New CURRENCIES Mid-Year Video Update! PART III/III

by WaveTrack International| July 24, 2019 | No Comments

Currencies and Interest Rates H2-2019 Video – PART III/III

We’re pleased to announce the publication of WaveTrack’s mid-year 2019 video updates of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES & INTEREST RATES – Parts I & II were released in June/early-July

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – out now!

Currencies Review – H1 2019

January/February’s annual report began by forecasting US$ dollar strength, currency weakness across-the-board. This was based upon the incomplete a-b-c zig zag advance in the US$ dollar index from its Feb.’18 low of 88.26. Upside targets to complete minor wave c. were towards 102.79+/- and six-months on, that’s still the current outlook.

The last several months has seen a gradual push higher for the dollar, but each time it has attempted to break to a higher-high, it has fallen back inside the preceding trading range. But importantly, it has produced higher-lows together with higher-highs which maintains wave c.’s five wave impulse uptrend. We can look back over the first-half of the year and say that nothing too much has developed, but that’s certainly not the case going forward, for the next 6-month period.

Currencies – Key Drivers/Events for H2 2019

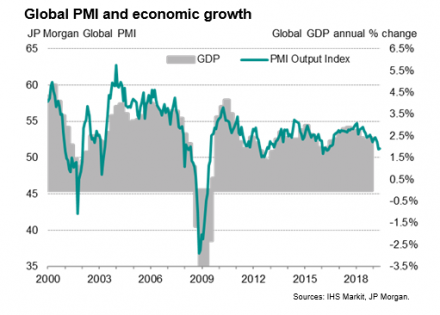

The most important event gripping the headlines revolves around expectations of a mild global recession. The latest Global Purchase Managers’ Index (PMI) from JP Morgan/IHS Markit shows economic activity continuing to oscillate towards a 3-year low.

That fact has not gone amiss with central banks. The European Central Bank and the Federal Reserve have both reiterated their commitment to ease back on monetary tightening policies with interest rate cuts, as necessary. Investors are watching how the trade negotiations are developing between the U.S. and China, but also Europe as the U.S. threatens to slap tariffs on European car imports.

Significance of the Inflation-Pop

From an Elliott Wave perspective, the slowdown in economic activity is expected to be simply a temporary dip within the larger ‘INFLATION-POP’ event. The ‘inflation-pop’ is the second event within the multi-decennial ‘SHOCK-POP-DROP’ deflationary cycle. The ‘inflation-pop’ began lifting asset prices higher following the end of the 2007-09 financial-crisis. Central banks added monetary liquidity that forced sharp asset price rises in the following years to this day.

Shock-Pop-Drop

The Shock-Pop-Drop can be visualized as an Elliott Wave expanding flat pattern, A-B-C – the ‘Inflation-Pop’ is simply wave B, itself unfolding in an upward direction as a primary degree zig zag pattern, A-B-C. Primary wave A represents the way asset values trended higher from the financial-crisis lows but ending into the peak in early-2011. Wave B then declined afterwards, but a retracement of wave A’s preceding advance – by necessity, wave B’s retracement is only a partial regression so it must end above the 2009 lows of wave A.

If you take a look at the JP Morgan/IHS Markit global PMI and the related Manufacturing/Services & Trade chart (see above), you’ll see the primary degree zig zag in upward progress from the 2009 lows. The peaks in 2010/11 complete primary wave A but wave B is still engaged to the downside, but is attempting to complete before year-end 2019. Levels might break slightly below the initial lows of 2013, but not too far – but afterwards, turning higher to begin primary wave C’s advance.

From this we can discern that the global economy will tick lower through H2-2019 into year-end, which is expected to have the effect of pushing the US$ dollar higher during the same period. Why is that? Mainly because a dip in the economies will prompt safe-haven buying of the US$ dollar, especially since Elliott Wave analysis expects U.S. stock markets to undergo a -11% per cent correction into year-end. But also because of interest rate differentials – the Euro currency is attracts negative interest rates, as does the Yen. That’s a huge premium for the US$ dollar.

