Elliott Wave Theory Bullish – Dow Theory Bearish

by WaveTrack International| November 27, 2018 | 6 Comments

Dow Theory vs. Elliott Wave Theory

Read more «Elliott Wave Theory Bullish – Dow Theory Bearish»

Nasdaq 100 Heading for Major Support

by WaveTrack International| November 21, 2018 | 3 Comments

Nasdaq 100 Breaks October Low but Heading for Major Support

Read more «Nasdaq 100 Heading for Major Support»

STLG/USD Declines Following Cabinet Brexit Approval

by WaveTrack International| November 15, 2018 | No Comments

Read more «STLG/USD Declines Following Cabinet Brexit Approval»

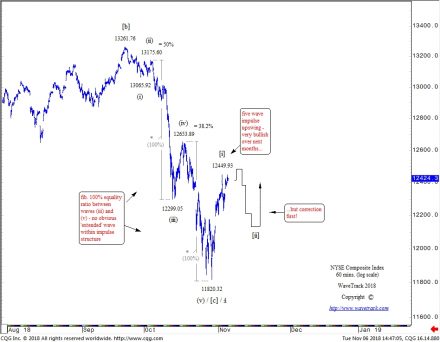

NYSE Composite Index – Latest Development

by WaveTrack International| November 6, 2018 | No Comments

NYSE Composite Index – Fib. 100% Equality Ratio in Waves (iii) – (v) – No ‘Extended’ Wave

The Elliott Wave pattern development within the third phase of U.S. stock index declines during September/October’s sell-off varied according to each index’s performance from earlier this year. For example, the large-caps like the SP500 and Dow Jones (DJAI) declined into three wave patterns. In zig zags to be precise, from the late-Sep./early-Oct. highs as wave [c] within a developing triangle. These lows terminated in late-October but above the February lows. In this way reflecting their outperformance during April’s strong advances that broke above the January highs.

Other indices like the underperforming Russell 2000 small-cap index declined during September/October’s sell-off into a five wave impulse pattern. This reflected its underperformance and an entirely different corrective pattern. In this case, a running flat, unfolding from last January’s high.

The NYSE Composite index was one of the underperforming indices for this year. It unfolded into a zig zag pattern, [a]-[b]-[c] and one of the exceptions by breaking below the Feb’18 lows in wave [c] ending at 11820.32 – see fig #1.

Wave [c] unfolded into a necessary five wave impulse pattern from September’s high of 13261.76 subdividing (i)-(ii)-(iii)-(iv)-(v). What was interesting from a Ratio/Proportion basis was that there was no ‘extended’ wave in this sequence. Rather, waves (iii) and (v) measured equally by a fib. 100% equality ratio. That’s somewhat unusual because R.N. Elliott stated that one wave must ‘extend’ or measure larger than the other two. But occasionally, this hasn’t occurred as this example proves. Although this is statistically uncommon, it’s enough to qualify his statement as a ‘guideline’ rather than a ‘rule’.

NYSE Composite Index – Looking Ahead

With this year’s zig zag decline out of the way, the NYSE Composite index, like the others, can now begin a multi-month recovery, extending the bull market, impulse uptrend that began from the Feb.’16 lows.

Shorter-term, the advance from 11820.32 has unfolded into an intra-hourly five wave impulse pattern ending last Friday at 12449.93 as minuette wave [i]. Wave [ii] has since begun a three wave counter-trend correction but this remains incomplete. Await some downside pull across the U.S. mid-term election results before the trend resumes higher.

What has the SP500 and Nasdaq 100 in common?

by WaveTrack International| November 1, 2018 | 5 Comments

Three Wave Zig Zag Decline Completed for SP500 + Nasdaq 100

The SP500’s decline from September’s high has completed a three wave zig zag corrective pattern into last Monday evening’s low of 2603.00. This development changes this year’s expanding flat into developing triangle pattern. Turning this into a bullish outlook from current levels through to year-end and into H1-2019. The Nasdaq 100 follows the same pattern. Ending into zig zag from October high at 6580.50 and again turning this into a bullish outlook into year-end.

This year’s declines from January’s highs have been labelled as unfolding into an expanding flat corrective pattern as minute wave 4. However, it is now changing into a triangle. See latest EW-Compass Report.

