The EW-Navigator

by WaveTrack International| November 23, 2020 | No Comments

U.S./European stock Indices set for Further Declines into Year-End – Underperformance in Technology – Emerging Markets to Pull Lower – Energy Stocks on Buy Signals + Eurozone Banks – US$ Dollar Heading Higher – Interest Rates Pulling Lower within Uptrend

The world is still adjusting to the uncertainties of this year’s COVID-19 pandemic. Especially, its effect on economic globalisation, second-phase lockdowns, huge rises in corporate defaults, and of course, the results of a U.S. election. Within that, risks of an uprising of popularism over mandatory vaccination and the withdrawal of civil rights are seemingly put aside as the financial world gorges on another round of central bank liquidity, driving asset prices significantly higher from the March lows. Back in 2011, the Elliott Wave Navigator report created a new term to describe the effects of a post-financial-crisis recovery, the ‘Inflation-Pop’. Almost a decade later, billionaire mavericks controlling family offices, hedge funds, and some of the world’s largest asset managers are now uttering the same words, ‘Inflation’ – ‘Inflationary’. What was it that inspired that long-range forecast back in 2011? And what effects does it hold in store for the coming decade as 2021 approaches?

This month’s report begins by taking a look at the current location of the U.S. stock markets’ price-development since last March, highlighting shorter-term risks supported by the very latest cycle analysis.

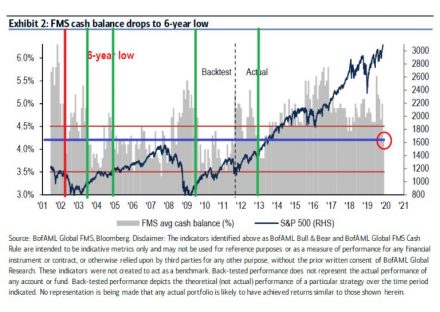

There’s good reason to forecast a 2-month correction unfolding from September’s/current highs especially when you consider just how bullish sentiment is right now, at least from a contrarian standpoint. The latest Global Fund Manager Survey from Bank of America/Merrill Lynch shows investors are in ‘full-bull’ mode as they push more funds into emerging markets, small-cap stocks, and the banking sector on hopes a COVID-19 vaccine will turn around these hard-hit market sectors.

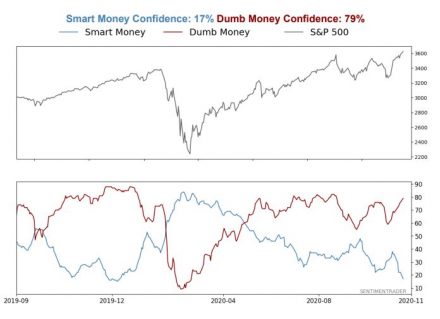

Sentiment is the most stretched since January as highlighted in the latest SentimenTrader report. The spread between ‘Smart Money’ and ‘Dumb Money’ confidence has eroded to minus -62% on their scale, one of the widest since data began recording in 1999.

Moving on, this month’s report updates the Nasdaq 100 and FANG+ index with price-directional forecasts through to year-end. Our monthly U.S. sector analysis updates the Elliott Wave pattern development of XLK-Technology, XLY-Consumer Discretionary, XLB-Materials, XLF-Financials, and two energy contracts, XLE-Energy and XOP Oil & Gas.

In recent months, since the COVID-19 pandemic lows reached last March, we’ve turned bullish in the Eurozone banks sector. The latest charts of the Eurostoxx Banks index are updated alongside short-term and medium-term price forecasts.

Major buy signals were triggered last March for Emerging Markets too, so this latest report also updates the relative position of upside progress in the MSCI EM index with some cautionary highlights for the next 2-month period.

In the Currency section of the EW-Navigator, we take a medium-term look at the US$ dollar’s pattern development and yes, it looks very bearish from the perspective of including the all-time-peak reached in year-1985. Elliott Wave analysis combined with cycle analysis bot point towards a marked depreciation of the US$ dollar over the next several years. That would certainly go a long way in triggering the next round, or phase 2 of the ‘Inflation-Pop’ cycle.

This month’s currency section focuses on the commodity currencies, the Australian dollar AUD/US$, the Canadian dollar US$/CAD, China’s Renminbi/Yuan US$/CNY, Brazilian REAL US$/BRL, Norwegian Krona US$/NOK, Russia’s Rouble US$/RUB and South Africa’s Rand US$/ZAR. These have huge upside potential over the next several years but we’re going to take a more introspective look at their shorter-term cycle mainly because Commodity markets are a little top-heavy since surging higher from the March COVID-19 lows.

Our final section on interest rates includes the latest analysis for the US10yr treasury yield, Germany’s benchmark Eurozone long-dated DE10yr yield, and a rather intriguing downside level for Italian ITY10yr yields – don’t miss this!

Comments

Leave a Reply