S&P 500 breaks above the April ’12 high – what’s next?

by m.tamosauskas| August 21, 2012 | No Comments

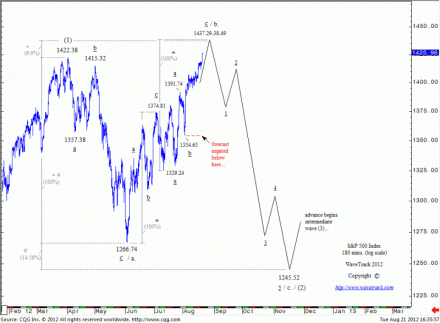

Back in the beginning of August we changed our preferential count on S&P 500. The main reason was correlation analysis between different stock indices, especially Eurostoxx 50 – at that time, this index required one additional advance to complete its countertrend pattern unfolding from the June ‘12 low. Usually, it is difficult to predict one positively correlated market going down whilst the other trades in the opposite direction – combined with comparisons to other asset classes, a compelling case for a continuation higher was evident.

You may download a piece of our Compass report published in 2nd of August here.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Dax 30

by m.tamosauskas| August 17, 2012 | No Comments

Cycle wave A ended its advance at 7441.82 and the counter-trend decline as wave B is shown unfolding into an expanding flat pattern labeled A-B-C in primary degree that completed at 4973.92 in September ‘11. Since that low, the Xetra Dax started to advance as cycle wave C. From an Elliott Wave perspective, the count from the bottom depicts a step-like series of 1’s and 2’s. Primary wave 1 finalised at 6430.60 in October ’11. A countertrend decline completed primary wave 2 in November ’11 at 5366.50.

The advance from the low of November ’11 at 5366.50 to the March ’12 high of 7194.33 represents the completion of intermediate wave (1) and this is currently being balanced by a counter-trend retracement decline as intermediate wave (2) – it is still in progress. This decline is unfolding into a single zig zag pattern, labeled a.-b.-c. in minor degree. Minor wave a. unfolded into a five wave expanding-impulse pattern that was completed in June ’12 at 5914.43. Minor wave b. is currently unfolding into a double zig zag pattern and is quickly approaching its upside targets towards 7102.40-28.81. Once completed the final down-swing as minor wave c. is expected to begin with ultimate downside targets towards 5487.99. This is expected to complete before year-end 2012.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

BUND – REVERSAL!

by m.tamosauskas| August 16, 2012 | No Comments

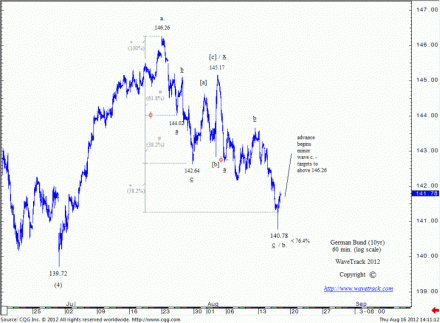

Germany’s 10 year Euro Bund future spiked briefly below downside targets of 141.26 on the opening of today’s session with a low recorded at 140.78 but was quickly rejected with trading almost immediately pulling prices back above the Fibonacci convergence targets to confirm a reversal signature (see previous posts).

This contract is negatively correlated to global stock indices – it provides an excellent timing indicator not only for a return higher for the Bund, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows.

We expect Germany’s 10 year Euro Bund future to accelerate upwards, whilst global stock indices should begin to react in the opposite direction anytime now.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

BUND – await for a reversal!

by m.tamosauskas| August 15, 2012 | No Comments

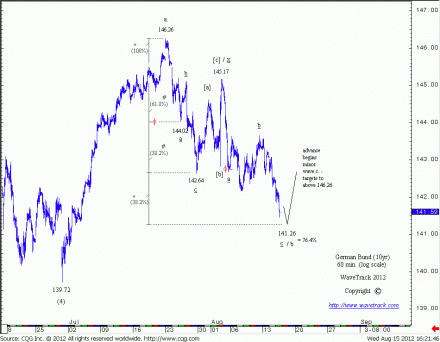

Germany’s 10 year Euro Bund future is quickly approaching its measured downside target to 141.26 discussed last week (see previous post).

Intermediate wave (5)’s advance from the June low of 139.72 is expected to unfold into a single zig zag pattern as the concluding sequence of a larger/aggregate ending diagonal pattern. Minor wave a. completed from 139.72 to the July 23rd high of 146.26. This upswing is now being balanced by a counter-trend decline as minor wave b. unfolding into a double zig zag pattern.

