XETRA DAX STAGES 5 WAVE DECLINE

by WaveTrack International| November 14, 2017 | No Comments

Xetra Dax – Sentiment Turns Bearish

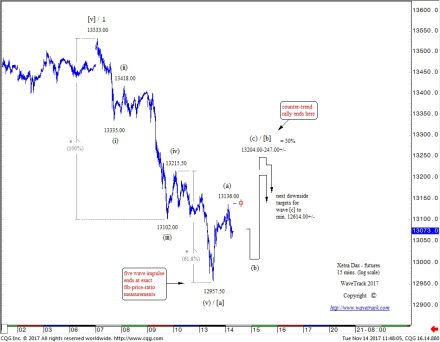

Xetra Dax‘s late-August five wave impulse advance from 11863.00 came to an end exactly this time last week at 13533.00. Concluding the larger 1st wave within minor wave v. five.

A 2nd wave correction has since begun, confirmed by an initial five wave impulse decline unfolding from last week’s high, ending yesterday at 12957.50. Note how the five wave structure is corroborated by Fib-Price-Ratios – i.e.

waves (i)-(iii) x 61.8% = (v) at 12957.50

The low at 12957.50 completes wave [a] of a developing zig zag pattern, perhaps even a larger double zig zag as this 2nd wave correction. For the moment, wave [b] rallies are still engaged to the upside – forecasts measure completion towards either 13204.00+/- or 13247.00+/- where the run higher to 13136.00 labelled wave (a) is extended by either a fib. 328.2% or fib. 61.8% ratio.

Once completed, wave [c] declines can begin targeting 12614.00+/-.

This overall downturn has obviously changed the short-term sentiment from bullish to bearish! And with the Xetra Dax as our near-term guide, can expect a similar downturn to begin for U.S. indices too.

Learn how to take advantage of WaveTrack’s Fibonacci-Price-Ratios!

Watch WaveTrack’s Fib-Price-Ratio videos on youtube to see how these measurements are applied. WaveTrack’s first Elliott Wave Academy video

Interested in the Xetra Dax – Get regular updates in our bi-weekly EW-Compass Report! Ensure you’re tracking our forecasts – subscribe online for the EW-COMPASS REPORT.

Visit us @ www.wavetrack.com and subsribe to our latest EW-COMPASS report!

Comments

Leave a Reply