EW-Forecasts H2 2019

For more detailed analysis, please view the video/report

Bitcoin

Crypto Currencies like Bitcoin have trended exponentially higher since ending 4th wave corrective lows last December. Our latest Elliott Wave analysis updates the medium-term outlook, Bitcoin’s uptrend over the next several years. Amazingly, it projects an uptrend towards some astonishingly high levels!! – this is going to be quite a journey!

Interest Rates Review – H1 2019

The year began with US30yr yields at 3.000% per cent, US10yr at 2.700% per cent and forecasts down to 2.690+/- and 2.075+/-. That seemed enough to depict a counter-trend correction unfolding from the late-2018 highs. Yields have since traded even lower, to 2.465% and 1.939% but they’re still counter-trend declines!

The big clues on interest rate direction comes from the fact that the 60-year cycle in AAA Corporate Bond Yields is very rhythmic, oscillating at 30 to 35-year sub-intervals from peak-to-trough-to-peak etc. The last cyclical peak occurred back in 1981 – thirty-five years later, the next cycle-trough bottomed in July 2016, at least for the long-end yields. It would take a phenomenal feat for interest rates to break back below those lows during 2019’s declines because the next 30-35 year cycle is already exerting its influence higher.

Interest Rates – Key Drivers/Events for H2 2019

This year’s corrective declines in underlying U.S. and European interest rates are expected to continue even lower than original downside targets. A global downturn in economies is being exacerbated by U.S. President Trump’s trade war with China and its allies, Japan, Europe, Canada and Mexico.

The IMF has just published its latest World Economic Outlook paper – it summarises ‘global growth forecast at 3.2% per cent in 2019, picking up to 3.5% per cent in 2020 (0.1 percentage point lower than in the April WEO projections for both years). GDP releases so far this year, together with generally softening inflation, point to weaker-than-anticipated global activity’. It highlights weak final demand, soft global trade and muted inflationary pressures.

EW-Forecasts H2 2019

For more detailed analysis, please view the video/report

New Currencies and Interest Rates H2-2019 Video – PART III/III

This MID-YEAR 2019 VIDEO UPDATE for CURRENCIES & INTEREST RATES is unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with cycles and Fibonacci price ratios.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 68 charts | Video duration: 1 hours 45 mins.

The contents of this CURRENCY & INTEREST RATES VIDEO include Elliott Wave analysis for:

• US$ index + cycle

• Euro/US$ + cycle

• Stlg/US$

• US$/YEN

• US$/CHF

• AUD/US$

• NZD/US$

• US$/CAD

• Euro/CHF

• Euro/Stlg

• Euro/YEN

• Stlg/YEN

• Stlg/ZAR

• Stlg/AUD

• Asian ADXY

• US$/IDR

• US$/MXN

• US$/TRY

• US$/ZAR

• US$/BRL

• US$/RUR

• US$/YUAN

• US$/PLZ

• Bitcoin

Interest Rates:

• U.S. AAA+ 30-Year Corporate Bond Yields

• US30yr Yield + cycle

• US10yr Yield

• US10yr TIPS Break-Even Inflation Rate

• DE10yr Yield

• ITY10yr Yield

• JPY10yr Yield

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – *$48.00 – PART III Currencies + Interest Rates Video 2019 (July ’19)

Triple Package offer – *$96.00 (saving 33%)! – PART I – PART II – PART III (June – July ’19)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

HOW CAN YOU RECEIVE THE VIDEO FORECAST?

To receive your VIDEO UPDATE please click here to contact us.

– Or opt for the TRIPLE PACKAGE for USD *96.00 in total?

– Next we will send you a PayPal payment request and provide you with the video link & PDF report once confirmed.

– Alternatively, we can process credit card payments for you as well – please contact us. Thank you.

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT. However, most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Comments

Leave a Reply