NASDAQ 100 – Success! Downside targets achieved

by WaveTrack International| March 26, 2018 | No Comments

NASDAQ 100 – Downside Targets Achieved @ 6507.84!

Last week’s escalating news-flow around President Trump’s plans to expand upon existing U.S. import tariffs caught the markets out. Subsequently, leading to declines of -9.5% per cent in the Nasdaq 100 over the last 10-day period. Naturally, mass media and analysts continue to debate the impact of a potential trade war. However, the Nasdaq 100 together with the other major U.S. indices is quietly unfolding into some near-perfect Elliott Wave patterns that eliminates all the ‘guessing’ and ‘opinion’ from investors and pundits alike.

Expanding Flat Pattern

January’s decline hasn’t finished yet! It’s identified as unfolding into an Elliott Wave expanding flat pattern – see tutorial graphic, top-right – fig #1. There are quite a few twists and turns in this pattern particularly in the second sequence. This means we have to expect a lot more price volatility over the coming month.

The expanding flat is composed of three main price-swings. These price swings are labelled in minuette degree as waves [a]-b]-[c]. Each of them subdividing 3-3-5 or otherwise termed as zig zag-zig zag-impulse patterns. Wave [a] establishes the initial price-extremity of the pattern. Wave [a] did this by declining from January’s high of 7022.97 into a zig zag, ending in mid-February at 6164.43. Now, waves [b] and [c] must then marginally break beyond wave [a]’s trading-range in order to complete the expanding flat. The amplitudes of waves [b] and [c] can be measured using fib-price-ratios.

First of all, the 2nd sequence of the expanding flat, wave [b] is unfolding higher from the mid-February low of 6164.43 as a zig zag pattern, labelled (a)-(b)-(c). Wave (b) was recently forecast as unfolding into an expanding flat pattern, labelled [A]-[B]-[C] with downside targets towards 6498.00+/-. Also, last week’s dramatic sell-off basis the Trump tariff news pulled prices directly into this downside area ending into Friday’s session low at 6507.84. This is less than ten points from objectives – Monday’s (today’s) opening has rejected this low, trading now at 6657.21. This ends wave (b) of February’s zig zag upswing – wave (c) is now en-route towards 7381.64+/-.

Trade Negotiations or Trade War?

US Treasury Secretary Steve Mnuchin said yesterday this about China – ‘We’re having very productive conversations with them. I’m cautiously hopeful we reach an agreement’. China’s Ministry of Foreign Affairs replied by saying ‘China is willing to negotiate to appropriately manage and control differences with the United States on the basis of mutual respect and mutual benefit’.

Conclusion

Basis the expanding flat, a short-term reprieve around tariff talks has softened last week’s sell-off. Hence today’s stock market pull away from last Friday’s lows. But if the expanding flat has another sharp decline coming once current prices trade to higher-highs, then for sure, we can expect the talks to break down – unless another exogenous event takes its place!

Are you trading Nasdaq 100, Russell 2000, Dow Jones 30, EuroStoxx, Dax, FTSE100, Shanghai Composite, Hang Seng or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

NEW UPDATE! Nasdaq 100 Breaks to Higher-Highs – then Collapse!

by WaveTrack International| March 15, 2018 | 2 Comments

NASDAQ 100 – EXPANDING FLAT! – NEW UPDATE!

Some of the major U.S. indices that declined during January/February’s sell-off unfolded into five wave impulse patterns. Yet, others developed into three wave corrective sequences. In order to maintain positive-correlation and pattern alignment, the ‘default’ procedure is to adopt developing [a]-[b]-[c] 5-3-5 zig zag pattern for the former. And naturally, an [a]-[b]-[c] 3-3-5 expanding flat patterns for the latter.

There is only problem with this. It demands a -19% decline for the outperforming Nasdaq 100 during wave [c]’s final sequence! That’s far too big compared to European and Asian indices. As these are already in the final stages of ending counter-trend declines that began from the November/January highs.

There are only two ways to reconcile this amplitude dislocation. Either the Nasdaq 100 and other U.S. indices will underperform European indices during wave [c]’s declines? Or the February lows ended the entirety of January’s correction for all U.S. indices with new impulse uptrends already in upside progress! However, with only a minor correction unfolding during the next week or so, correlating to final declines in Europe/Asia.

Shorter-term, we’ve detected the more recent upswing for the Nasdaq 100 from the early-March low of 6645.03 into this week’s high of 7186.09 unfolding into a three wave zig zag – see fig #1. That indicates wave (b) is transforming from a zig zag correction. Originally labelled ending at 6645.03, into a more complex correction, an expanding flat. However, wave [C] downside targets are now towards 6498.00+/-.

Conclusion

We can’t be certain which of these two scenarios will unfold! But one thing is for certain, a short-term decline to 6498.00+/- would present the next major buying opportunity. This is labelled as either ending wave (b) within a zig zag with wave (c) upside targets to 7381.64+/- or ending minuette wave [ii] two within a new impulse uptrend.

