Global Opportunities, US Risks and the Grand ‘Re-Synchronisation’

by WaveTrack International| August 17, 2017 | No Comments

Global Opportunities, US Risk – Global Outlook Report by Gail Fosler in collaboration with Peter Goodburn

Global Financial Opportunities, US Risks

Elliott Wave Indicators

It was in early-January 2010 that we caught the first glimpse of how the US asset price recovery was developing. Even if contrived by central bank intervention following the end of the financial-crisis just 9-months earlier. It became apparent as major US stock prices continued higher along with commodity prices that Elliott Wave ‘impulse’ patterns were emerging. This was confirming the continued upside progress which has lasted another 7-years to this day.

The definition of an uptrend, in layman terms, is a price chart which depicts the progress of higher-highs and higher-lows. In Elliott Wave Theory (EWT), this is somewhat more explicit. Elliott Wave defines an uptrend as a five wave pattern development, an ‘impulse’ pattern, 1-2-3-4-5 but with very specific parameters. Why does this provide such a huge advantage over other methods? Because it also adds price ‘dimension’ and often some degree of ‘timing’ in the assessment for completion. In this way, EWT is classified in scientific terms as a ‘deterministic’ or predictive system. As by the means of this ‘string’ of patterned price data it can be ‘nonlinearly’ extrapolated to project the future course of price activity.

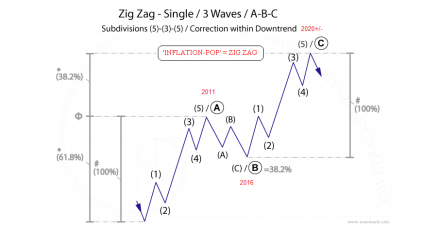

The ‘Inflation-Pop’

Evidence of a five wave impulse pattern development from the financial-crisis lows of end-2008, early-2009 led to an amazing financial discovery. It projected a continuation of the asset price recovery to new record highs! Even though this event was many years into the future. The continuation of gains in Commodity prices and Emerging Markets was projected to new all-time-highs. Actually, several years into the end of the current decade and perhaps early into the next! This event is termed as the ‘INFLATION-POP’ because its specific Elliott Wave pattern development was identified as a three wave zig zag sequence – see fig #1. This meant it would ultimately test new record highs in a relatively short period of time prior to the asset bubble getting ‘popped’.

Grand ‘Re-Synchronisation’

The fixed positive-correlation between US stock indices and commodities continued until late-2012 when peaks were broken above in the benchmark S&P 500 whilst commodities continued to trade lower. This dislocation ended in Jan/Feb.’16 when both asset classes formed major lows. Representing a corrective decline in the S&P 500 from the May ’15 high but a far larger corrective decline in commodities that began from the peaks of 2011. When these formed major lows together, we termed this event as the Grand ‘RE-SYNCHRONISATION’ process. It triggered a simultaneous ‘BUY’ signal for both asset classes but it also brought PATTERN RE-ALIGNMENT together. See fig #2.

SP500 | Hang Seng | MSCI Emerging Markets | Singapore Straits Times – Correlation Study by WaveTrack International

Since then, prices have surged higher as the next phase of the ‘inflation-pop’ gets underway. Price trends like this do not head directly higher in a straight-line. Instead, they are dynamic in their progress unfolding with alternating corrective declining sequences along the way. The Elliott Wave methodology is equipped to identify those occasions when pockets of corrective price declines are about to begin. But overall, the major uptrends are set to continue in the years ahead.

Gail Fosler Group LLC – Oil Prices, the US Dollar, and Emerging Markets

Much of our analysis has overlapped with the findings of one of our closest allies, the Gail Fosler Group LLC. Gail is a formidable economist, twice awarded the nomination of America’s most accurate economic forecaster by the Wall Street Journal. She is the former president and trustee of The Conference Board, and is a member of The Conference Board’s Global Advisory Council.

Gail’s team of economists have recently updated their outlook in their latest ‘Global Opportunities, US Risks’ report. An excerpt ‘Oil Prices, the US Dollar, and Emerging Markets‘ is posted on their website. You can read an extract in these links. The full report is available too – just contact Gail’s team.

You’ll be amazed at how one of America’s most acclaimed economists looks at the world’s financial developments and how it dovetails into our own ‘inflation-pop’ hypothesis.

Gail’s report is ‘Vitally Important for Traders in Securities, Commodities, Investors, Bankers, Business Managers (CEO’s) and Trusts’. And with recent geopolitical risks being heightened, I think we all agree how important it is to understand how the current financial landscape is unfolding.

Yours faithfully,

Peter Goodburn, CFTe, MSTA

Managing Director & Chief Elliott Wave Strategist

WaveTrack International

Comments

Leave a Reply