BREXIT and Elliott Wave

by WaveTrack International| June 14, 2016 | No Comments

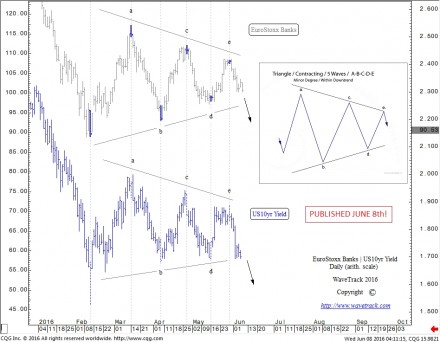

Elliott Wave Triangle – Eurostoxx Banks index + US10yr Treasury Yield Forewarns Decline Ahead of Brexit Poll Change. Elliott Wave can be a powerful tool for financial forecasting – independent insights which can predict when newsflow is failing to give a clear answer.

Purchase full report here

And receive the latest Elliott Wave insights by subscribing to the EW-COMPASS report.

Visit us @ www.wavetrack.com

Subscribe here Elliott Wave Compass

Tags: Brexit

COMMODITIES Resurgence! Semi-Annual Video Update!

by WaveTrack International| June 10, 2016 | No Comments

We’re pleased to announce the publication of WaveTrack’s mid-year video update of medium-term forecasts for COMMODITIES!

Back in January this year, WaveTrack International’s annual 2016 Elliott Wave Commodity forecasts forewarned of an imminent and major low being approached for all of the main sectors, Base Metals, Precious Metals and Energy/Crude Oil contracts. It didn’t take long for this to be realised! Led slightly earlier by Precious Metals, Gold and Silver bottomed the previous month, in December, closely followed by double-bottom activity in Crude and Brent Oil – Base Metals also responded in major reversals although less enthusiastic in their subsequent advances. Gold has since traded higher by +24% per cent, silver by +32% per cent, Crude Oil by a massive 92% per cent and copper so far lagging but higher by +18% per cent. Some of the commodity equities we identified as big buying opportunities, especially those for precious metals came good with Newmont Mining up by a massive +194% per cent!

Precious and Base metals have since given back some of those initial gains but the BIG MESSAGE derived from these initial movements is this – we can expect even higher levels during the next several years.

In this mid-year update, we’ll be updating all of the contracts shown last January, plus a few new correlations that we hope will distil and clarify some of the ongoing trends –

The COMMODITIES list includes medium/long-term Elliott Wave analysis for the following:

In this video Peter discusses the various intricacies revealed by his correlation studies to forecast yet another supporting strong evidence of a Commodity Resurgence.

We’ll send you a personal link so that you can watch the video, anytime at your convenience.

COMMODITY TRACK RECORD SAMPLE:

Since then, Newmont Mining has traded higher by an amazing +108% per cent!

And if you followed the CURRENCY video in combination with the Emerging Market and Commodity outlooks, you would have been fully prepared for a big change in the US$ dollar, and related EM/Commodity Currencies, like the Canadian Dollar:

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00 – PART II COMMODITIES

Triple Package offer – $96.00 (saving 33%)! – PART I – PART II – PART III

PART III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST?

To receive your VIDEO UPDATE please click here to contact us.

– Please state if you wish to purchase the SINGLE VIDEO for COMMODITIES for USD 48.00?

– Or opt for the TRIPLE PACKAGE for USD 96.00 in total?

– Next we will send you a PayPal payment request and provide you with the video link & PDF report once confirmed.

This is the most insightful and precise Elliott Wave financial forecast available.

