Eurostoxx 50 – Elliott Wave Running Flat

by WaveTrack International| October 4, 2016 | No Comments

When a Horizontal Flat turns into a Running Flat

Recent updates in our bi-weekly reports have intoned a very bearish outlook for global stock markets for the next several months. This is mainly because of multi-month running flat patterns unfolding in indices like the Eurostoxx 50 and Nikkei 225, ending early-September.

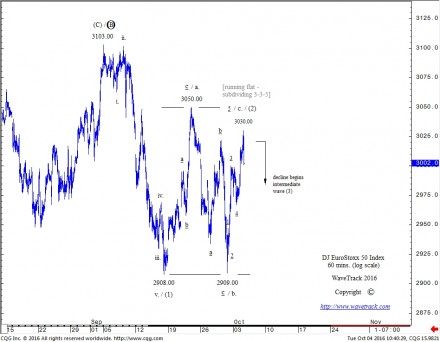

For the Eurostoxx 50, this running flat pattern ended at 3103.00 (futures). The subsequent decline affirms the bearish outlook for the next several months because it unfolded into a clearly visible Elliott Wave impulse pattern, specifically, a five wave expanding-impulse ending at 2908.00 – see chart, fig #1.

This has subsequently been balanced by a counter-trend upswing which is just completing, now, at 3030.00. The correction has unfolded into a horizontal flat and labelled in minor degree, a-b-c, subdividing 3-3-5. The horizontal flat is identified because its second sequence, minor wave b. unfolded into a three wave zig zag, but completed at the horizontal low of the origin of minor wave a., at 2908.00.

Ordinarily, the third sequence as minor wave c. would be expected to now unfold higher whilst unfolding into a five wave pattern, but ending at the horizontal high that ended minor wave a. / began minor wave b. at 3050.00. But in this case, it has run short, ending the five wave pattern at 3030.00. This means the horizontal flat changes into a running flat because wave c. is ‘truncated’.

Some Elliott Wave practitioners eliminate the possibility that a horizontal flat, where waves a. and b. remain horizontal can allow wave c. to run short to mutate into a running flat. The argument is that wave b. ordinarily would break below the extremity of wave a. to validate this. For the record, this is not necessary, as this chart proves.

Get access to WaveTrack’s bi-weekly Elliott Wave Compass report featuring many short-term updates of all 4 asset classes!

Successful trading with WaveTrack International

Subscribe to the EW-Compass here…

Comments

Leave a Reply