by m.tamosauskas| October 26, 2012 | No Comments

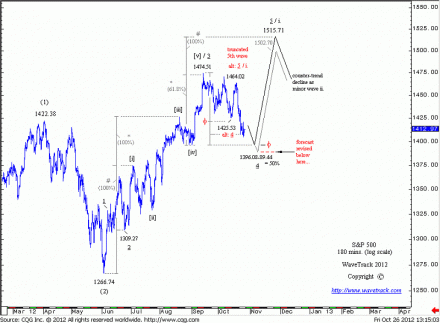

The decline from the September high of 1474.51 is still in progress, unfolding as a 4th wave within a larger ongoing five wave upswing from the June low of 1266.74. Shorter-term, downside targets measure to 1396.08 but could also extend to the fib. 50% support at 1389.44. As this is commonly the max. retracement for a 4th wave, <b>any acceleration below 1389.44 would revise this forecast. A reversal from the 1396.08-1389.44 area would otherwise trigger the finalising 5th wave advance in the weeks ahead, with original upside targets to 1502.70-15.71.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

Leave a Reply

Recent Posts

Recent Comments

- David Afoa on GOOGLE – Fib-Price-Ratio Study

- Lili Berkman on The Silver Wheaton Difference!

- Reena Wheat on Currencies and Interest Rates 2019 Video Outlook | PART III/III

- Lyndon Poock on Stock Index Video Outlook – 2021 | PART I/III

- Reyes Benusa on Reversal-Signature and Price-Rejection – The Golden Rule

Archives

- February 2026

- December 2025

- August 2025

- July 2025

- June 2025

- March 2025

- February 2025

- January 2025

- December 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- August 2023

- July 2023

- June 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- August 2022

- July 2022

- June 2022

- May 2022

- March 2022

- February 2022

- January 2022

- December 2021

- August 2021

- July 2021

- June 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

Categories

- ADXY Index

- Agnico Eagle Mines

- AI Artificial Intelligence

- Alcoa

- Amazon

- AngloGold Ashanti

- Antofagasta

- APPL

- Apple

- ASX 200

- AUD vs USD

- AUDNZD

- AUDUSD

- Australia ASX 200

- Baltic Dry Index

- Banking

- Base Metals

- Biotechnology

- Bitcoin

- Bovespa

- Broadcom

- Catalexit

- central banks

- Christmas

- Commodities

- Commodities Video Outlook 2020

- Conference

- Copper

- Coronavirus Sell-Off

- CRB

- Crude oil

- crude oil price chart

- CryptoCurrency

- Currencies

- Currencies + Interest Rates Video Outlook

- Cycles

- Dax 30

- deutsche bank

- Dewey Cycle

- DJ Transportation Average

- DJ Utilities

- Dow Jones 30

- Dow Theory

- ECB

- economy

- Elliott Wave

- Elliott Wave Charts

- Elliott Wave Patterns

- Elliott Wave Principle

- Emerging Markets

- Ending-Diagonal Elliott Wave Pattern

- Equity

- EUR vs CHF

- EUR/USD

- Euro / US$

- Eurostoxx 50

- EuroStoxx50

- EuroStoxxBanks

- EURUSD

- Expanding Flat Pattern

- FAAMG

- FANG+

- fib-price-ratio

- Fibonacci Trading

- Fibonacci-Price-Ratio

- Financial Forecasting

- Fixed Income

- forex

- Freeport McMoran

- FTSE 100

- Fund Management

- FX

- FXStreet

- GBP/AUD

- GBP/USD

- GDX

- GDXJ

- Germany 10 year Euro Bund future

- Gilead Sciences

- Glencore

- Global Economy

- Gold

- Gold Mining

- Golden Ratio

- goldman sachs

- Google Inc.

- Google/Alphabeth

- Greek debt crisis

- Hang Seng

- Harbinger

- Hungarian Forint

- IBEX 35 Index Spain

- Independent Research

- India-CNX Nifty 50

- Interest Rates

- Interview

- IRP Independent Research

- kbw bank index

- Lonmin

- MAG-7

- McDonald's

- MID-YEAR VIDEO UPDATE!

- Mifid II

- Mines

- Mining

- MSCI China

- MSCI Emerging Markets

- Nasdaq 100

- Nasdaq Biotechnology Index

- Nasdaq Composite

- Nasdaq100

- Netflix

- Newmont Mining

- Nikkei 225

- NVIDIA

- NYSE Composite Index

- Palladium

- Platinum

- Precious Metals

- Ralph Nelson Elliott

- Reversal-Signature

- Russell 2000

- Russia RTS

- S&P 500

- Sector

- Secular-Bull

- Sentiment Survey

- Shanghai Composite Index

- Silver

- Slanting Flat Elliott Wave Pattern

- SP100

- SP400 Mid-Cap

- SP500

- SPX 500

- STLG/AUD

- Stlg/US$

- STLG/USD

- STLG/YEN

- STLG/ZAR

- Stock Index

- Stock Index Tracking

- Stock Index Video

- Stock Indices

- Stock Indices Video Outlook 2023

- Stock Indices Video Outlook 2025

- Sugar

- Summary

- Tesla

- Tesla Inc

- Toyota

- Track Record

- trading

- Trusts

- Tutorial

- Uncategorized

- UniCredit

- US

- US Dollar Index (DXY) (USDX)

- US$ Index

- US-Dollar Index

- US10yrYields

- USD

- USD/ARS

- USD/CNY

- USD/IDR

- USD/INR

- USD/MXN

- USD/SGD

- USD/THB

- USD/YEN

- USD/ZAR

- Vale

- Value Line Index

- video

- VIDEO OUTLOOK 2018

- VIDEO OUTLOOK 2020

- VIX

- W.D. Gann

- WaveTrack International

- XAU Gold/Silver Index

- Xetra Dax

- XOP

- Yields

- Zig Zag

- Zinc

- ‘INFLATION-POP’

- ‘SHOCK-POP-DROP’

About WTI

WaveTrack International is a financial price forecasting company dedicated to the Elliott Wave principle and work of the R.N. Elliott. Clients include Investment Banks, Pension Funds, Total/Absolute-Return/Hedge Funds, Sovereign Wealth Funds, Corporate and Market-Making/Trading institutions and informed individuals -- & just about anyone who is affected by directional price change.

Subscribe to our feed

WTI Links

- Visit us on our HomePage

- Follow us on Twitter

- Like us on Facebook

- Circle us on Google+

- Follow us on YouTube

- Visit us on Xing