Most sincerely,

WaveTrack’s Elliott Wave Team

Visit us @ www.wavetrack.com or read more about our STOCK INDICIES VIDEO UPDATE here

GOLD – Just for the record

by WaveTrack International| May 31, 2016 | No Comments

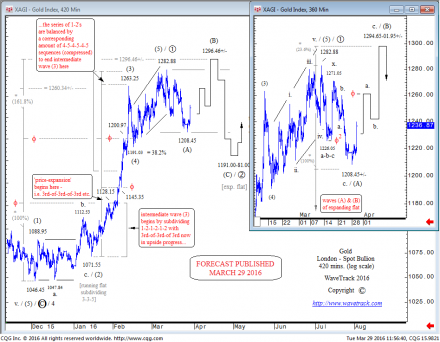

Just for the record! This forecast has been published by WaveTrack’s Elliott Wave team on the 29th March 2016! If you follow Gold – the result is pretty impressive. Or it perhaps not if you understand Elliott Wave and can forecast an Expanding Flat correction for GOLD?

Receive the latest Elliott Wave insights by subscribing to the EW-COMPASS report.

Visit us @ www.wavetrack.com

Subscribe here Elliott Wave Compass

XME Index (ETF) – Elliott Wave Symmetry

by WaveTrack International| May 30, 2016 | No Comments

The XME index (ETF) is a composite index of the major mining companies, totaling 38. Their interests span across many different commodities including the major metals miners such as Freeport McMoran Copper, Noranda Aluminium but also Arch Coal, Newmont Mining Gold and United States Steel, to name a few.

This year’s annual 2016 Elliott Wave forecasts announced an imminent low was forming, ending declines that began from the April ’11 highs. The XME was no exception – important lows were also being approached by the entire commodity asset-class.

Since January’s low, a near-perfect five wave impulse pattern has unfolded higher, assigned to minor degree, i-ii-iii-iv-v. Its 3rd wave underwent ‘price-expansion’ which is consistent with approximately 80-85% per cent of ‘expanding’ impulse patterns where third waves are normally the longest of the three sequences. The 5th wave is slightly shorter than the 1st but that’s quite okay with a visible five wave subdivision in the pattern to its terminal high at 25.13.

From a geometric, ratio/proportion perspective, there is also a visible adherence to the Fibonacci sequence. Extending the 1st wave to 15.53 by a fib. 161.8% ratio projects a terminal high for the 5th wave to 25.68 – with the actual high finishing the pattern at 25.13, this is accurate especially when taking into account the slight price-spike that ended the 1st wave high.

A counter-trend pattern is now in full swing to the downside. The activity so far suggests this is taking the form of a double zig zag pattern although a single zig zag count is also possible. Extending the initial downswing to 20.01 by a fib. 61.8% ratio projects a terminal low towards 17.38+/-. This measurement is valid for both the single or double zig zag pattern. Remember, should prices test the 17.38+/- level, be aware that the pattern could still mutate into a triple zig zag by searching for even deeper retracement levels.

Get access to WaveTrack’s bi-weekly Elliott Wave Compass report featuring many short-term updates of all 4 asset classes!

Successful trading with WaveTrack International

Subscribe to the EW-Compass here…

Tags: XME Index

STOCK INDEX VIDEO – Code Word “Re-Synchronisation”

by WaveTrack International| May 26, 2016 | 2 Comments

ANNOUNCEMENT | 24th May 2016

MID-YEAR ELLIOTT WAVE VIDEO SERIES – PART I/III – STOCK INDICES

Elliott Wave Price Forecasts & Cycle Projections for 2016/17

Re-Synchronisation of Developed vs. Emerging Markets!

We’re pleased to announce the publication of WaveTrack’s mid-year video update of medium-term forecasts for STOCK INDICES!

Since the inaugural edition of the EW-Compass report was published, you’ve asked for accompanying medium/long-term analysis in gaining a broader perceptive of Elliott Wave pattern development for many of the world’s major indices. So we’ve taken many charts from our institutional Elliott Wave Forecast database and compiled them into a video series, publishing each December/January, exactly for this purpose in preparation for the coming year.

As the demand for more indices grew, so did our task in maintaining them to a sufficient standard – no problem! So now, we’ve set aside sufficient resources to ensure the medium/long-term outlooks are sent to you – not just once but TWICE a year!