Are you trading Nasdaq 100, Russell 2000, Dow Jones 30, EuroStoxx, Dax, FTSE100, Shanghai Composite, Hang Seng or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

NASDAQ 100 – EXPANDING FLAT!

by WaveTrack International| March 13, 2018 | 4 Comments

Nasdaq 100 Breaks to Higher-Highs – then Collapse!

During January’s steep declines, benchmark indices like the S&P 500 unfolded lower whilst developing into five wave impulse sequences. If so, then this indicates downward continuity once a three wave corrective upswing has ended. But some indices like the outperforming Nasdaq 100 declined from January’s high into the mid-February lows unfolding into a three wave zig zag pattern. So how can you have two major indices that are positively-correlated unfolding into two diametrically opposite patterns? One that implies downward action, the other upward!

The Un-Common Denominator – Elliott Wave Pattern Secret

Well, there is a un-common denominator! And it combines a zig zag development for indices like the S&P 500 and the broader Value Line Index with yes, an expanding flat for the Nasdaq 100.

The Value Line index was selected as a ‘proxy’ for the slight underperforming indices because it declined from the January highs into a picture-perfect five wave impulse pattern, from 6413.16 to 5699.27 – see fig #1. Using proprietary fib-price-ratios, note that wave (v) five declined by a fib. 61.8% ratio of waves (i)-(iii) ending at the exact low. That gave unequivocal confirmation that the decline did unfold into a five wave pattern, not a three, and that a counter-trend rally would then unfold. But that counter-trend rally must end below the January high. It can be very deep, but basis the rules of the Elliott Wave Principle, it must end below 6413.16. If the Value Line index is scheduled to complete a counter-trend rally ending below the January high before resuming the larger zig zag decline afterwards, then in all probability, the outperforming Nasdaq 100’s advance to higher-highs will also be capped, and that’s where the expanding flat comes in.

Value Line and the Nasdaq 100 and Zig Zag Patterns

Both the Value Line and the Nasdaq 100 are pushing higher from the mid-February lows into three wave zig zags but whereas the Value Line should not, must not break to higher-highs, this is a perquisite for the Nasdaq 100 because its January decline unfolded into a three wave zig zag, not a five wave impulse sequence – see fig #2.

The Nasdaq 100’s expanding flat is labelled in minuette degree, [a]-[b]-[c] – see tutorial chart, inset. Wave [a] declined to 6164.43 as a zig zag and this is being replicated by wave [b]’s subsequent advance. Note that wave (a) of this zig zag ended below the preceding January peak that began the pattern. Extending wave [a] by a fib. 38.2% ratio projects a terminal high for wave [b] towards 7381.64+/-. It looks like it will be a tight squeeze to fit a five wave subdivision into wave (c)’s advance from 6645.03 but it’s certainly possible. The rarer fib. 61.8% extension ratio comes in at 7612.32+/- but this seems unlikely to be tested relative to upside targets for other major indices, including the Value Line.

Conclusion

Once wave [b] ends the Nasdaq 100’s advance, it opens the door to another sizable sell-off for wave [c] within this developing expanding flat pattern. Downside targets are towards the 5977.63+/- area, derived by extending wave [a] by a fib. 23.6% ratio. This was selected over-and-above the other two fib-price-ratios because this closely converges with the fib. 38.2% retracement support of the preceding uptrend.

Market commentators are split between the hedonistic-bullish, and the perma-bears, but on this occasion, it looks like those treading the middle-ground have a more realistic chance of trading successfully in the months ahead.

Are you trading Nasdaq 100, Russell 2000, Dow Jones 30, EuroStoxx, Dax, FTSE100, Shanghai Composite, Hang Seng or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

SP500 – Drama, Declines & Opportunity!

by WaveTrack International| February 12, 2018 | 9 Comments

DIARY OF AN ELLIOTT WAVE ANALYST

SP500 – A WEEK OF DRAMA, DECLINES & OPPORTUNITY!

It was a week of drama, declines & opportunity for SP500. But it all began several days before, on Friday 26th January. The SP500 index was testing upside targets of 2861.75+/-, eventually overrunning slightly to 2878.50 (futures) first thing Monday morning. It then spent most of the week working lower. However, importantly unfolding into an intra-hourly five wave impulse pattern to 2813.00 ending a 1st wave in the process. Evidence of a five wave impulse pattern ensured downside continuity once a short-term correction had completed. And that’s exactly what happened by Thursday night when the index ended a 2nd wave correction at 2836.75. From then on, it was all downhill. Friday’s trading saw the SP500 decline in a 3rd wave sequence ending at 2755.00. On Monday, the 3rd wave ended at 2733.00 followed by a 4th correction to 2763.00 by the time the U.S. markets began trading. The 5th wave collapsed into Monday’s session to 2596.00, then extended into Tuesday’s low at 2529.00.

