Big Day!

by m.tamosauskas| September 18, 2013 | No Comments

A big day is expected to be today with a FED minutes to be released just a few hours away…What can we expect in a U.S. stock market? Can it spike up or will it immediatly will roll down? Based on our primary Nasdaq Composite Elliott Wave count markets are poised to a sharp decline. We will know more by the end of the day.

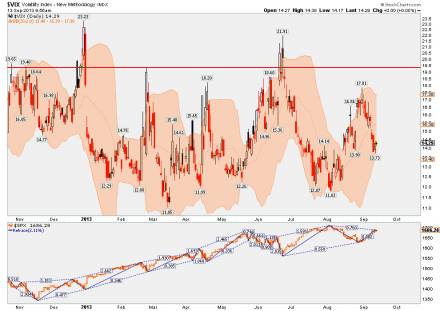

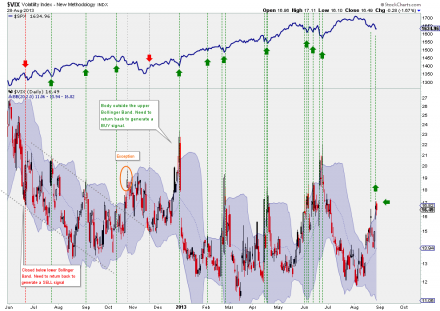

VIX

by m.tamosauskas| September 13, 2013 | No Comments

The Elliott Wave count on many stock indices are advocating for a reversal sooner rather than later. Vix is supporting this idea – its very close to alower BB line that usually limits the upside potential for strocks.

Nasdaq – 100

by m.tamosauskas| September 11, 2013 | No Comments

Whilst some stock indices are clearly advancing in a corrective sequences, Nasdaq 100 is just about to finish its advance that began from the Aug ’11 low of 2034.92. Primary wave 1 that dates back to that low unfolded into a five wave expanding-impulse pattern, subdividing into intermediate degree, (1)-(2)-(3)-(4)-(5). Wave (5) from the June ’12 low of 2443.92 constitutes the most important measure to gauge the overall situation of global stock indices in general. This is because this upswing has taken the shape of an ending-contracting diagonal sequence that implies a sustained counter-trend decline in the subsequent weeks. This diagonal is corroborated by the fact of almost perfect three wave subdivisions (as is required for an ending type) and fib-price-ratio measurements.

S&P 500 is struggling to rebound…

by m.tamosauskas| August 30, 2013 | No Comments

…but should do it as a minor wave b. The very short-term counter-trend rally from 1627.47 is likely to extend towards the ‘4th wave preceding’ area of 1669.51+/- prior to a resumption of the larger downswing in progress from the 1709.67 high. Next subsequent interim targets project to 1581.14 – ultimate objectives to be approached during the next several weeks remain towards 1524.64-20.33. The revision level remains at 1709.67.

VIX generates a short-term BUY S&P 500 signal

by m.tamosauskas| August 29, 2013 | No Comments

VIX index has traded back inside Bollinger Bands – statistically such an event generates a short-term buy S&P 500 index signal. Futures market held overnight lows, so a rebound wouldn’t be a surprise from the current price level.

DAX hasnt completed its upswing

by m.tamosauskas| August 23, 2013 | No Comments

I think this chart summarizes the current stock market condition – U.S. markets have started their counter-trend rebound whilst European markets haven’t finished their five wave sequences. The Dax quickly recovered from last week’s low and is now on its way to ultimate upside objectives at 8645.55 to finalise a five wave expanding-impulse sequence from the June ’12 low of 5914.43. Hopefully, U.S. during that time will be able to complete wave ‘B’ or ‘X’.

Some serious drop overnight (India)

by m.tamosauskas| August 21, 2013 | 4 Comments

Back from holidays 🙂 As I can see, weak markets started to roll over. Hope all of you stayed safe, but don’t fall asleep – a buying opportunities are clearing up. India is showing extreme weakness. A dramatic sell-off during the last days has brought India’s Nifty already into min. original downside targets at 5282.30. Normally, a reversal signature would now be expected to initiate upside acceleration in the months ahead. However, the substructure of the downswing from this year’s high of 6229.45 so far is incomplete. Moreover, the correlation with most other U.S., European and Asian indices suggests a sustained devaluation lies ahead. All combined, the probability clearly favours a continuation lower. The cut-off point to differentiate between the scenario depicted in the former issues and the one proposed in this chart is 5191.90 – acceleration below there would validate a much larger downswing to 4531.15+/- in the months ahead. This implies a modification of the entire pattern from the Nov.’10 high of 6335.90.

S&P 500 medium-term analysis (Annual Holiday)

by m.tamosauskas| August 2, 2013 | No Comments

Here we go – I am leaving the office for the next two weeks for my annual holidays. It could be that I will miss a lot of action on the market, because it seems that topping process in most of the stock indices is approaching completion. Would like to leave with a bigger picture on S&P 500. There wont be any updates for the next two weeks but I want to remind that EW-Compass team will be working and publishing reports as usual, twice a week. Good luck!

Gold and Silver Update

by m.tamosauskas| July 31, 2013 | No Comments

Gold and silver has accelerated down since we did the last video update. Our team has prepared an updated video analysis on precious metals which is accesable here on our Youtube channel.

Hang Seng on a cliff!

by m.tamosauskas| July 26, 2013 | No Comments

We just wanted to share a perfect inflection point for the Hang Seng index:

Last week’s high of 22034.38 is a perfect spot for a possible reversal. This is because original upside objectives basis a fib. 61.8% retracement towards 22106.37 are very close and a fib. 61.8% extension of the initial 19426.36-21004.56 advance pinpoints the achieved high (see inset). Once the reversal has occurred, it will confirm the completion of the counter-trend rally from 19426.36 and initiate declines towards 17100.00+/- during the next months. This forecast is revised only above 23944.74.