The first zig zag unfolded from 146.26 to 142.64 – by itself it cuts into a perfect Golden Ratio (marked as red phi symbol), where minute wave a is exactly a 61.8% ratio of the entire zig zag decline between 146.26 and 142.64. The second zig zag is now almost complete with an ultimate target towards 141.26. This is derived by extending the first zig zag by a fib. 38.2% ratio. It is astonishing that the same level also represents a fib. 76.4% retracement of the preceding upswing. When two of convergences of deferent of trend form together in close proximity (in this case equality), this attracts the price towards it in a culmination of the existing trend. Once completed, minor wave c. is expected to begin its advance projecting targets back above 146.26 as a minimum requirement. It is important to note, that a more bearish count from 146.26 (e.g. series of 1’s and 2’s) was negated when minute wave x exceeded the high of minute wave b of the first zig zag.

More importantly, this contract is negatively correlated to global stock indices – it provides a excellent timing indicator not only for a return higher for the Bund, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows. Watch for a reversal signature during the next several trading days.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

AUDUSD

by m.tamosauskas| August 13, 2012 | No Comments

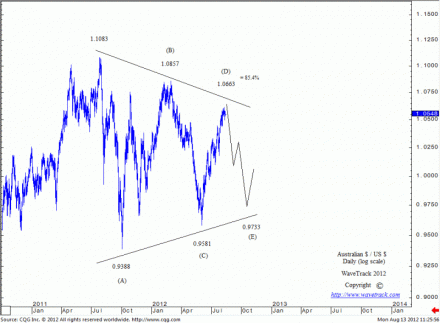

Australian $ / US $ started a counter-trend decline from the July’11 high of 1.1083. It is taking the form of a triangle pattern with ultimate downside targets to 0.9733 that is scheduled to complete late 2012. The triangle is specifically a contracting/symmetrical type, labeled (A)-(B)-(C)-(D)-(E) in intermediate degree. Each wave is retracing about fib. 85.4% of the preceding wave. Intermediate wave (D) is now in progress to the upside from the June ’12 low of 0.9581 and it is expected to finish near the 1.0663 price level (fib. 85.4%). Once completed, the final decline as wave (E) of the triangle will unfold into a three wave zig zag sequence to a measured downside target of 0.9733 (fib. 85.4%). This currency pair is positively correlated to global stock indices – it provides another excellent timing indicator not only for a return lower for the Australian $ / US $, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows. Watch for a reversal signature during the next several trading days.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Bund

by m.tamosauskas| August 7, 2012 | No Comments

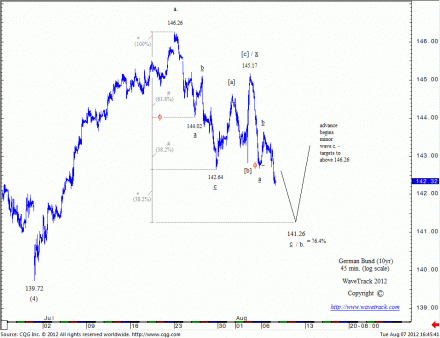

Germany’s 10 year Euro Bund future is trading lower from the July ’12 high of 146.26 and its counter-trend pattern remains incomplete with more downside to come.

Intermediate wave (5)’s advance from the June low of 139.72 is expected to unfold into a single zig zag pattern as the concluding sequence of a larger/aggregate ending diagonal pattern. Minor wave a. completed from 139.72 to the July 23rd high of 146.26. This upswing is now being balanced by a counter-trend decline as minor wave b. unfolding into a double zig zag pattern. The first zig zag unfolded from 146.26 to 142.64 – by itself it cuts into a perfect Golden Ratio (marked as red phi symbol), where minute wave a is exactly a 61.8% ratio of the entire zig zag decline between 146.26 and 142.64. The second zig zag is still in progress with an ultimate target towards 141.26. This is derived by extending the first zig zag by a fib. 38.2% ratio. It is astonishing that the same level also represents a fib. 76.4% retracement of the preceding upswing. When two of convergences of deferent of trend form together in close proximity (in this case equality), this attracts the price towards it in a culmination of the existing trend. Once completed, minor wave c. is expected to begin its advance projecting targets back above 146.26 as a minimum requirement. It is important to note, that a more bearish count from 146.26 (e.g. series of 1’s and 2’s) was negated when minute wave x exceeded the high of minute wave b of the first zig zag.

More importantly, this contract is negatively correlated to global stock indices – it provides a excellent timing indicator not only for a return higher for the Bund, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows. Watch for a reversal signature during the next several trading days.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Euro / US$

by m.tamosauskas| August 3, 2012 | No Comments

Yesterday’s news flow created unique Elliott Wave pattern we would like to share with you.

Last week’s high of 1.2390 has completed the 1st wave within an impulse advance – 2nd wave counter-trend was expected to decline measured to the fib. 61.8% support at 1.2174 prior to an acceleration upwards. The uniqueness of this down-swing is that minute wave 2 as an expanded flat pattern has a smaller expanded flat pattern inside as a minuette [b] wave. An alternate count the coming upswing describes as a minuette wave [c]. In any case it is expected a sharp acceleration phase during the next several weeks. Note: a break below 1.2042 would negate the continued upside momentum.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

« go back