Celebrating 40-Years of Trading!

by WaveTrack International| December 19, 2017 | 4 Comments

Celebrating 40-Years of Trading!

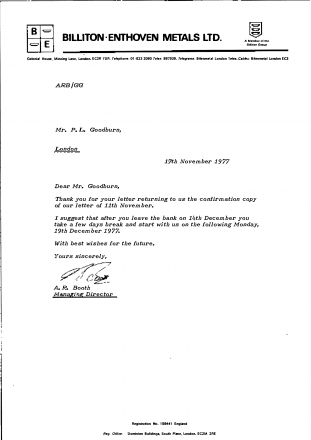

This day, December 19th 1977 was my first day of trading in the markets. I joined Billiton-Enthoven Metals as a junior trader/analyst at their City of London operations, Colonial House, Mincing Lane, EC3. The company was a ‘floor’ member of the London Metals Exchange. It was a time when the commodity markets dominated exchanges in London A period when the stock markets were just emerging from an 8-year bear market and the bond market was practically non-existent. Actually, bond futures began trading in May 1982! Investment Banks were clients to the privately-owned exchange members. And it wasn’t until deregulation occurred in 1985, known as ‘Big Bang’, did banks break into the closely-held membership of market-makers and exchange membership.

fig #1 – view of trading ‘ring’ – London Metals Exchange – circa 1978/79 (I’m standing a 1 O’clock positon – third box from left)

fig #2 – Entrance to London Metals Exchange, Leadenhall Market (right) – circa 1971 – courtesy of the London Metals Exchange

fig #3 – Entrance to London Metals Exchange, Leadenhall Market (right) – circa 2012 – courtesy Peter Goodburn

Trading or a Baptism of Fire

The first couple of years was a baptism of fire! Commodity markets were booming following President Nixon’s announcement of his New Economic Policy, a programme ‘to create a new prosperity without war’. This became known as the ‘Nixon shock’. Mainly, because it effectively dissolved the Bretton Woods system of fixed exchange rates established at the end of World War II. Instead ushering in a free-floating system – inflationary pressures soon emerged with soaring commodity prices.

Beginning in the early 1970s, Bunker Hunt and his brother William Herbert began accumulating large amounts of silver. Both physical bullion and by buying into the futures market. By 1979, they had nearly cornered the global market. I remember being given the silver ‘book’ to trade in the office at Billiton-Enthoven Metals as prices were continually being marked higher. That meant making bids-and-offers simultaneously several times a minute to the eager clients that were ‘phoning into the sales team sitting opposite me. Was I glad to see the senior market-maker return after his lunch break!

There were many fond memories of that time. Leaving the office at 11:30am to walk the half-mile to the London Metal Exchange at Leadenhall Market which began trading the first of two 2 ½ hour price-fixing sessions of each day. And the 10 minute break which allowed us floor traders to take a quick ‘pint’ of beer in the cellar of the Lamb pub which was opposite the entrance to the exchange.

Elliott Wave Journey

My introduction to Elliott Wave analysis came through listening to daily updates of financial commentary by Bob Beckman on LBC radio (London Broadcasting Company) around the early eighties. And the intimate journey that followed is so far, mostly untold. Forty years may seem a long time to you, but for me, it’s a flashing moment. I guess we all experience a life journey like that? This one is far from over, or at least I believe it to be. And for the time that remains, I sincerely hope to be able to transfer as much as I know about the art of ‘price-forecasting’ to you and everyone out there!

Happy anniversary!

Comments

4 Responses to “Celebrating 40-Years of Trading!”

Leave a Reply

December 19th, 2017 @ 6:05 pm

Dear Mr. Goodburn,

Wow ! Very fascinating.

May God give you many more [40 more :)] years of strength to continue in this profession and enjoy your passion.

I am one of those who reads regularly and religiously, bi-weekly market updates on your website and benefited from your knowledge sharing.

With Regards,

December 19th, 2017 @ 7:09 pm

Dear Praveen Vishnu Shamain, Thank you for taking the time to write your very kind comment. Much appreciated! We are always pleased to hear when our work benefits others. Wishing you and your family health, happiness and success in all you do. Very best wishes.

December 21st, 2017 @ 4:58 pm

Thank you Mr. Goodburn for sharing part of your life with us, yours subscribers.

40 is a very important number and I am happy to be reading your weekly forecasts from very far away and also very fast and near , thanks to the internet technology of nowadays.

Continue sharing your knowlege with us !!

Thank you very much.

From Chile

Ernesto Valdés V

December 21st, 2017 @ 5:14 pm

Dear Ernesto Valdes, Thank you for your delightful comment. We feel the same – it is a privilege to communicate with so many different walks of life around the world interested in Elliott Wave. Most of all a network of people who willing to look for solutions, think out of the box and are willing to help each other. Yes, 40 is rather an interesting end of a cicle. And a new one beckons. Wonderful that you enjoy the forecasts. Very best wishes, Peter and the EW-team.