Stock Indices Mid-Year Video Update PART I/III

by WaveTrack International| June 25, 2025 | No Comments

Stock Indices Mid-Year Video Update 2025

Includes ECONOMIC INDICATOR & SENTIMENT STUDIES

Fang+ 7 Mag-7 Equities to outperform Tech Indices

Analyzing the Markets: Insights from Elliott Wave Theory for Traders and Investors

As investors and traders, staying updated on Stock Indices market trends is crucial for making informed decisions. Earlier this year, we witnessed significant movements in the stock market, particularly around April, which has set the stage for current and future trading opportunities. Many of our subscribers could take advantage of our Elliott Wave Video Outlook 2025 already as we forecasted the SP500, Nasdaq100, Alphabeth/Google amongst others correctly…

As we reach the midpoint of 2025, financial markets are in a continual state of flux, influenced by various sentiment shifts and underlying factors that affect trading strategies. If you’re an investor interested in Elliott Wave analysis and the dynamics of stock indices, you’re in for a treat with WaveTrack’s Stock Indices Mid-Year Video Update.

In this post, we’ll break down the essential insights from the Stock Indices Mid-Year Video Update. We’re covering everything from market corrections to potential future trends, all while ensuring it’s easy to digest for both seasoned investors and the financially curious.

A Quick Look Back: April Low Points

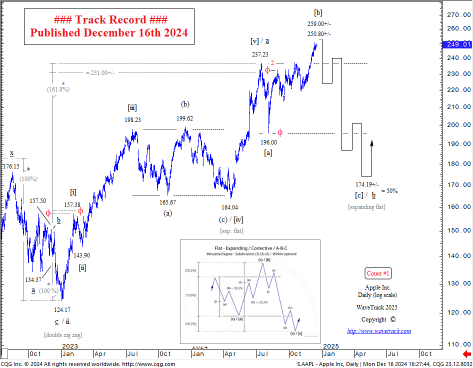

In December, forecasts indicated a potential correction of 20-30% for major indices. Especially those tied to AI technologies. Fast-forwarding to April, those projections materialized as the markets hit key downside targets. This period of uncertainty, however, has laid the groundwork for a new bull market uptrend.

Current Market Sentiment: What the Data Shows

Despite a recovery since April, large asset managers are exhibiting a degree of hesitation. Their equity allocations have only modestly increased, remaining net -38% underweight in U.S. equities. This sentiment is deemed contrarianly positive; when big players show reluctance, it often suggests that a broader market rally could be on the horizon, particularly as hedge funds are demonstrating renewed interest.

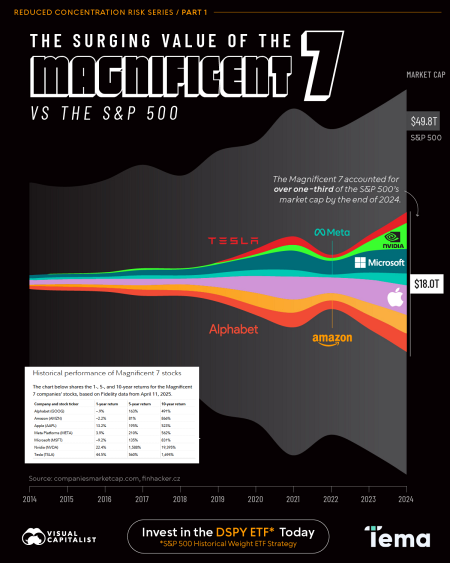

MAG7 – FANG+ Technology Sector Spotlight

The video focuses on the performance of major technology stocks, notably the Fang+ and Mag-7 equities. As per Elliott Wave principles, these stocks showcase strong uptrends driven by hedge fund activities. Riding these waves could be beneficial for those looking to capitalize on the tech boom we are witnessing.

Fig #29 – % Capitalisation of Magnificent 7 Stocks in S&P 500 – WaveTrack International’s Mid-Year Financial Video Forecast 2025

Sector Highlights: Banks and Semiconductors

Following April’s lows, various U.S. sectors are showing signs of recovery. Particularly, banks and semiconductors are seen as having bottomed out and are primed for growth. For instance, the semiconductor sector is positioned to outperform, which can be pivotal as technology continues to be a driver of market momentum.

European Markets: An Attractive Alternative

Interestingly, as U.S. asset managers recalibrate their portfolios, there has been a notable shift towards European equities. Drawn by more attractive valuations compared to the U.S. In contrast, benchmarks like the Eurostoxx 50, Xetra DAX, and FTSE-100 have all bottomed and are entering new bullish uptrends. This could suggest a potential for considerable gains if you have exposure to these markets.

Global Indices: A Mixed Outlook

When examining global indices, the MSCI Emerging Markets index presents a more complex picture. While there’s bullish sentiment for countries like Brazil, Russia, and India, China’s indices are at a crossroads. Above all, the balancing between bearish and bullish scenarios is essential. Monitoring resistance levels in these markets will be vital for determining the next directional movement.

Why You Should Watch WaveTrack’s Mid-Year Update

In conclusion, WaveTrack’s Stock Indices Mid-Year Video Update offers a keen insight into market dynamics and provides practical information that can assist investors in navigating their trading strategies effectively. With the market facing both challenges and opportunities, leveraging Elliott Wave analysis could be your edge in achieving financial success in today’s complex landscape.

Stay ahead of the curve—watch the full video update now and prepare for what’s to come in the second half of 2025!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Indices Mid-Year Video Update 2025

Charts: 110 | Video: 2 hours 30 mins.

ONLY FOR CLIENTS outside the EU – SELECT YOUR PACKAGE

Single Video – *$55.00 – PART I Stock Index Mid-Year Video Uptrend 2025 (June ’25) or send us an email to services@wavetrack.com

Triple Package offer – *$111.00 (saving!)! – PART I – PART II – PART III (June – August ’25)

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

PARTS II & III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST within the Europeean Union?

– If you are a EU client contact us under services@wavetrack.com so that we can issue you a quote with added VAT! Sorry for the extra step but it is European tax law. Thank you for your understanding!

– Alternatively, if you like to pay via credit card, we are very happy to send you a credit card payment link – contact us via email to services@wavetrack.com/

*(additional VAT may be added depending on your country of residence. Currently, the US, Canada, Asia have no added VAT except EU countries)

To receive your VIDEO UPDATE please use this instant PayPal payment link for US, UK, Australian and international customers click here.

– Or opt for the TRIPLE PACKAGE for USD *111.00 in total?

– As soon as we receive payment either via the instant PayPal payment link or via the credit card link we provide you with the video link & PDF report once payment is confirmed. Please know the reply can take up to 6 hours. But rest assured we will give our best to provide you with the information as soon as possible!

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Comments

Leave a Reply