The original expanding flat patterns were labelled [a]-[b]-[c], subdividing [3]-[3]-[5]. They were requiring a five wave downswing from the late-September/early-October highs. Hence, for the SP500 from 2940.91 (cash) and 2947.00 (futures) and for the Nasdaq 100 from 7700.56 (cash) and 7728.75 (futures). But we’ve detected a visible three wave zig zag pattern unfolding in wave [c]’s decline rather than a developing five wave sequence. The two downswings from 2947.00-2712.25 and from 2824.25-2603.00 measure equally. In case of the SP500 by a fib. 100% equality ratio (see SP 500 – inset left) and for the Nasdaq 100 from 7728.75-6907.75 and 7368.50-6850.50 (see Nasdaq 100 – inset right). This fits the characteristic of the zig zag. It therefore ends wave [c] but within a developing triangle because a triangle is labelled [a]-[b]-[c]-[d]-[e] but importantly, subdivides [3]-[3]-[3]-[3]-[3].

Conclusion

These zig zags confirm a good recovery can begin as wave [d] within the triangle. As a result, the SP500’s upside targets are aiming towards 2855.75+/- and Nasdaq 100’s towards 7544.00+/- into year-end, perhaps into January. Looking ahead, the triangle confirms minute wave 4 and upon completion, wave 5’s push to record highs.

Bi-weekly updates on the SP500, Nasdaq 100, US Dollar Index, Crude Oil, EuroStoxx, Russell 2000, Dow Jones 30, Dax, ASX200 and more! Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

US$ Dollar Gains After Fed – Shouldn’t Crude Oil Also Decline?

by WaveTrack International| September 28, 2018 | No Comments

US$ Dollar Gains After Fed – Shouldn’t Crude Oil Also Decline?

Following Wednesday’s Federal Reserve interest rate hike of 0.25% to 2.25%, the US$ dollar has pulled higher by 1.23% per cent from 93.95 to 95.11. The US$ dollar looks set to continue higher over the next week or two as the finalising sequence of the expanding flat pattern (see Twitter post 26th September 2018).

Now what about Crude Oil?

But the intriguing question now relates to Crude Oil – see fig #1.

As you can see from this analogue, there’s currently a high-negative correlation with the US$ dollar index. Even price-amplitudes are closely aligned. The US$ dollar index pulled higher through Wednesday/Thursday and continuing this advance today (Friday). However, Crude Oil has failed to respond lower in reaction to the stronger US$ dollar. Is there any obvious reason for this breakdown in the correlation?

From an Elliott Wave perspective, the exact same Elliott Wave count is applied to Crude Oil, where an expanding flat is unfolding from Crude Oil’s early-September high of 71.40 – see fig #2. Labelled [a]-[b]-[c]. Wave [a] declined into a zig zag ending at 66.86 on September 7th. And was followed by a double zig zag upswing as wave [b] into the Sep. 25th high of 72.78. If correct, as we believe, then it really should decline now as wave [c] towards levels of 66.20-65.80+/-.

Conclusion

Perhaps it’s simply a case of playing ‘catch-up’. However, delays in these types of set-ups are not uncommon. One might view the delay as a complete breakdown of the negative correlation. In this case, Crude Oil’s underlying uptrend is so strong that it’s able to withstand a shorter-term US$ dollar rally. But often, trading opportunities exist where the divergence is simply delayed. Consequently, Crude Oil will perhaps suddenly, trade sharply lower.

Differentiation between the two possibilities comes down to the qualitative assessment of Crude Oil’s pattern. September’s advance does certainly conform to a double zig zag pattern (66.86-72.78). Therefore, the probability that it can still decline as wave [c] to 66.20-65.80+/- is increased.

Risk/Reward becomes a factor in whatever trade set-up is taken. Ensure close stops are applied, e.g. Crude Oil above the fib. 38.2% extension level of wave [a]’s trading-range at 73.15 would probably negate this high area as wave [b] of the expanding flat.

Bi-weekly updates on the US Dollar Index, Crude Oil, SP500, EuroStoxx, Nasdaq 100, Russell 2000, Dow Jones 30, Dax, ASX200 and more! Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Apple Inc. – Right on Target!

by WaveTrack International| September 24, 2018 | 2 Comments

Apple Inc. Hits Upside Targets of 228.42+/- Then Stages Reversal-Signature!

The August 3rd update of Apple Inc. forecast upside price acceleration following the publication of strong quarterly earnings results. Elliott Wave analysis had identified this latest push to record highs as a concluding 5th wave within the five wave impulse pattern unfolding higher from February’s low of 150.24. But this was minor wave v. five within the larger impulse uptrend. This wave dates back to the May ’16 low of 89.47, labelled intermediate wave (5) which means a much larger uptrend was approaching completion.

Using fib-price-ratios, Apple Inc. was forecast higher from 207.39 ending minor wave v. five at 228.42+/-. The actual test of this price level occurred on September 5th at 229.67. It was derived where minor wave v. five unfolds by a common fib. 61.8% correlative ratio of waves i-iii one-three.

Since achieving this upside target for wave v. five of (5), Apple Inc. has now staged price-rejection. The subsequent reversal-signature confirms that a counter-trend decline has begun.

