Crude oil

by m.tamosauskas| September 3, 2012 | 1 Comment

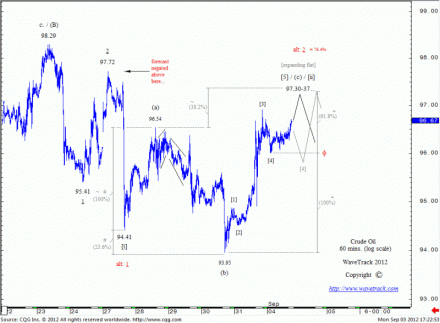

Last week’s advance broke above the 96.54 level transforming the counter-trend zig zag upswing from 94.41 into a more complex expanding flat pattern. This counter-trend rally remains as minuette wave [ii] but remains incomplete with revised upside targets towards 97.30-37. Price targets for minuette wave [ii] are measured this way: first, extending sub-minuette wave (a) of the expanding flat pattern by a fib. 38.2% ratio projects target towards 97.37 – second, extending the total distance of waves [1] to [4] of the impulse pattern unfolding as sub-minuette wave (c) by a fib. 61.8% ratio projects a target level towards 97.30. Such convergences are important inflexion points that signify potential reversal levels of the future. Elliott’s rule is that second wave retracements must not break beyond the starting point of the first wave, in this particular example, the high at 97.72 of minuette wave [i] – a break above this level will negate this bearish count allowing higher highs before a reversal to the downside.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

One Response to “Crude oil”

Leave a Reply

October 30th, 2013 @ 7:11 am

as how to lose 10 pounds in 2 weeks describes at this website

crude oil, critical level, bearish count for te near future