Commodities Video Outlook 2025 PART II/III

by WaveTrack International| January 28, 2025 | No Comments

Commodities Video Outlook 2025

Expert Financial Forecasts for Market Success

WaveTrack International is proud to present the latest installment of our Annual Trilogy Video Series, an in-depth analysis of financial markets using the renowned Elliott Wave Principle. This comprehensive video series provides price forecasts for 2025 and extends into the culmination of the current ‘Inflation-Pop’ Cycle, expected to complete around 2027-2030. Divided into three insightful parts, the series covers:

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now! Buy here

• PART III – CURRENCIES & INTEREST RATES – coming soon!

A Deep Dive Into Commodities – Part II

In Part II, we examine over 79 Elliott Wave charts and cycles across the Commodities sector, encompassing Base Metals, Precious Metals, and Energy. This year’s analysis takes a meticulous look at key market drivers, significant price trends, and sector-specific dynamics.

What’s Inside?

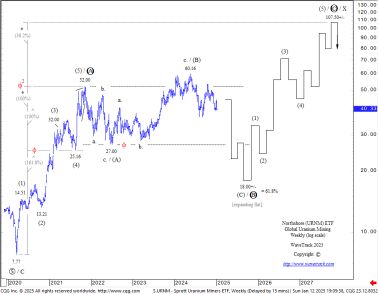

Base & Precious Metals

We dive into leading Base Metal and Precious Metal Miners, providing Elliott Wave-based price forecasts and critical levels to watch. Strategic metals like Iron Ore, Uranium, and Rare Earths ETFs also feature prominently in this year’s report, reflecting their growing importance in global markets.

Energy & Inflation-Sensitive Commodities

Our analysis extends to inflation-sensitive assets such as Energy and Food, offering insights into ETFs like the DB Agriculture Fund.

Fibonacci-Price-Ratio Analysis

WaveTrack’s proprietary techniques blend Elliott Wave patterns with geometric principles of ratio and proportion, illustrating price convergence points through Fibonacci-based matrices. This method provides a detailed road map for traders and investors alike.

Intermarket Relationships

Commodities do not operate in isolation. Our analysis emphasizes the interconnectedness of various asset classes, highlighting the importance of viewing the broader market matrix, even if you trade a single asset.

Commodities Key Market Drivers for 2025

This year’s report begins with an overview of the major forces shaping commodity markets in 2025. Key drivers include:

Inflationary Expectations: As the 2024 U.S. presidential election approaches, markets are pricing in rising inflation due to potential increases in trade tariffs and protectionist policies.

Geopolitical Risks: Ongoing conflicts, such as Ukraine/Russia and tensions in the Middle East, continue to create volatility in commodity prices.

Recession Risks & the U.S. Dollar: While recession fears linger following the U.S. yield curve inversion in 2022, a potential decline in the U.S. dollar—expected through Elliott Wave analysis—could mitigate these risks and support commodity prices.

Why This Report Matters

Whether you’re a trader, investor, or market enthusiast, this year’s Commodities Video Outlook offers actionable insights and detailed analysis to help navigate the complexities of global markets. The Elliott Wave Principle, combined with Fibonacci-Price-Ratio projections, offers unparalleled clarity on future price developments.

Get Started

This is your opportunity to gain exclusive access to the latest insights from WaveTrack International. With the growing importance of commodities in a world shaped by inflationary pressures and geopolitical risks, this report is a must-have resource for anyone seeking to stay ahead in today’s markets.

Sincerely,

Peter Goodburn & EW-team

Commodities Video Outlook 2025 Part II/III

Contents: 79 charts

Time: 2 hours 16 mins.

• FED, Interest Rate, Inflation charts

• US 10yr Yield Cycle

• China Growth

• Commodities Headwinds + Tailwinds

• US Dollar index

• CRB-Cash index

• Food and Agriculture Index

• DB PowerShares Agriculture Fund

• Baltic Dry Index

• Copper

• Aluminium

• Lead

• Zinc

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Glencore

• Rio Tinto

• Vale

• Iron Ore

• Uranium

• Rare Earths

• Gold

• Gold-Silver Ratio

• Silver

• Gold/Platinum Ratio

• Platinum

• Palladium

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• XAU Gold/Silver Index

• Crude Oil

• Brent Oil

• Natural Gas

• TTF Natural Gas

• XLE Energy SPDR

• XOP Oil and Gas Index

How can you purchase the video?

1. Single Commodities Video! Simply click on this PayPal payment link for the Commodities Video Outlook 2025 for USD 55.00 (for non-EU clients). Please note that it can take up to 6 hours until you receive this video.

2. Triple Video! Simply click on this PayPal payment link for the Triple Video Outlook 2025 for USD 111.00 (for non-EU clients). This covers Stock Indices, Commodities and Currencies + Interest Rates. Please note that it can take up to 6 hours until you receive this video.

3. Additionally, we now offer as well payment via credit card payment link – For the credit card payment option please Contact us @ services@wavetrack.com and state if you like to purchase the Commodities Single video for USD 55.00 + VAT* or the Triple Video for USD 111.00 +VAT*?. Thank you.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Comments

Leave a Reply