There are over 120 charts being maintained round the clock so it’s necessary to split the videos into THREE parts – Part I STOCK INDICES, PART II COMMODITIES & PART III CURRENCIES & INTEREST RATES.

PART I Stock Indices VIDEO is available NOW!

This latest update of U.S., European and Global/Emerging market indices covers 40 newly illustrated Elliott Wave forecasts of the medium and long-term time-series. Our Chief Elliott Wave analyst and Founder of WaveTrack International, Peter Goodburn is again your host. Once again, he talks us through all of the main themes and up-coming changes that are apparent within the pattern development of the major markets. He also illustrates some of the major cycles for the benchmark S&P 500 index, expounding his articulate knowledge of cyclicity obtained from his 25-year study of luminaries such as Edward Dewey and W.D. Gann.

The stock index list includes medium/long-term Elliott Wave analysis for the following:

• Recap of S&P forecasts of last several years

– Performance – Secular-Bear vs. Secular-Bull

• Comparative Charts of Developed Markets vs. Emerging Markets:

– highlighting Re-Synchronisation

• Affirmation of last year’s S&P forecasts

– extended 3rd or 5th wave development

• Weekly S&P composite cycle and its trend for the next 12-18 month period

• S&P Elliott Wave counts for the next several months incl. specific target levels

• Another look at the 18yr and 43.5yr cycles

• S&P from the Great Depression lows and ultimate targets

• Dow Jones & Fibonacci perfection!

• Nasdaq 100 – positive correlation and 6-12 month price objectives

• Russell 2000 – small-cap outlook

• Sectors – KBW Banking Index

• Sectors – Nasdaq (NBI) Biotechnology

• Europe – Eurostoxx 50

• Europe – Xetra Dax

• MSCI Emerging Market Index – RE-SYNCHRONISATION

• MSCI BRIC (Brazil-Russia-India-China)

• Brazil – Bovespa Index

• Russia – RTS Index

• India – Sensex Index

• China – MSCI China Index

• Shanghai Composite

• China Enterprises

• MSCI Hong Kong

• Hang Seng

• Singapore Straits Times

• Australia – All-Ordinaries

• Japan – Nikkei 225 Index

Peter’s work is absolutely unique – you’ll be taking a look at Elliott Wave counts never seen anywhere else – GUARENTEED!

His 25-years of ground-breaking research into the seamless adherence of pattern development unfolding within specific geometric, Fibonacci dimensions provides the foundation for all the Elliott Wave forecasts shown in this video. This has enabled Peter to identify major directional changes ahead of time over the last sixteen years – for example:

In last December’s Stock Index update, Peter described how major indices were trending lower but with the S&P’s cycle analysis signalling a major low in late-January/February – see this cycle analysis below…

…and how the KBW Banking Index was finalising a major low before resuming its medium-term uptrend…

These were just two hints that markets were going to get off to a shaky start, but then turn around to resume larger uptrends!

Get Up-to-date on the next 6-month outlook – & beyond!

As an Elliott Wave Compass subscriber, we’ve ensured you have access to this Institutional–grade analysis at very modest expense.

PART I Stock Indices VIDEO is available now, at only $48.00!

We’ll send you a personal link so that you can watch the video, anytime at your convenience.

And if you’d like to subscribe to the up-coming COMMODITIES & CURRENCIES videos in PART II & PART III, you can receive ALL THREE for $96.00! – that’s a saving of 33% per cent!

• Single Video – $48.00

• Triple Package offer – $96.00 (saving 33%)!

If you saw the EW forecasts for the COMMODITIES Video published in January’s PART II update, you’d find that downside targets were successfully achieved!…here’s an extract:

Since then, Newmont Mining has traded higher by an amazing +108% per cent!