SP500 – Could such huge declines really be predicted?

Well, yes, why not. Perhaps the speed of the declines were not necessarily predicted unless you are familiar with the principle of VELOCITY in financial markets. If you’ve stared and studied such phenomenon in the past, you will begin to see! Understand that when any market runs higher, exponentially, upon exhaustion, it will decline by an equal or often larger velocity. That was certainly the case here.

In Friday’s January 26th Elliott Wave report, the SP500 was forecast building an important high towards the 2861.75+/- area. But then beginning a multi-month correction with minimum downside targets towards 2625.00+/-. This happened to be the fib. 23.6% retracement of minute wave 3’s advance measuring from its origin, the June ’16 Brexit low. Soon enough, the collapse gathered pace as last week’s trading began. Subsequently, resulting in reaching this downside target in short succession! – see Track Record in fig #1.

The Imporance of Correlations

Cross-referencing the decline with various other global indices, a synchronous pattern began to emerge. Monday/Tuesday’s rapid, accelerative declines was actually a 5th wave that was undergoing an ‘extension’, where one of three impulse sequences within a five wave pattern unfolds much larger than the other two. We could ‘proof’ that through fib-price-ratio analysis – for example, a common ratio found in 5th wave extensions is where it unfolds by a fib. 161.8% ratio of the 1st-4th waves – see fig #2. This projected a low for the 5th wave towards 2595.02 (cash index) – the actual low was 2593.07!

When 5th waves ‘extend’ like this, it commonly results in a hefty corrective upswing that follows, once again, the VELOCITY principle at work. During Wednesday’s session a three wave corrective sequence was forecast in our Elliott Wave report ending towards 2717.00+/-, the actual high was at 2727.67!

The ‘Compensation’ Factor

But because the preceding decline was an extended 5th wave plus the fact that the market’s emotions were running high, another principle was enacted – that of ‘COMPENSATION’. It’s function is to allow the market’s behaviours and emotions to ‘catch-up’ with the volatile price movements, and that often translates itself into a correction which unfolds as a ‘complex’ pattern, i.e. a horizontal/expanding flat, or perhaps a triangle. The subsequent trading-range created by such patterns allows the market’s behaviours and emotions to ‘digest’ the recent volatility. Our analysis reflected this too in Wednesday’s forecast for the S&P 500 to unfold the correction into an expanding flat pattern – labelled wave [b]. This required a decline from 2717.00+/- [2727.67] to a slightly lower-low, estimated down towards 2575.00+/-, [actual low was 2532.69] but then a hefty upside recovery that begins its final sequence, targeting upside levels towards 2738.50+/-. You can see how effective this forecast was into late-session Friday. The SP500 (cash) swing dramatically higher ending at 2619.55 – and this advance is by no means finished yet.

SP500 and Futures Contracts

Friday’s Elliott Wave report forecast this same decline, then reversal upswing for the SP500’s futures contract – see fig #3. The same five wave impulse pattern ended wave [a] into Tuesday’s low, but the following upswing to 2726.75 ended the entirety of wave [b]. The following decline actually begins the 1st wave within wave [c] declines, and in the morning, this was still incomplete with downside targets towards 2527.00+/-. This downside target was measured from the internal five wave development of this decline, where the fifth wave unfolds by a fib. 61.8% correlative ratio of the first-third waves.

Fast-forward to the evening session of Friday, the SP500 ran lower amidst nervous selling and a lot of bearish headline media reports, but within a few hours of the close, the SP500 hit a low at 2530.25, just a few points from ‘idealised’ target levels, then popped higher to begin wave [c]’s 2nd wave rally.

This coming week is expected to be a very positive week with more upside potential.

These price-forecasts are dedicated to R.N. Elliott’s work and discoveries – Peter Goodburn

PS: All of this has been forecasted in WaveTrack’s EW-COMPASS REPORT

For Stock Indices Traders

Single Video – $48.00* *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do) – PART I – STOCK INDICES (54 charts 2 hours long) (Dec. ’17/Jan. ’18) Table of Contents for the STOCK INDICES VIDEO

Are you trading Currencies – SP500, Nasdaq 100, Russell 2000, Dow Jones 30, EuroStoxx, Dax, FTSE100, Shanghai Composite, Hang Seng or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Elliott Wave – The SLANTING FLAT Pattern – GBP/USD

by WaveTrack International| February 9, 2018 | No Comments

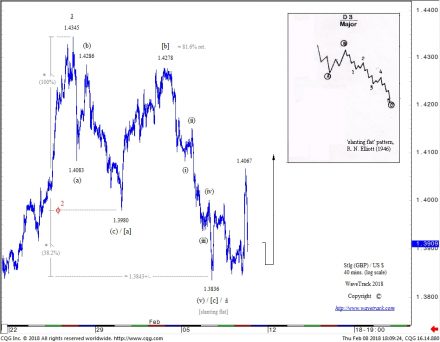

R.N. Elliott’s SLANTING FLAT Pattern – GBP/USD

There’s a variation to the corrective ‘FLAT’ pattern that R.N. Elliott documented which causes some confusion in identification. Fortunately, it’s quite rare though. It’s called a SLANTING FLAT. Like the ‘horizontal’, ‘running’ and ‘expanding’ flat’s it subdivides the same, as a 3-3-5 sequence but with some slight differences.

