other Central Banks continue tightening.

Risk of Banking Crisis

Furthermore, there’s also an increasing risk that a 2nd phase of last March’s U.S. regional banking crisis. The development contributes to a recession as bank’s balance sheets deteriorate with depositor withdrawals quickening.

Risk of Real Estate Crisis

And a new risk of defaults in the property sector arises as major Real Estate Investment Trusts offer little in the way of dividends whilst China’s property developer giants seek U.S. Bankruptcy protection.

In short, without doubt, a global recession means Commodities would take another hit to the downside.

Subscribe to the latest EW-Commodities Outlook report and get trading insights and much more… Note the EW-Commodities Outlook includes a report and video update!

Currencies and Interest Rates Mid-Year Video Update 2023

by WaveTrack International| August 14, 2023 | No Comments

We’re pleased to announce the publication of WaveTrack’s annual Triple Video Mid-Year Update 2023 of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES and INTEREST RATES.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Now, let’s look at some of the Currencies and Interest Rates Mid-Year Video Highlights that are crucial to know during this economic timeline…

Highlights

Currencies and Interest Rates Preview

Central Banks’ Interest Rates?

Despite lingering concerns about Central Banks’ persistent interest rate levels, we’ve got you covered. Our cutting-edge Elliott Wave forecasts will help you navigate the challenging landscape, even as CPI inflation takes a dip from last year’s highs.

G10 Currency Trends Unveiled

Get ready for a shift in G10 currency pairs over the upcoming months…

Yen and Swiss Franc Shine: Amidst the changes, the Yen and Swiss Franc might emerge as safer havens compared to the dollar.

🇪🇺🇺🇸 Euro/US$ Decline: The Euro/US$ pair is expected to weaken from its high at 1.1277 in July, targeting downside levels around 1.0208+/-.

🇬🇧🇺🇸 Stlg/US$ Journey: Brace for a decline in Stlg/US$ from 1.3143, with a target of 1.1662+/-.

🇺🇸🇳🇴 US$/NOK Reversal: Watch for a turnaround in the US$/NOK pair, climbing from its low of 9.9245 in July and aiming for 11.4022+/-.

G10 Currency Crosses Dynamics

🇪🇺🇬🇧 Euro/GBP Dip: Euro/GBP is continuing its decline from July’s high at 0.8702, aiming for 0.8309+/-.

🇪🇺🇨🇭 Euro/CHF Direction: Euro/CHF is projected to move lower, heading towards 0.8850+/-.

🇪🇺🇯🇵 Euro/Yen Patterns: Euro/Yen completes an upswing, but get ready for a downward trend in the coming weeks and months, reflecting Yen strength.

🇪🇺🇨🇳 Euro/CNY Movement: Euro/CNY’s corrective upswing from July ’22 to July ’23 is evident, marking a change in direction…

Review all the contracts WaveTrack covers in this extraordinary Elliott Wave forecasting masterpiece published only twice a year. Stay informed and empowered in the ever-evolving financial landscape.

Ready to unlock a whole new dimension of financial insights? 📈 We’re thrilled to invite you to the next chapter of our financial journey through an exciting video experience.

What Awaits You?

Get ready to gain a fresh perspective, delivered right to your screen. Prepare for enlightening discussions, visual breakdowns, and the latest market insights based on Elliott Wave, Fibonacci-Price Ratio’s and Cycle work – all in one place.

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 147 charts | VIDEO DURATION: nearly 2 hours 54 mins.

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Forex (94 charts):

• US Deposit Outflows

• US Bank Annual Balance Sheet Changes

• US$ Index + Cycles

• USD COT

• Euro/US$

• Stlg/US$

• US$/Yen

• US$/CHF

• US$/NOK

• US$/SEK

• AUD/US$

• US$/CAD

• NZD/US$

• Euro/Stlg

• Euro/CHF

• Euro/Yen

• Euro/CNY Renminbi

• Stlg/YEN

• Stlg/ZAR

• AUD/YEN

• AUD/CNY Renminbi

• AUD/NZD

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• US$/TRY

• US$/ARS

• US$/PLZ

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• Bitcoin

• Ethereum

Interest Rates (53 charts):

• US10yr Real Yield

• US30yr Yield + Cycles

• US10yr Yield + Cycles

• US5yr Yield

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• 3mth EuroDollar-US10yr Yield Spread

• Comparison US10-DE10yr vs S&P 500

• US10yr TIPS Break Even Inflation Rate

• US10-DE10yr Yield Spread

• DE10yr Yield

• UK10yr Yield

• ITY10yr Yield

• Italy10-DE10yr Yield Spread

• Australia 10yr Yield

• Japan 10yr Yield

How to buy the Forex + Bonds Video Outlook 2023

Simply contact us @ services@wavetrack.com to buy the CURRENCIES + INTEREST RATES Mid-Year Video Update 2023 for USD 49.00 (+ VAT where applicable) or alternatively our Triple Video Offer for USD 99.00 (+ VAT where applicable) – Review the content of WaveTrack Stock Indices Video PART I here and the Commodities Video PART II here.

Please state your payment preference in the order email – we offer PayPal or a secure Credit Card payment link! Many thanks.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com