Commodity Highlights

by WaveTrack International| May 4, 2022 | No Comments

‘COMMODITY CORRECTION DURING NEXT 6-8 MONTHS’ – ‘PAUSE WITHIN INFLATION-POP’ CYCLE UPTREND’ – INFLATIONARY PRESSURES EASE – Base Metals Turning Down – Energy Resuming March’s Decline – Precious Metals Testing Important Support Levels – Gold Miners Remain Bullish

Extract from May’s Elliott Wave Commodity Outlook Report

Commodity May Report – In This Edition

Base Metals

Commodity prices have continued to trade near relative post-pandemic highs. But they’ve also remains below the March peaks in a sign of directional change. Base Metals are trading lower over the week following last month’s short-term corrective rallies. Prices for Copper, Aluminium, Lead and Zinc are all heading lower. Negative headwinds are centered around a strong US$ dollar. However more recently, the impact from China’s latest city-wide coronavirus lockdowns are raising concerns.

Inflationary pressures remain in focus as long-dated U.S. interest rates remain stubbornly high although there are several signs of an imminent interim peak forming within this inflation-pop cycle.

U.S. headline Consumer Price Index (CPI) continued to break records with the March ’22 data at 8.5% per cent whilst the Fed’s PCE headline numbers are at 6.6% per cent, core at 5.2% per cent. The Federal Reserve remains on track to deliver a 50bps hike in rates this week to 0.75-1.00% per cent although it remains far behind the curve. Its quantitative tightening programme is too little, too late with the bond market pricing-in too much at current levels. One elevator is rising whilst the other is declining.

US Dollar

The US$ dollar has exceeded our upside expectations although the longer-term picture remains bearish. A dollar peak sometime this month would represent an ensuing decline as inflation-trade long-positioning is unwound.

Precious Metals and Miners

Precious metals have been declining over the last month. This trend is in-line with Elliott Wave analysis with downside risk in focus. But there are alternate bullish counts which show an imminent low forming just below current price levels in gold and silver that could, if held, turn things around. Several of the gold miners are approaching important support levels, turning bullish.

Energy

In the Energy markets, Natural Gas has been the commodity that has continued higher over the last month. Although it too has hit some important upside levels and is now edging lower. Crude and Brent oil completed their five wave impulse post-pandemic uptrends into the March highs and is set to accelerate lower this month in a continuation of multi-month corrections. The XLE Energy ETF and the XOP Oil & Gas ETF’s are also set to head lower.

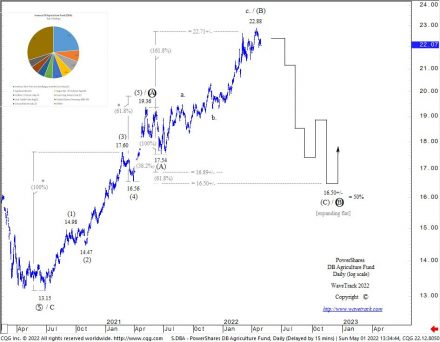

DB-Agriculture Fund ETF

Inflation-led commodities like grains and other foodstuffs are trading into upside resistance levels as measured in the DB-Agriculture Fund ETF. An ensuing corrective downswing is expected to begin now, lasting into year-end. A correction is also signalled for the FAO’s Food & Agriculture index.

The Food and agriculture sectors have been in focus once again as inflationary pressures continue to rise. Ukraine is a major producer of grains to the world (see graphic in last month’s Elliott Wave Commodity April 2022 report – fig #2) and as the war with Russia rolls on, so has there been talk of major shortages due to disruptions in the spring planting season. There’s also problems with supplies of fertilizers which rely on natural gas for conversion. And natural gas prices have risen exponentially over the last couple of years. China is apparently hoarding over half of the world’s grain. This year, China will have 69% per cent of the world’s corn, 60% per cent of its rice and 51% per cent of its wheat. The question is why? Are they expecting some catastrophic event?

Commodity Spotlight China

Beginning in 1999/2000, China implemented grain policies to reduce its excessive stocks. By early 2004, with global stocks at a more normal level relative to use, global rice prices began to slowly increase. Prices then rose exponentially higher. However, China secured a long-term lease with Madagascar back in 2008 to grow rice ensuring supplies when prices had just reached an all-time-peak. In hindsight, that was a really bad trade as prices collapsed lower in subsequent years. Which means the build-up of its current stockpile might simply be due to a hard learning curve from the rice explosion of a decade earlier.

The DB Agriculture Fund (ETF) has unfolded higher from the pandemic low of 13.15. Now, completing a five wave impulse pattern into the May ’21 high of 19.36 as primary wave A – see fig #1. This is an important date as will become apparent later. It’s the same date that ended the post-pandemic five wave impulse uptrend for the US10yr Breakeven Inflation Rate (TIPS) and for LME 3mths Copper. All three contracts have since begun corrective downswings in the form of expanding flats. For the Agriculture Fund, this is labelled in intermediate degree, (A)-(B)-(C) where wave (B) has just completed into April’s high of 22.88. Wave (C) is set to decline over the coming months. Ultimate targets remain unchanged towards 16.50+/-.

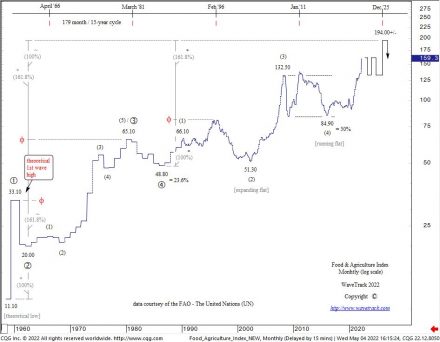

Food & Agriculture Index

The Food & Agriculture Organisation, a division of the United Nations posted latest data for the Food & Agriculture Index – see fig #2. Intermediate wave (5)’s advance within the long-term primary degree uptrend began from grand ‘Re-Synchronisation’ low of 84.90 of late-2015/early-2016. This advance is developing nicely, into a smaller degree five wave impulse pattern, i-ii-iii-iv-v where its 3rd wave is peaking now at 159.30. Note, a corrective 4th wave is forecast over the next 6-8 month period. This is an indication that the current scarcity narrative being broadcast in mainstream media is overcooked. A correction would also mean inflationary pressures are set to pause for a while.

Special Coverage of Base Metals, Precious Metals, Energy and Metal Miners in WaveTrack’s latest Elliott Wave Commodity Report

Available here EW-Commodity Report Subscription for USD 240 per month.

Comments

Leave a Reply