In a horizontal flat, waves A-B-C oscillate within almost-exact horizontal/parallel lines – in an expanding flat, wave A establishes an initial trading range, but waves B and C marginally exceed wave A upon completion – and finally, the running flat where waves A and B conform to the same movements as the expanding flat except that wave C falls short of ending towards the completion of wave A – see fig #1.

Slanting Flat Pattern

But the ‘SLANTING FLAT’ is a bit of a hybrid of these other patterns. Wave A establishes the trading range-extremity whilst subdividing into a three wave zig zag (can also unfold into a double/triple zig zag). But when wave B begins to unfold, it doesn’t equal or break above the original level of wave A – rather, it falls short. It does subdivide into a three wave zig zag though (can also unfold into a double/triple zig zag). Here’s the interesting bit – the next sequence as wave C unfolds into a five wave impulse pattern and it exceeds the completion of wave A. Sounds simple enough, but here’s the ‘rub’ – how can this be differentiated between a developing double zig zag pattern, i.e. A-B-C-X-A-B-C, 5-3-5-X-5-3-5? The same subdivisions for the ‘slanting flat’occur up until the sequence A-B-C-X-A…waves B-C are missing.

There’s only one certain way to differentiate between a completed ‘slanting flat’ and a developing double zig zag and that’s cross-referencing the pattern with other contracts/markets – there’s a good chance the pattern is unfolding differently but is less ambiguous.

GBP/USD

For what it’s worth, GBP/USD has just completed a real-time ‘SLANTING FLAT’ pattern – see fig #2.

R.N. Elliott’s original template is inserted top-right. Labelled in minuette degree, [a]-[b]-[c], note that wave [a] subdivides into a required zig zag ending at 1.3980 and how wave [b] doesn’t quite make it to wave [a]’s origin of 1.4345 instead ending short at 1.4278 (a retracement of 81.6%). In reality, the 1.4278 high could have ended wave [x] within a developing double zig zag. The following five wave impulse decline to 1.3836 is labelled as ending wave [c] of the slanting flat but could be mistaken for wave [a] within a secondary zig zag. A comparative look at the Euro/US$ confirms the slanting flat because it has synchronously completed a double zig zag at the same time GBP/USD traded to 1.3836.

Fib-Price-Ratios

Our proprietary use of fib-price-ratios also comes in useful in verifying the completion of a slanting flat rather than a developing double zig zag pattern. Extending wave [a] by a fib. 38.2% ratio projects a terminal low for wave [c] to 1.3843+/-, the actual low was 1.3836.

Conclusion

Yes, it is still possible to conclude the following rally from 1.3836 to 1.4067 in GBP/USD is wave [b] of the secondary zig zag within a double formation but again, analysis must be cross-referenced to other positively-correlated contracts/markets.

Good luck and best wishes,

Peter Goodburn

WaveTrack International

For Currency Traders

Single Video – $48.00* *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do) – PART II – CURRENCIES (55 charts 2 hours long) (Dec. ’17/Jan. ’18)

Are you trading Currencies – USD, EUR, STLG or AUD? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

3 Reasons to watch out for Copper

by WaveTrack International| January 30, 2018 | No Comments

Copper – 2016 impulse uptrend concluding with ending-diagonal pattern!

It was exactly two-years ago that Copper prices were forging important lows at $4318 tonne. At the very same time the grand ‘RE-SYNCHRONISATION’ lows formed for developed and emerging markets. This major event was identified and documented in our monthly INSTITUTIONAL EW-NAVIGATOR REPORT and subsequent bi-weekly supplemental reports throughout 2016 onwards. It triggered what we termed as the 2nd PHASE of the ‘INFLATION-POP’. In Elliott Wave terminology this is called the next uptrend for primary wave C for major Emerging Markets & Commodities, including Copper.

Fast-forward to January/February 2018, Copper prices are approaching an interim terminal peak within the medium-term uptrend of Primary wave C which is labelled intermediate wave (1). This is the five wave impulse uptrend that began from the Feb.’16 low.

Copper – An Ending-Diagonal within Minor Wave v. Five

The fifth wave of wave (1)’s advance, labelled minor wave v. five began from the May ’17 low of 5463. Adhering to the fractal nature of financial markets, this fifth wave is also subdividing into a smaller five wave pattern. In this case a 1-2-3-4-5 pattern. Interestingly, minute wave 5 is itself unfolding into an ending/contracting-diagonal pattern, a wedge-shaped impulse sequence. Furthermore, this sequence itself is composed of five price-swings which began from last September’s low of 6366 – see fig #1.

