AUDUSD

by m.tamosauskas| August 27, 2012 | No Comments

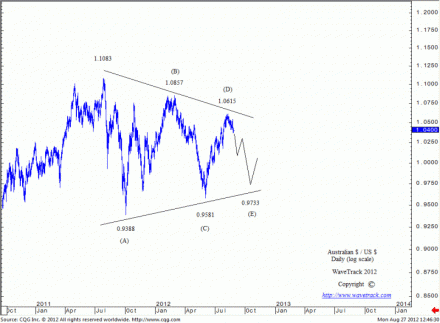

Australian $ / US $ started counter-trend decline from the July’11 high of 1.1083. It is taking the form of a triangle pattern with ultimate downside targets to 0.9733 that is scheduled to complete late 2012. A down-swing is unfolding into a triangle pattern, labeled (A)-(B)-(C)-(D)-(E) in intermediate degree. Each wave is retracing about fib. 85.4% of the preceding wave.

Intermediate wave (D) finalised at 1.0615 near 85.5% retracement level of the preceding intermediate wave (C). The final decline as wave (E) of the triangle is in early progress. It is expected it will unfold into a three wave zig zag sequence to a measured downside target of 0.9733 (fib. 85.4%). This currency pair is positively correlated to global stock indices, in that case we should expect some downward pressure for S&P 500, DAX 30 and others till intermediate wave (E) will finalise.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).

Comments

Leave a Reply