What Next?

The next question is how far can Apple Inc. decline in this correction? Intermediate wave (5)’s advance from the May ’16 low was also the concluding 5th wave of primary wave 5. It stretches back to the April ’13 low of 55.01. And primary wave 5 is also part of the longer-term impulse uptrend that began from the July ’82 low of 0.19. If correct, then Apple Inc. could begin a major correction lasting a decade or more. Returning prices back to low-double-digit levels! But is this likely at this juncture of the secular-bull uptrend? After all, the Nasdaq 100 is still some way off Elliott Wave upside targets of 11946.00+/- (see bi-annual video series).

Apple Inc. – Alternate Counts

Although Apple Inc.’s historical data begins in December 1980, this isn’t enough to verify an absolute terminal price-peak for ending its long-term uptrend. Major indices bottomed in 1974, six years earlier so we can only guess what Apple Inc. would have traded then. It makes a huge difference in Fibonacci-Price-Ratio measurements of the secular-bull uptrend and of course, the Elliott Wave pattern itself.

The current long-term wave analysis is therefore one of a few potentialities labelling primary wave 1 ending into the April ’91 high of 2.61, primary wave 2 into the Dec.’97 low of 0.45, primary wave 3 ending into the Sep.’12 high of 100.72 and now primary wave 5 completing in Sep.’18 at 229.67.

But what we can determine with some surety is that a five wave impulse upswing from the May ’16 low of 89.47 did end into the early-September high of 229.67 which at the very least, indicates a corrective retracement towards ‘fourth wave of preceding degree’ which is at the Feb.’18 level of 150.24.

One alternate count that prolongs Apple Inc.’s secular-bull uptrend relabels the intermediate degree subdivision of primary wave 5’s advance from the April ’13 low of 55.01 so that wave (1) ends into the April ’15 high of 134.54, wave (2) into the May ’16 low of 89.47, wave (3) into the Sep.’18 high of 229.67 with wave (4) now engaged in a corrective downswing towards the fib. 38.2% retracement level of 160.00+/-. Naturally, this decline would necessitate unfolding into a three wave pattern, or a multiple seven/eleven wave sequence to validate its corrective credentials so would be easily spotted and differentiated to a more bearish impulse pattern.

Conclusion

Apple Inc. has underperformed over the last weeks. In fact, coming bottom of the Dow Jones 30 index table of component stocks. Apple reached a decline of -2.8% per cent over the last week alone and down -6.25% per cent from the high. This is consistent action following the completion of the 5th wave at 229.67. However, it’s too early to verify Apple Inc.’s long-term consequences. This means for the time being, downside targets are at least towards the 160.00+/- area.

Are you trading the SP500, EuroStoxx, Nasdaq 100, Russell 2000, Dow Jones 30, Dax, FTSE100 or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Dow Jones – Expanding Flats + Triangles

by WaveTrack International| August 24, 2018 | 3 Comments

Elliott Wave Patterns – Expanding Flats + Triangles

Expanding Flats

This year’s corrective downswing in the Dow Futures from January’s high is of particular interest. Mainly, because its early-April low at 23344.50 briefly penetrated below the early-February low 23360.20. This allows an expanding flat to develop from the February low as a corrective sequence. At the same time confirming April’s advance as the third sequence of the pattern rather than part of a sustainable uptrend. (See latest EW-Compass Report). April’s advance is labelled wave (c) unfolding into an ending/expanding-diagonal.

The final stage of April’s diagonal can be seen approaching a terminal high into current levels. A perfectly formed expanding flat formed from the late-July high of 25572 (futures) into the mid-August low of 24955 – see fig #1. Labelled (a)-(b)-(c) subdividing 3-3-5. Wave (a) declined into a zig zag. Wave (b) rallied into another zig zag prior to wave (c)’s decline as a five wave impulse into the 24955 low.

Moreover, fib-price-ratios (FPR’s) are evident. Providing authenticity to the pattern – extending wave (a) by a fib. 14.58% ratio projects within a few points of wave (b)’s high – extending wave (a) by a fib. 23.6% ratio projects wave (c) to within a few points of the actual low.

Triangles

Within wave (c)’s impulse decline, 1-2-3-4-5, wave 4 can be seen unfolding into a triangle (see inset, top-left). We bring attention to this because triangle patterns are actually uncommon patterns in terms of recurrence/frequency and are often misidentified in the EW community. This example is a good example of an actual triangle.

It’s important to ensure that each wave within the triangle, a-b-c-d-e develops within a near-symmetrical formation with approximately equal boundary lines. This ensures each wave gets close to touching the upper and lower boundary lines. If one sequence is too short so that it doesn’t approach the boundary line, then it probably isn’t a triangle at all which means the analyst must look at other possible wave counts. The only exception is in wave ‘e’ when sometimes, it does fall short. However, none of the others should exhibit this aspect.

