ELLIOTT WAVE Half Moon Pattern

by WaveTrack International| July 2, 2018 | 8 Comments

Half Moon Pattern – TWITTER question dated 30th June 2018:

Q. Great work! I have a question in which I hope you can answer. Elliot mentioned a phenomena in the market called the Half Moon. Was this a pattern and is this valid under the wave principle according to your opinion?

R.N. Elliott – The Wave Principle – page 30, paragraph 2, Half Moon

RARITIES IN THE 1937-1938 BEAR MARKET

The 1937-1938 Bear Market provided a number of Novelties, for example:

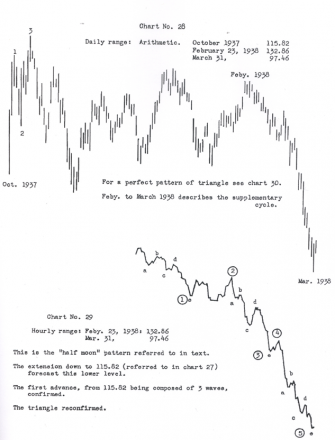

Half Moon Elliott Wave History: This is the name given to the pattern which developed between February 23rd and March 31st 1938, 132.00 to 98.00. It curved downward and at bottom almost perpendicular – just like a ‘half moon’. The same pattern occurred in April 1936, 163.00 to 141.00. Both were retracements of extensions. On account of the high speed, it is necessary to recur [sic, refer] to the hourly record, especially during the latter half. See Chart 29.

Peter Goodburn’s Half Moon Answer:

R.N. Elliott’s discoveries were a work in progress – given time, access to more historical data and the use of software that can measure Fib-Price-Ratios, I’m sure some of his notes would be amended in later revisions.

As for the – Half Moon – pattern (see ‘The Wave Principle’ – 1938) Elliott noted the especially the speed of the decline from the February 23rd 1938 high of 132.86 into the low of March 31st at 97.46. He indicated the velocity and trajectory of this decline was like a – half moon. Mainly, because the curvature of the acceleration into the low was almost perpendicular (inverse/vertical). He explained this was the case because the 5th wave within this impulse decline was the ‘extended’ wave sequence of the three impulse sequences. For example the largest of waves 1 3 5 – see fig #1 (charts #28 & #29 – The Wave Principle – R.N. Elliott – pages 30 & 47). See fig #1 in this article.

He continued to make distinctions between the perpendicular decline of the February/March 1938 decline and the pattern during the Great Depression collapse of 1929-32. And yes, there are significant pattern differences in the way these two declines. But that is not the important issue.

Half Moon – The bigger question is whether 5th wave extensions always advance or decline in vertical/perpendicular characteristics?

We tend to think not because the 1974 advance is a cycle degree 5th wave extension and yet it shows no sign of an exponential or perpendicular rise (at least not so far!). This must be viewed with a perspective from the 1932 low. But we do acknowledge that this phenomenon is more likely to be seen in the wave ‘C’ location of a zig zag downswing when labelled as a 2nd wave. We’ve documented many situations when the ‘C’ wave slides lower in such a manner that it no longer measures in proportionality with the ‘A’ wave that preceded it. In this case it is much larger by comparison whilst its five wave subdivision often contains an ‘invisible’ 4th wave and sometimes a 5th wave ‘extension’.

WaveTrack’s Half Moon Observations

Let’s take another look at R.N. Elliott’s example of the – Half Moon – impulse decline. Can you see that it was actually the larger 5th wave, i.e. intermediate wave (5) within an impulse decline that began from the April ’37 peak of 195.50 labelled primary wave A? See fig #2. Wave (5) declined following the completion of a contracting/symmetrical-triangle pattern that unfolded in wave (4). Elliott’s observations concluded that a break-out following a triangle is severe and accelerative. And this is exactly what happened for wave (5)! It seems to us that wave (5) needn’t have contained a fifth wave extension because its trajectory and speed of decline was dictated by the triangle that preceded it. The fact that it did contain a fifth wave extension in its subdivision was, however, a contributing factor of the perpendicular way it ended the decline which resulted in Elliott’s Half Moon terminology.

Comments

8 Responses to “ELLIOTT WAVE Half Moon Pattern”

Leave a Reply

July 11th, 2018 @ 9:19 pm

Traditional chartists would just call this the “falling knife” phenomenon.

July 11th, 2018 @ 9:49 pm

Thank you, for adding this information to our discussion. Very best wishes.

July 19th, 2018 @ 10:57 am

The thing with Elliott wave you can never be wrong because there is always an alternative count to explain away why they didn’t get it right in the first place. Oddly they expect people to pay good money for this.

July 19th, 2018 @ 4:04 pm

One longtime Wave analyst told me “by the time you figure out exactly where in the wave you really are, by then you have already been washed out to sea”. Good joke no? However I do use Wave analysis as my main tool for chart analysis. I find it that good. It takes experience, knowledge and skill just like most other things in life. Happy trading.

July 20th, 2018 @ 8:24 am

Thank you, BrainsB4Emotions. Brilliant comment + we totally agree. Very best wishes.

July 20th, 2018 @ 5:49 pm

Another Wave joke that comes to mind > two newbie wannabe Wave traders were chatting one day about how frustrating wave counting can be when one trader asked the other trader why it was that Elliot had waved in the first place. The second trader replied he must have been IMPULSIVE whilst his wife must have been CORRECTIVE. Another good wave joke no.

July 26th, 2018 @ 12:11 am

Recently scientific researchers have discovered that the very best indicator of addiction is impulsivity. So we now know why it is that impulse waves are larger in both time duration and wave amplitude than corrective waves, because trading “junkies” are addicted to them. They keep trading the impulse waves upward until they finally crest, and all their trading acts to prolong and extend the impulse waves both in terms of time duration and wave amplitude.

Well that is what I believe anyway. What are your ideas about this research?

July 27th, 2018 @ 9:29 am

Very amusing! Would you be so kind as to send us a link for this research – its contents will assist our reply to you – many thanks.