DAX 30 – REVERSAL

by m.tamosauskas| August 22, 2012 | No Comments

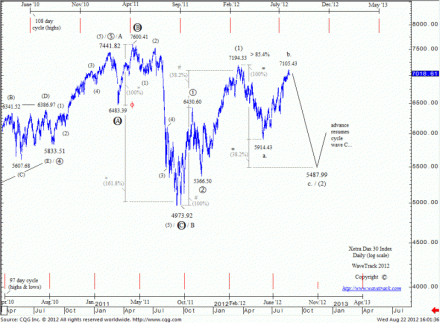

The advance from the low of November ’11 at 5366.50 to the March ’12 high of 7194.33 represents the completion of intermediate wave (1) and this is currently being balanced by a counter-trend retracement decline as intermediate wave (2) – it is still in progress. This decline is unfolding into a single zig zag pattern, labeled a.-b.-c. in minor degree. Minor wave a. unfolded into a five wave expanding-impulse pattern that was completed in June ’12 at 5914.43. Minor wave b. unfolded into a double zig zag pattern and yesterday has reached its lower upside targets towards 7102.40-28.81 with a high of 7105.43. The final down-swing as minor wave c. has begun with ultimate downside targets towards 5487.99. This is expected to complete before year-end 2012.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

Leave a Reply