Conclusion

The Dow has since traded to a higher-high at 25885. And whilst it could extend a little higher, this existing high has done enough to end the 5th wave thrust from the mid-August low whilst ending the larger 5th within April’s diagonal and the expanding flat from February’s low. That’s bearish!

SP500 – Higher-Highs but Approaching a Terminal Peak

by WaveTrack International| August 7, 2018 | 4 Comments

Despite the SP500’s intra-hourly five wave impulse decline from the July 25th high of 2849.50, the index has manged to secure a higher-high this week. Something that shouldn’t have occurred if a new downtrend was about to begin. There’s only one explanation. The five wave pattern was the concluding sequence within an expanding flat correction. In this case, a-b-c where its three price-swings subdivide 3-3-5 with the five sequence ending at 2791.00 – see fig #1.

The expanding flat is then incorporated into the developing five wave upswing that began from the late-June low of 2693.25 as micro wave [5]. Subdividing 1-2-3-4-5, the expanding flat becomes wave 4 with wave 5 already in upside progress. The fib-price-ratio measurements project to 2870.25+/- where wave [5] unfolds by a fib. 61.8% ratio of waves 1-3. If the same ratio measurement is used but including the ‘b’ high within wave 4, then wave 5 could push as high as 2890.00+/- but this is seen as a lower probability event.

It’s worth noting that the recent five wave decline in the Nasdaq 100 (not shown) from 7530.00 to 7166.75 was too large to be incorporated as wave 4 within the same five wave upswing from the late-June low as the SP500. Which means there is a heightened probability it will crash lower from below the existing 7530.00 high.

Conclusion

April’s diagonal pattern remains the best description for this uptrend from 2553.80. Comparing this with other indices like the Nasdaq 100 simply reinforces the bearish implications. Even the Dow Jones Industrial Average which is simply attempting a retest of its late-February high is alerting to bearish divergence across the major U.S. indices. We anticipate a -12% per cent decline unfolding over the next few months.

Are you trading the SP500, EuroStoxx, Nasdaq 100, Russell 2000, Dow Jones 30, Dax, FTSE100 or ASX200? Don’t miss WaveTrack’s regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our Forex forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Apple Inc. Extends Uptrend Following Quarterly Results

by WaveTrack International| August 3, 2018 | 5 Comments

Apple Inc. Extends Uptrend Following Quarterly Results – Terminal High Projection to $228.42+/-

Apple Inc. published its latest quarterly earnings earlier this week with strong numbers. It caused the share price to leap beyond the nearby resistance illustrated in the diagonal pattern (see update dt. July 23rd).

• EPS: $2.34 vs. $2.18 (source: Thomson Reuters estimates)

• Revenue: $53.3 billion vs. $52.34 billion (source: Thomson Reuters estimates)

• iPhone sales: 41.3 million vs. 41.79 million (source: StreetAccount)

The diagonal pattern as minor wave v. five was constructed because of three wave activity contained in the two advancing sequences from June ’17 onwards. And because of ‘overlap’ in its more recent dip during last June’s sell-off from 194.20 to 180.73 (180.73 broke below the previous March high of 183.50). But this is now negated basis the recent thrust above the upper boundary line of the diagonal.

This revised wave count relabels minor wave v. five beginning from a later low traded in February ’18 at 150.24 as a five wave ‘expanding-impulse’ pattern. The only problem is the ‘overlap’ conundrum which is difficult to overcome. Unless a closing/line chart is used as a filter – no overlap occurs when using this test.

But it would indicate Apple Inc. continuing to push even higher, targeting 228.42+/-.

Apple Inc. + Fib-Price-Ratios

Minor wave v. five can be seen unfolding within the five wave expanding-impulse pattern of intermediate wave (5) that began its uptrend from the May ’16 low of 89.47 – this wave labelling hasn’t changed – only the location of minor wave v. five has. Now if minor wave iii. three ended into the Nov.’17 high at 176.24, then two fib-price-ratios are derived from extending minor waves i-iv one-four by a fib. 61.8% ratio to project wave v. five to 206.97+/- or taking a fib. 61.8% correlative ratio of waves i-iii one-three adding to iv. four which projects wave v. five to 228.42+/-.

Conclusion

Apple Inc. has certainly bucked the trend of the Nasdaq 100 index’s wave count which shows a more immediate topping formation with some stark downside potential during the coming months. It’s difficult to expect Apple Inc. to sustain its run higher for any significant length of time if the broader markets begin to trend lower – assuming the 228.42+/- target is realistic, then it must test this number within the next week or two so that it can then join the major indices in their downturn.

« go back — keep looking »