In Elliott Wave methodology, a five wave diagonal pattern only appears at either the beginning or the ending of an existing trend. Clearly, this one is an ending-type given Copper has been trending higher for two years. And so evidence of a diagonal pattern appearing now is a forewarning of an imminent change of direction.

Fib-Price-Ratios

However, the diagonal is not quite ready to complete just yet. It seems to require one additional upside attempt above December’s 3rd wave high of 7312. This is labelled as minuette wave [iii] to fulfil a terminal high for the 5th wave, minuette wave [v]. Our proprietary fib-price-ratios applied to fifth waves of a ‘contracting’ type diagonal propose wave [v] will unfold higher by a fib. 61.8% correlative ratio of wave [iii] which projects a final upside test to 7400+/-.

Conclusion

Our monthly EW-COMMODITIES OUTLOOK report is about to be published with Copper’s entire five wave impulse sequence shown unfolding from the Feb.’16 low along with cycles and its positive correlation with other Base Metals. It suggests that Copper and other base metals are forming important highs for the entire year, with multi-month corrective declines about to begin. That of course, contrasts to market consensus, but taking a contrarian stance at key junctures is what financial-forecasting is all about!

3 Reasons to watch out for Copper Prices

Naturally, should Copper form a high then turn lower as we expect, it will have far-reaching effects in many other asset classes too – 1. U.S. stocks are extremely elevated right now and could do with a bit of a wash-out dell-off to trim the excesses – 2. also, watch for ‘fake-out’ not ‘break-outs’ in precious metals and – 3. long-dated interest rates over the coming month.

Good luck and best wishes,

Peter Goodburn

WaveTrack International

Take advantage of WaveTrack’s COMMODITY OUTLOOK 2018 including Base Metals, Precious Metals, Energy and a special feature of Base and Precious Metal Miners. Subscribe here to our Elliott Wave Commodities Outlook.

Currencies & Fixed Income 2018 Video Series

by WaveTrack International| January 29, 2018 | No Comments

This latest installment of WaveTrack International’s Annual 2018 three part VIDEO SERIES takes an in-depth look at how Elliott Wave patterns and cycles translate across most of the major currencies & interest rates of the world – PART III, CURRENCIES & INTEREST RATES – 2018 & BEYOND.

Our latest Video/Report analyses over 55 charts and cycles highlighting major trends, reversal levels together with Fibonacci-Price-Ratio projection levels of the major currency pairs/crosses and interest rates of the U.S., Europe and Japan. Don’t hesitate. This is the most thoroughly researched, accurate ELLIOTT WAVE ANALYSIS on the planet. We’ll be taking a look at currency trends over a 50+ year period and projecting these trends into the future. And if you want to see what the US$ Dollar looks like over a period of 350-years and U.S. interest rates over a period of 250+ years, then this latest ANNUAL 2018 ELLIOTT WAVE PRICE-FORECASTS & CYCLE PROJECTIONS will tell you.

US Dollar 2017 Recap

It was exactly 1-year ago, in January 2017 when the annual forecast wrote: This year’s most anticipated event is the changing trend for the US$ dollar against its G4+ counterparts. Over the last 7.8-year cycle period, the US$ dollar index has traded higher from the pre-financial-crisis lows to current levels but contained within a typical Elliott Wave, THREE price-swing pattern…This 7.8-year cycle upswing is about to complete, into Q1’17 then stage a reversal-signature that resumes the long-term downtrend. The dollar’s decline over the next several years will be massive, fueling a resurgence in commodity values and other assets classes in this 2nd phase of our ‘INFLATION-POP’ scenario.

It’s easy to forget just how prescient this forecast was because the US$ dollar has since declined so rapidly during the last year. It is now already embedded into our current reality – in other words, we’ve got used to it! But at the time, it was oh-so contrarian with consensus opinion heavily tilted towards a strengthening US$ dollar. Mainly because the Federal Reserve was expected to continue tightening monetary policy and a resurgent U.S. economy triggered by President Trump’s ‘America First’ programme. But all that was blown away during 2017. The US$ dollar index benchmark has since declined by -14.8% per cent – but why? Part of the reason has been a resurgent Euro which is the world’s second most traded currency unit. Yet, we believe the real reason behind the US$ dollar’s decline is the change in its alternating 7.8-year cycle.

Currencies and 7.8-Year Cycle Downtrend

Back in 2008, the dollar index formed a low at 70.70. Fast-forward another 7.8-years to late-2017, early 2017, the cycle alternates to form its next major peak. This of course, means the next 7.8-year cycle is now in a downwards direction from the US$ dollar. But what path is it likely to follow during this time period? No trend or even counter-trend trades in a straight-line! This annual report examines that path for the US$ dollar, but also how this relates to the Euro/US$, Stlg/US$, US$/Yen and many more currency pairs and crosses. And to place the 2018 forecasts into context, we’re examining long-term trends to see how they’ve interacted in the past, how they influence the future.