And if you followed the CURRENCY video in combination with the Emerging Market and Commodity outlooks, you would have been fully prepared for a big change in the US$ dollar, and related EM/Commodity Currencies, like the Canadian Dollar:

CONTACT US NOW VIA EMAIL – SELECT YOUR PACKAGE

Single Video – $48.00 – PART I STOCK INDICES

Triple Package offer – $96.00 (saving 33%)! – PART I – PART II – PART III

PARTS II & III will be available in a few weeks’ time – we’re working on it!

HOW CAN YOU RECEIVE THE VIDEO FORECAST?

To receive your VIDEO UPDATE please click here to contact us.

– Please state if you wish to purchase the SINGLE VIDEO for STOCK INDICES for USD 48.00?

– Or opt for the TRIPLE PACKAGE for USD 96.00 in total?

– Next we will send you a PayPal payment request and provide you with the video link & PDF report once confirmed.

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Most sincerely,

WaveTrack’s Elliott Wave Team

Visit us @ www.wavetrack.com

DJ Transportation Average – The Beginning of a Major Advance

by WaveTrack International| April 22, 2016 | No Comments

The price declines that began unfolding for the DJ Transportation Average from the November ’14 all-time-high of 9310.20 ended a typical counter-trend zig zag pattern last January at 6403.30. This is labelled as a 4th wave retracement within the upward progress of intermediate wave (3) that began its uptrend from the Oct.’11 low. A 5th wave advance is now engaged to the upside with ultimate targets towards 10876.20+/- derived where it unfolds by a fib. 61.8% ratio of the net advance of the 1st-3rd waves.

It may take another year or so before the 10876.20+/- number is reached with the condition that it subdivides into a five wave expanding-impulse pattern, labelled in minute degree, 1-2-3-4-5.

Minute wave 1 began this uptrend last January from 6403.20 – see fig #1. It too must subdivide into a smaller five wave expanding-impulse pattern (the term ‘expanding-impulse’ is given to five wave patterns that contain ‘price-expansion’ in one of the impulse waves, i.e. 1-3-5 – in other words, one of the waves ‘extends’ so that it measures larger than the other two, commonly occurring in the 3rd wave position – this differentiates it from a ‘diagonal-impulse’ that does not contain the quality of ‘price-expansion’ – a diagonal contains ‘overlap’ because its 3rd wave has not expanded the price action).

The DJ Transportation Average’s upside progress began hesitantly, building into a series of gradual upside movements in a step-like progression associated with a sequence of 1-2-1-2-1-2’s. These are a function of ‘fractalisation’ where a 3rd wave subdivides into smaller degrees of trend prior to ‘price-expansion’. This is evident in the DJTA upswing until a 3rd-of-3rd-of-3rd wave advance began mid-February. The conclusion of price-expansion as this third wave ended on the 17th February at 7383.10. The series of 1-2’s, three of them in total must ultimately be followed by an equal amount of 4-5’s, i.e. 4-5-4-5-4-5. Two 4-5’s have so far completed, a third 4th wave as minuette wave [iv] into the early-April low at 7623.80. This leaves just one final 5th wave advance, as minuette wave [v] to develop higher.

A final upside target is measured towards the 8462.60+/- to 8491.70+/- levels. These are derived from two ‘golden-section’ measurements of the entire impulse pattern from the Jan. ’16 low. The point where price-expansion began at 7129.40 is extended from the Jan.’16 low by a fib. 161.8% ratio that projects to 8462.60+/-. Also, extending minuette waves [i]-[iv] by a fib. 61.8% ratio projects to 8491.70+/-.

So these become the main target levels for the completion of this impulse pattern. Naturally, a counter-trend decline will then begin a larger 2nd wave pullback. It will be interesting to see how deep that one evolves!

Stay up-to-date!

Institutions – contact us for access to the EW-Forecast database where over 200 forecasts are illustrated with market commentary including all time-series for all global indices.

