NYSE Composite Index – Latest Development

by WaveTrack International| November 6, 2018 | No Comments

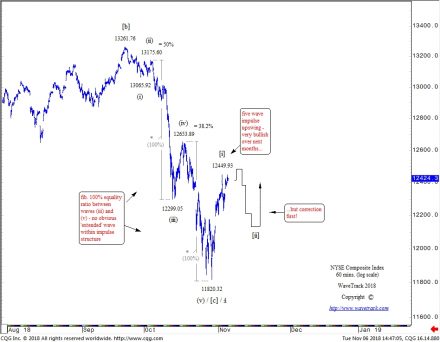

NYSE Composite Index – Fib. 100% Equality Ratio in Waves (iii) – (v) – No ‘Extended’ Wave

The Elliott Wave pattern development within the third phase of U.S. stock index declines during September/October’s sell-off varied according to each index’s performance from earlier this year. For example, the large-caps like the SP500 and Dow Jones (DJAI) declined into three wave patterns. In zig zags to be precise, from the late-Sep./early-Oct. highs as wave [c] within a developing triangle. These lows terminated in late-October but above the February lows. In this way reflecting their outperformance during April’s strong advances that broke above the January highs.

Other indices like the underperforming Russell 2000 small-cap index declined during September/October’s sell-off into a five wave impulse pattern. This reflected its underperformance and an entirely different corrective pattern. In this case, a running flat, unfolding from last January’s high.

The NYSE Composite index was one of the underperforming indices for this year. It unfolded into a zig zag pattern, [a]-[b]-[c] and one of the exceptions by breaking below the Feb’18 lows in wave [c] ending at 11820.32 – see fig #1.

Wave [c] unfolded into a necessary five wave impulse pattern from September’s high of 13261.76 subdividing (i)-(ii)-(iii)-(iv)-(v). What was interesting from a Ratio/Proportion basis was that there was no ‘extended’ wave in this sequence. Rather, waves (iii) and (v) measured equally by a fib. 100% equality ratio. That’s somewhat unusual because R.N. Elliott stated that one wave must ‘extend’ or measure larger than the other two. But occasionally, this hasn’t occurred as this example proves. Although this is statistically uncommon, it’s enough to qualify his statement as a ‘guideline’ rather than a ‘rule’.

NYSE Composite Index – Looking Ahead

With this year’s zig zag decline out of the way, the NYSE Composite index, like the others, can now begin a multi-month recovery, extending the bull market, impulse uptrend that began from the Feb.’16 lows.

Shorter-term, the advance from 11820.32 has unfolded into an intra-hourly five wave impulse pattern ending last Friday at 12449.93 as minuette wave [i]. Wave [ii] has since begun a three wave counter-trend correction but this remains incomplete. Await some downside pull across the U.S. mid-term election results before the trend resumes higher.

Comments

Leave a Reply