Furthermore, we also take a look at the net aggregated US$ dollar positioning against 8 currencies which offers a glimpse into sentiment extremes and what the immediate future holds for many of these trends. We expect to see a significant directional change of intermediate degree status into Q1 2018 which will have an effect on all currency pairs and crosses. Specific attention is also drawn to Commodity Currencies like the Aussie and Canadian dollar, together with Yen crosses against other majors. Our attention then turns to Emerging Market currencies, the Asian ADXY basket, but also some directional hints for the Korean Won, Singapore Dollar, Indian rupee, Taiwan Dollar, Thai Baht, Malaysian Ringgit, Indonesian Rupiah and the Philippine Peso. Our analysis will also include the Mexican Peso, US$/Rand, Brazilian Real, the Russian Rouble and China’s Renminbi – oh, I almost forget to mention Bitcoin!

Interest Rates – U.S. | Europe | Japan

Interest Rates are a big subject for 2018. Whilst the Federal Reserve has begun to withdraw from monetary stimulus over the last year with rate hikes a normal feature and expectation for 2018, it’s quite a different story with two other major central banks. The European Central Bank is continuing to exert its stimulus programme with continued bond purchases with no signs of withdrawal. Even though it acknowledges the Eurozone economy is in a strong recovery. The Bank of Japan has just reiterated its commitment in maintaining its own economic stimulus agenda whilst its key inflation measures remain benign. This dislocation is an intriguing one but there is some uniformity in the way long-dated interest rates are behaving.

One aspect worthy of mention is that despite U.S. stock markets reaching new record highs and a strong economic reading across many industrial sectors. Yet, the US10yr yields are relatively low by comparison! This annual 2018 report will offer some insights as to why this is happening whilst planning a definitive route for long-dated yields for this coming year. We’ll make comparisons with the benchmark European DE10yr yield and adding some cycle analysis before finalising with an outlook for the TIPS 10yr Inflation rate and Japanese 10yr yield forecast.

Only Twice a Year!

This new 2018 CURRENCY & INTEREST RATES VIDEO is like nothing you’ve seen anywhere else in the world. It’s unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Cycles and Currencies, Interest Rates from around the world. It is only available twice a year!

We invite you to take this next part of our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

The contents of this CURRENCIES & INTEREST RATES VIDEO include Elliott Wave analysis for:

Currencies:

• US$ index

• Euro/US$

• Stlg/US$

• US$/Yen

• US$/CHF

• AUD/US$

• NZD/US$

• US$/CAD

• Euro/Stlg

• Euro/Yen

• Asian ADXY

• US$/IDR

• US$/MXN

• US$/ZAR

• US$/BRL

• US$/RUR

• US$/CNY

• Bitcoin

Interest Rates:

• U.S. AAA+ 30-Year Corporate Bond Yields

• US30yr Yield

• US10yr Yield

• US10yr TIPS Break Even Inflation Rate

• DE10yr Yield

• JPY10yr Yield

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00* *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do) – PART II – CURRENCIES (55 charts 2 hours long) (Dec. ’17/Jan. ’18)

Triple Package offer – $96.00* (saving 33%) *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do)! – PART I – PART II – PART III (Dec. ’17 – Feb. ’18)

And the latest COMMODITIES video covers 67 charts and is 2 hour 5 mins long. click here to read more about the COMMODITIES video content

Visit us @ www.wavetrack.com

BOVESPA – How to time the S&P 500 turn!

by WaveTrack International| January 23, 2018 | No Comments

U.S. stock indices are stretching ever higher whilst setting quite a few records into the end of 2017. Last year, it gained in each month, something never done before. And as for January 2018, it’s one of the longest runs in history without a -3% per cent correction!

We’re setting a few records in terms of Elliott Wave analysis and Fibonacci-Price-Ratios too! This is significantly evident in the way the S&P has run higher from last August’s low of 2415.75 (futures). This five wave impulse pattern is labelled as minuette wave [v]. The fifth wave within the larger 3rd uptrend that began from the June ’16 Brexit low. It started subdividing into a series of 1-2’s, three sequences in all prior to undergoing what we term as ‘price-expansion’ which defines the 3rd-of-3rd-of-3rd wave sequence.

Setting Fib-Price-Ratio Records!

There’s a high-occurrence statistic associated with impulse patterns that undergo several degrees of subdivision. This is where the 1-2-1-2-1 sequence is extended by a fib. 161.8% ratio in projecting the terminal high for the entire pattern through each degree of trend, i.e. to finish the entirety of minuette wave [v]. Consequently, this projected the exact high traded on December 4th 2017 at 2665.25. But the uptrend didn’t finish there, and this is why it’s setting some fib-price-ratio records too! It’s very rare for an index to extend beyond such measurements. The only occasion we’ve recorded a previous event was in the run-up to ending the great bull market uptrend of the 1990’s! So this current pattern will go into our archives!