Private-Clients – subscribe to the Elliott Wave Compass report for bi-weekly updates for stock indices, currencies, bonds and commodities

Mining Investment Asia 2016 Conference – Singapore 13th April 2016

by WaveTrack International| April 11, 2016 | No Comments

Announcement – MINING INVESTMENT ASIA 2016 CONFERENCE SINGAPORE – 13th April 2016

WaveTrack’s founder Peter Goodburn is being invited by the high profile Mining Investment Asia 2016 conference in Singapore to speak about ‘Is the commodity super-cyle really dead? Cand inflation re-appear and what impact can this have on price-forecasts for copper and gold during the next several years’.

He will be featuring the impressive Copper forecast published in January 2011 (see below – forecast published in WaveTrack’s reknown ‘Base Metals Report’) and show during the conference WaveTrack’s updated forecast for 2016 and beyond.

For more information visit www.mininginvestmentasial.com

Global Stock Index Tracking

by WaveTrack International| April 5, 2016 | No Comments

86% of Active Equity Funds Underperform – Can Global Index Tracking Reverse this Figure?

A recent survey of 25,000 ‘active’ equity funds has revealed that firms based in Continental Europe, almost all underperformed their benchmark index over the past decade. A figure of 80% per cent underperformed over the past five-year period, rising to even higher levels in the Netherlands, Switzerland and Denmark.

The research by S&P/Dow Jones Indices also showed that 98.9% per cent of U.S. equity funds underperformed their benchmark over the last ten-year period as did 97% per cent of those specialising in Emerging Market funds and 97.8% per cent for those managing Global Equity funds.

U.K. active equity funds fared better by comparison, outperforming over a 1-3-5 year period but over 10-years, all categories underperformed.

These latest statistics are nothing new to the active vs. passive fund management debate on efficiency – it’s been hotly contested for the last decade and longer. There are trade-offs for both methodologies of course. Investing in ‘active’ equity funds enables managers to be agile in manging portfolios in an environment where price volatility has increased during the last decade-and-a-half. Passive funds attracts lower fees for the investor.

What can we glean from this survey?

A few aspects come to mind.

- The efficiency of active equity funds would not be debated if they outperformed the index, after fees, on a more regular basis.

- Over a ten year assessment, nearly all funds underperform – this is most probably due to the fact that it encompasses the period of the financial-crisis sell-off during 2007-09 – and yet, the percentage figures are still incredibly high over the 5-year sampling.

- It is driving investment out of active equity funds and into the low-cost exchange traded fund market which has a six-fold increase over the last decade to $2.9tn dollars.

But the real question remains not of underperformance per se, but its cause/s. Is this because of poor stock-picking? – if so, is the analysis underperforming? – if not, are there other causes such as the difficulties in adapting to high volatility in a non-trending environment? Maybe.

Can this underperformance trend be reversed?

Yes, it can. But first, it’s important to understand the real reason for underperformance. It doesn’t necessarily lie in the re-evaluation of bottom-up equity research consumed – it lies in the ability of individual fund managers to extricate themselves from the instinct of herding. This is imperative in an environment that is much more volatile than in previous decades. ‘Herding’ is the tendency for individuals to mimic the actions of the larger/aggregate group.

As Albert Phung explains: ‘There are a couple of reasons why herd behaviour happens. The first is the social pressure of conformity. You probably know from experience that this can be a powerful force. This is because most people are very sociable and have a natural desire to be accepted by a group, rather than be branded as an outcast. Therefore, following the group is an ideal way of becoming a member. The second reason is the common rationale that it’s unlikely that such a large group could be wrong. After all, even if you are convinced that a particular idea or course or action is irrational or incorrect, you might still follow the herd, believing they know something that you don’t.

