S&P 500

by m.tamosauskas| October 10, 2012 | No Comments

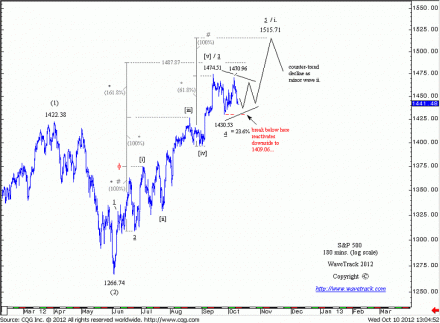

The sell off from last week’s high of 1470.96 has greatly increased the probability for the contracting-symmetrical triangle scenario. This means the S&P should remain within the range between the 1474.51 high and the 1430.53 low during the next several trading days before it stages one finalising advance to original upside at min. 1487.87 or max. 1515.71 to complete the entire upswing from the June low of 1266.74. Only a break below 1430.53 would trigger additional downside potential to 1409.06.

Comments

Leave a Reply

Recent Posts

Recent Comments

- David Afoa on GOOGLE – Fib-Price-Ratio Study

- Lili Berkman on The Silver Wheaton Difference!

- Reena Wheat on Currencies and Interest Rates 2019 Video Outlook | PART III/III

- Lyndon Poock on Stock Index Video Outlook – 2021 | PART I/III

- Reyes Benusa on Reversal-Signature and Price-Rejection – The Golden Rule

Archives

- February 2026

- December 2025

- August 2025

- July 2025

- June 2025

- March 2025

- February 2025

- January 2025

- December 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- August 2023

- July 2023

- June 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- August 2022

- July 2022

- June 2022

- May 2022

- March 2022

- February 2022

- January 2022

- December 2021

- August 2021

- July 2021

- June 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

Categories

- ADXY Index

- Agnico Eagle Mines

- AI Artificial Intelligence

- Alcoa

- Amazon

- AngloGold Ashanti

- Antofagasta

- APPL

- Apple

- ASX 200

- AUD vs USD

- AUDNZD

- AUDUSD

- Australia ASX 200

- Baltic Dry Index

- Banking

- Base Metals

- Biotechnology

- Bitcoin

- Bovespa

- Broadcom

- Catalexit

- central banks

- Christmas

- Commodities

- Commodities Video Outlook 2020

- Conference

- Copper

- Coronavirus Sell-Off

- CRB

- Crude oil

- crude oil price chart

- CryptoCurrency

- Currencies

- Currencies + Interest Rates Video Outlook

- Cycles

- Dax 30

- deutsche bank

- Dewey Cycle

- DJ Transportation Average

- DJ Utilities

- Dow Jones 30

- Dow Theory

- ECB

- economy

- Elliott Wave

- Elliott Wave Charts

- Elliott Wave Patterns

- Elliott Wave Principle

- Emerging Markets

- Ending-Diagonal Elliott Wave Pattern

- Equity

- EUR vs CHF

- EUR/USD

- Euro / US$

- Eurostoxx 50

- EuroStoxx50

- EuroStoxxBanks

- EURUSD

- Expanding Flat Pattern

- FAAMG

- FANG+

- fib-price-ratio

- Fibonacci Trading

- Fibonacci-Price-Ratio

- Financial Forecasting

- Fixed Income

- forex

- Freeport McMoran

- FTSE 100

- Fund Management

- FX

- FXStreet

- GBP/AUD

- GBP/USD

- GDX

- GDXJ

- Germany 10 year Euro Bund future

- Gilead Sciences

- Glencore

- Global Economy

- Gold

- Gold Mining

- Golden Ratio

- goldman sachs

- Google Inc.

- Google/Alphabeth

- Greek debt crisis

- Hang Seng

- Harbinger

- Hungarian Forint

- IBEX 35 Index Spain

- Independent Research

- India-CNX Nifty 50

- Interest Rates

- Interview

- IRP Independent Research

- kbw bank index

- Lonmin

- MAG-7

- McDonald's

- MID-YEAR VIDEO UPDATE!

- Mifid II

- Mines

- Mining

- MSCI China

- MSCI Emerging Markets

- Nasdaq 100

- Nasdaq Biotechnology Index

- Nasdaq Composite

- Nasdaq100

- Netflix

- Newmont Mining

- Nikkei 225

- NVIDIA

- NYSE Composite Index

- Palladium

- Platinum

- Precious Metals

- Ralph Nelson Elliott

- Reversal-Signature

- Russell 2000

- Russia RTS

- S&P 500

- Sector

- Secular-Bull

- Sentiment Survey

- Shanghai Composite Index

- Silver

- Slanting Flat Elliott Wave Pattern

- SP100

- SP400 Mid-Cap

- SP500

- SPX 500

- STLG/AUD

- Stlg/US$

- STLG/USD

- STLG/YEN

- STLG/ZAR

- Stock Index

- Stock Index Tracking

- Stock Index Video

- Stock Indices

- Stock Indices Video Outlook 2023

- Stock Indices Video Outlook 2025

- Sugar

- Summary

- Tesla

- Tesla Inc

- Toyota

- Track Record

- trading

- Trusts

- Tutorial

- Uncategorized

- UniCredit

- US

- US Dollar Index (DXY) (USDX)

- US$ Index

- US-Dollar Index

- US10yrYields

- USD

- USD/ARS

- USD/CNY

- USD/IDR

- USD/INR

- USD/MXN

- USD/SGD

- USD/THB

- USD/YEN

- USD/ZAR

- Vale

- Value Line Index

- video

- VIDEO OUTLOOK 2018

- VIDEO OUTLOOK 2020

- VIX

- W.D. Gann

- WaveTrack International

- XAU Gold/Silver Index

- Xetra Dax

- XOP

- Yields

- Zig Zag

- Zinc

- ‘INFLATION-POP’

- ‘SHOCK-POP-DROP’

About WTI

WaveTrack International is a financial price forecasting company dedicated to the Elliott Wave principle and work of the R.N. Elliott. Clients include Investment Banks, Pension Funds, Total/Absolute-Return/Hedge Funds, Sovereign Wealth Funds, Corporate and Market-Making/Trading institutions and informed individuals -- & just about anyone who is affected by directional price change.

Subscribe to our feed

WTI Links

- Visit us on our HomePage

- Follow us on Twitter

- Like us on Facebook

- Circle us on Google+

- Follow us on YouTube

- Visit us on Xing