What Next?

The next series of fib-price-ratio measurements extend the 3rd-of-3rd-of-3rd wave high traded at 2577.25 (Oct. 23rd) by a fib. 161.8% ratio which projects a terminal high at 2861.75+/-. We notice a fib-price-ratio convergence-matrix at the 2860.00+/- area from measuring December’s final impulse wave upswing and the minuette degree impulse from the June ’16 Brexit low, so there is good reason to think the index will complete and stage a reversal-signature at this upside area.

Bovespa

In order to verify an upside exhaustion for the S&P 500 like this, it must be corroborated by comparing the progress and pattern development of various complimentary, but different indices. One interesting proxy that might just assist in timing the turn for the S&P is Brazil’s Bovespa.

In this chart, you’ll notice a clean five wave impulse pattern unfolding higher from the Feb.’16 low of 37265.00 – see fig #1. There’s no record-setting gains or unique or rare fib-price-ratio’s here – plain and simple! The only complexity is the price-spike low traded in the 4th wave correction in May ’17. If the extremity of this is used, then a final 5th wave can unfold by a fib. 61.8% ratio of the 1st-3rd waves ending at 85668.00+/-. That’s not too far above current levels. And even nearer if the price-spike is filtered to its closing level – extending waves [i]-[iv] by a fib. 61.8% ratio would project a terminal high for wave [v] towards 82817.00+/-.

Conclusion

The Bovespa is approaching an important peak with a multi-month correction due to begin afterwards. That would pull prices significantly lower until mid-year. The exact timing of this correction can be used to help pinpoint the next peak for the S&P – and it’s not too far away anymore!

Don’t forget to subscribe to our bi-weekly reports for updated ELLIOTT WAVE forecasts on these indices and their next price developments!

Good luck and best wishes,

Peter Goodburn

WaveTrack International

PS: If you want to find out WaveTrack’s long-term trends for global financial STOCK INDICIES dont’t forget to check our latest STOCK INDICES video. Published only twice a year!

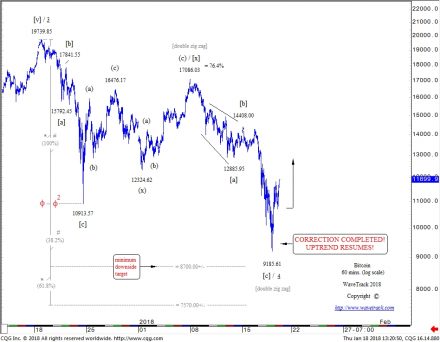

BITCOIN – CORRECTION COMPLETED – UPTREND RESUMES!

by WaveTrack International| January 18, 2018 | No Comments

BITCOIN in the media

Back in September of last year, 2017, we noted in our analysis of Bitcoin that its uptrend would last longer than most believe (13th Sept. 2017 Bitcoin Bubble or no Bubble). And that it would post higher highs for some time to come. More recently, last December, we forecast Bitcoin would undergo a healthy correction from its high of $19891.00 with minimum downside targets towards 8700.00+/-.

Well, we’ve read some horror stories from investors since. Particularly over the last several days as prices have plummeted lower. Now if you’re reading this and have experienced the effects of this downswing, let me just say this is a market for experienced people. If you haven’t traded actively for several years in volatile conditions, then you probably don’t have the experience to handle this type of huge price-swings associated with public schizophrenia. Our recommendation – seek advice, or stop trading before you lose all your capital. This analysis is the product of 40+ years’ experience in trading such volatile markets. And sometimes, even the pro’s get it wrong. The top pro’s always work with mathematical ‘probabilities’ which are themselves taught by their ‘Masters’. Yes, there’s a hierarchy of knowledge how to trade, not unlike good doctors, great doctors and their ‘masters’ too!

Correction Completed! – Uptrend Resumes!

Minimum Fibonacci-downside targets being approached yesterday (Wednesday 17th January ’18) with intra-day trading touching 9231.10 (cash bitcoin), 9185.61 (CME). And, yes, the decline does conform to a completed Elliott Wave double zig zag pattern. This ended minute wave 4 according to our original analysis from the beginning of January. It’s taken less than a month to complete this pattern, a double zig zag, labelled in minuette degree, [a]-[b]-[c]-[x]-[a]-[b]-[c] – see fig #1.

What Next?