It’s only natural that a majority get engulfed within the ‘group-think’, more now than ever because of the sheer amount of information that we consume via e-mail, social media and financial news providers. But it’s a trap! When markets are trending, yes, an established momentum of optimism occurs, probably but not always, resulting in outperformance of the index. But when markets come to a point of ‘exhaustion’, usually when few expect it to, then human instinct clicks in. Once benchmark indices trade lower, in any meaningful way, equities invariably follow lower too. During these declining phases, even though many equities may match the index in percentage terms, the fund manager that is herding is likely to get caught-up in executing at levels of stress when the equity is momentarily underperforming because everyone else is doing the same thing at the same time!

And there’s been plenty of those severe pullbacks in the stock markets over the last few years. Taking the S&P 500 index as a benchmark, there’s been three such sell-offs during the last 18 months alone – minus -9.8% per cent in September ’14, -12.4% per cent in July ’15 and more recently -14.4% per cent last November ’15. This excludes the larger decline of May ’11, -21.6% per cent and a few others in-between.

So how can we extricate ourselves from getting too caught up in herding?

One answer lies in the practice of de-herding – becoming more independent in thought and process. This doesn’t mean becoming a fixed ‘contrarian’, but at important inflexion points, yes, it becomes an essential quality to adopt. To do that, it is important to rely on some ‘anchors’ that will support us during stormy times. These anchors are certain laws that define financial markets that in turn, govern the price development of all indices and equities. These laws reverberate causing certain repetitions of market behaviour – this allows them to be monitored, tracked and even used to forecast future price development. These laws become very apparent through volatile times, like the period of the financial-crisis. The lows in March ’09 were predictable basis these laws. It takes time though, to build a ‘belief’ system in these anchors and everyone will be different in their assessment of such knowledge. But to those that can withdraw from the financial ‘noise’, great benefits await!

The anchors/laws are as follows:

- Market price activity alternates in periods of ‘action’ followed by ‘reaction’, ‘trend’ and ‘counter-trend’

- Historical price activity has a direct relevance/impact to its future development – know the past and the future becomes predictable

- Price activity forms recognisable ‘patterns’ that repeat over and over again

These patterns form in a specific sequence and are not random events

Varying patterns are limited to 13 basic formats that encompasses all market activity - These patterns form consistently and repetitively throughout many time-series – they can be observed spanning many decades or evolving within several minutes (fractal in nature) of price activity

- Pattern size/amplitude of price development is governed by its relative association within its peer/corresponding group – this means it is hierarchical in nature, forming larger/aggregate patterns with self-similar components and sub-components

- The size/amplitude of price activity/patterns can be measured using specific Fibonacci-Price-Ratio (FPR) measurements – these often produce accurate target levels calculated into the future

Most important of all, once an understanding of these laws/principles is obtained, it must be practiced – but only belief can instil its effectiveness. Fear must be overcome and that only visits us during times of extreme stress, when peer sentiment is wreaking havoc! But that is precisely the time to become the contrarian! A good example of this was when Warren Buffet began to buy equities, specifically, the banks near the lows of the financial-crisis in year-2009. Almost everyone else was selling. The outcome we know.

This was an extreme case of bearish sentiment of the time – if it could be reliably measured, it would probably read 80/100, a hundred being the worst case of pessimism or despondency on record (Great Depression, 1932?). There are different magnitudes of this condition too, and it’s opposite, optimism and euphoria. The sentiment measurement will be less in smaller percentage declines/advances. For example, what about the recent event in January/February ’16? Could the low traded in early/mid-February be predicted?

Could this have prevented underperformance of the underlying index? – Yes, Yes!

The global indices of the world markets are excellent proxies in tracking the overall trends of sector/derivative equites. Know how these perform, trend, and you have a pretty good idea if top-down, your equity is going to suddenly fall off a cliff, or be the defensive king!

