BUND

by m.tamosauskas| August 30, 2012 | No Comments

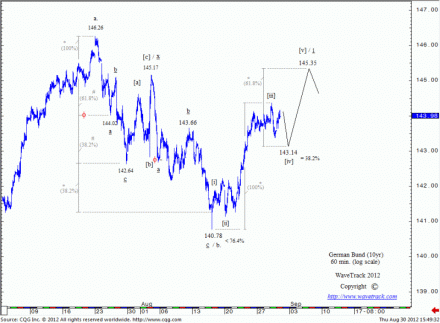

Germany’s 10 year Euro Bund future from the high of 146.26 to the low of 140.78 unfolded into a double zig zag pattern. It has reversed and now is unfolding into an expanding-impulse pattern, labelled [i]-[ii]-[iii]-[iv]-[v] in minuette degree. So far only three waves are visible which means the upswing that started from 140.78 is not complete. An ideal price target for minuette wave [v] is measured towards 145.35. Once again, we are looking for other asset classes to confirm our outlook for the stock market. Recently, the correlation between bunds and global stock indices is somewhat mixed but it should resolve sooner rather than later into the common negative correlation.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

Leave a Reply