The prevailing uptrend can now continue. We can see the obvious sign that this has already begun as prices have unfolded subsequently higher into a five wave impulse pattern up to 11655.00 (cash bitcoin), 11822.79 (CME) in early trading Thursday (18th Jan.’18). This uptrend can either reattempt the December highs, then fall back again so that minute wave 4 continues as a more complex corrective pattern. Or it can surge to higher-highs as minute wave 5 of minor wave iii. three. Either way, a platform of support is now behind us at 9231.10 (cash bitcoin), 9185.61 (CME) and this acts as the stop-loss for any trading strategy.

If you’d like more information about next upside targets, get in touch with us by leaving comments below. We’d love to gauge your interest!

Good luck and best wishes,

Peter Goodburn

WaveTrack International

COMMODITIES VIDEO OUTLOOK 2018

by WaveTrack International| January 15, 2018 | No Comments

COMMODITIES VIDEO OUTLOOK 2018 – Part II

Correction for Base Metals – Platinum to Outperform Gold – Energy Bullish into Mid-Year!

This time last year, in January 2017, Base Metals led by Copper were trading into a sideways pause within uptrends that began from the Jan/Feb.’16 lows. Whilst, Precious Metals were just ending corrective declines that began from the summer 2016 heights but were preparing to resume larger uptrends. And Energy Markets such as Crude Oil were about to begin a sizable correction that eventually ended several months later. These disparate rhythms are not unusual for these different commodity sectors over periods of several months but it does emphasise just how important it was when they all converged into simultaneous lows back in Jan/Feb.’16 – we termed this event as the grand ‘RE-SYNCHRONISATION’ process. It was a time when Developed Markets (DM) and Emerging Markets (EM) & Commodities ended major counter-trend declines at exactly the same period which resulted in triggering the 2nd Phase of the ‘INFLATION-POP’ where asset prices undergo another multi-year price advance, similar to the gains that unfolded immediately after the lows of the financial-crisis.

The upside progress for each sector has been uneven though, and this is again something visible in the Elliott Wave pattern progression for this coming year, 2018. Intermediate-term peaks and troughs will occur at different times although they each remain within the larger multi-year uptrend of the inflation-pop. Exactly which sector forms peaks first or troughs later depends on various factors, including the path of the US$ dollar as all are still predominantly priced basis the U.S. currency.

Bullish Uptrends with Short-Term Downside Risk

This latest Annual 2018 Commodity Outlook remains overwhelmingly bullish for each of the three sectors we analyse over the intermediate/medium-term. However, shorter-term, there are some downside retracement risks that lie just ahead. This may have something to do with a minor US$ dollar rally which would force a counter-trend correction for some key areas as 2018 begins. The US$ dollar isn’t quite yet ready for a sustained recovery as 2018 gets underway – rather, we expect this to begin following a low in May/June ‘18.

Short Summary of all 3 Commodities Sectors

New Commodities 2018 Video – PART II/III

These are some of the themes we’ll be talking about in our latest video. For 2018, we expect to see some huge price movements across the three major sectors. Although, they aren’t necessarily going to be uniform in their price development. Base Metals are an indicator of the overall global economy. To define its rhythms of growth and decay and this will be key to understanding how this year’s overall path of global expansion is developing. Precious Metals are either on the verge of breaking higher to resume the next stage of the ‘inflation-pop’ or they’ll turn lower for a short while to prolong last year’s correction before resuming uptrends later. The Energy sector including Crude/Brent oil are already surging higher. Here we’ll be taking an in-depth look at both preferential and alternate counts to see just how far these price gains can last.

This new 2018 COMMODITIES video is like nothing you’ve seen anywhere else in the world. It is unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Cycles and major contracts of other asset classes from around the world.

We invite you to take this next part of our financial journey with us. Video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Commodities Video Outlook – How to Subscribe

Contents: 67 charts

• CRB-Cash index + Cycles

• Copper + Cycles

• Aluminium

• Lead + Cycles

• Zinc + Cycles

• Nickel

• Tin

• Iron-Ore

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Kazakhmys Copper

• Gold + Cycles

• GDX Gold Miners Index

• Newmont Mining

• GoldCorp Inc.

• Barrick Gold

• Agnico Eagle Mines

• AngloGold

• Silver + Cycles

• XAU Gold/Silver Index

• Gold/silver Ratio

• Palladium Correlations

• Palladium

• Platinum

• Crude Oil + Cycles

• Brent Oil

• IXC iShares Global Energy Index

• XLE Energy SPDR Index

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00* *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do) – PART II – COMMODITIES (Dec. ’17/Jan. ’18)

Triple Package offer – $96.00* (saving 33%) *(additional VAT may be added depending on your country of residence. Currently US, Canada, Asia have no added VAT but most European countries do)! – PART I – PART II – PART III (Dec. ’17 – Feb. ’18)

. And the latest COMMODITIES video covers 67 charts and is 2 hour 5 mins long.

PART III will be available in a few weeks’ time (2018!) – we’re working on it!

PS: Part III for Currencies & Interest Rates will be published towards the end of January/beginning of February 2018.

Visit us @ www.wavetrack.com