Our methodology of using the anchors/laws is commonly known as the Elliott Wave Principle (EWP). It’s dynamic in nature and application – over the last 25 years, we’ve developed a proprietary way of measuring all the patterns identified by its discoverer, R.N. Elliott (1871-1948). This assists in the objective assessment of pattern identification. For example, using these laws, the underlying stock market sell-off in February ’16 was expected to finalise an important low – even though consensus at the time was very bearish with mainstream headlines/analysts calling for continued declines –

o January 29 – This reliable indicator says we’re in a bear market for stocks

o February 12 – JP Morgan Warns Upcoming Recession

o February 25 – Smart-beta guru is now warning of a crash

o February 29 – Investors pull more than $60bn from mutual funds

Contrastingly, major indices were forecast as forming an important low:

WaveTrack Report, February 5 – ‘Despite consensus pessimism throughout the stock market, especially since the banking sector is still working itself lower, there exists signs of an emerging recovery. Should shorter-term overhead resistance be overcome, it would signal a more sustained advance unfolding for the next several months with price targets to last year’s highs, and eventually beyond’. See fig’s #1 & #2 from that report:

Start Index Tracking today! Get access to WaveTrack’s bi-weekly Elliott Wave Compass report featuring many short-term updates of various asset classes and three exclusive videos!

Successful trading with WaveTrack International

Subscribe to the EW-Compass here…

Dow Theory, Elliott Wave & the Golden Ratio Phi – What do they have in common?

by WaveTrack International| March 9, 2016 | No Comments

TradersWorld Issue #62 – Read WaveTrack’s latest article ‘Dow Theory, Elliott Wave & the Golden Ratio Phi’

The latest edition of the TradersWorld Magazine is hot of the press! The renown publication is again a gold mine of interesting articles, trends and trading ideas. Download your own free copy now. Click here!

On page 86 you find WaveTrack’s new article entitled ‘Dow Theory, Elliott Wave & the Golden Ratio Phi‘. It examines a lesser known aspect of Ralph Nelson Elliott’s study of Dow Theory and it principles and clearly outlines the essential tenets distilled in this process.

Dow’s Divergence Principle is explained in its historcial context as well as illustrated on the basis of the DJ Transportation Average chart. And finally, Peter Goodburn adds a new tenet to the process ‘Fibonacci-Price-Ratios’ as the perfect complement to examine patterns in a smaller time frame. Read the full article here: TradersWorld Issue #62

Interested in Elliott Wave? Get access to WaveTrack’s bi-weekly Elliott Wave Compass report featuring many short-term updates of various asset classes and three exclusive videos!

Read more about the latest Currencies (Forex) Video Update here!

Successful trading with WaveTrack International

Subscribe to the EW-Compass here…

US Dollar Index – Do Fibonacci Price Measurements Really Work?

by WaveTrack International| March 4, 2016 | 4 Comments

Sometimes, markets unfold in an intricate way that appears incomprehensible to fundamental or orthodox technical analysts. It is in these times when Elliott Wave practitioners can gain an insight into the value of fib-price-ratio analysis.

In mid-January, we proposed a very delicate pattern structure for the US$ index – an ending contracting-diagonal that began from the Aug.’15 low and was forecast to continue during the next months. Of special importance was the December decline from 100.51 to 97.19 that was seen as wave [a] of the larger 2nd wave. Basis fib-price-ratio measurements, we projected an ultimate low for the 2nd wave towards 95.20 – this was derived from a fib. 61.8% extension of the initial decline to 97.19, a standard measurement for zig zag sequences.

The actual outcome, as can be seen a month later, is quite amazing! The US$ index declined to a recorded low of 95.23 and was immediately rejected!

This testifies to the value of fib-price-ratio measurements that, correctly applied, can sharpen the awareness in terms of pattern/price-convergences. Only too often we see that patterns terminate at important fib-price-ratio support/resistance-levels. This can be an invaluable clue for someone trying to figure out the structure of a pattern.

Get access to WaveTrack’s bi-weekly Elliott Wave Compass report featuring many short-term updates of various asset classes and three exclusive videos!

Read more about the latest Currencies (Forex) Video Update here!

Successful trading with WaveTrack International

Subscribe to the EW-Compass here…