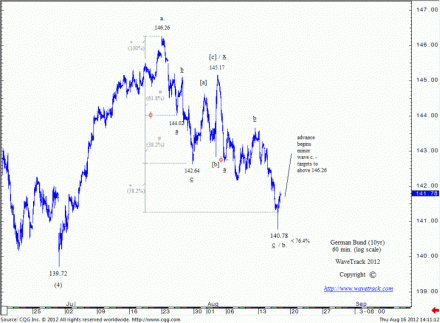

BUND – REVERSAL!

by m.tamosauskas| August 16, 2012 | No Comments

Germany’s 10 year Euro Bund future spiked briefly below downside targets of 141.26 on the opening of today’s session with a low recorded at 140.78 but was quickly rejected with trading almost immediately pulling prices back above the Fibonacci convergence targets to confirm a reversal signature (see previous posts).

This contract is negatively correlated to global stock indices – it provides an excellent timing indicator not only for a return higher for the Bund, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows.

We expect Germany’s 10 year Euro Bund future to accelerate upwards, whilst global stock indices should begin to react in the opposite direction anytime now.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

Leave a Reply