Currencies + Interest Rates Video Outlook 2021

by WaveTrack International| March 2, 2021 | No Comments

CURRENCIES and INTEREST RATES – PART III

US$ Dollar Index ends 9-Month Downtrend in January – Multi-Month Risk-Off/Safe-Haven Counter-Trend Rally Underway – Euro/US$ Hits Tops, Heading Lower in 5-6 Month Corrective Decline – Stlg/US$ Heading Lower – US$/Yen Higher with Yen Weakest in G10 – Commodity Currencies Set for 5-6 Month Corrective Declines – Asian ADXY Currencies begin Corrective Declines within Backdrop of Strengthening US$ Dollar – US10yr Treasury Yields Ending August ’20 Uptrend – Set for Multi-Month Correction – US10yr Breakeven Inflation TIPS ending Uptrend form March ’20 Lows – Reflation-Trade Unwinds over next 5-6 Months – DE10yr Yields Trending Higher but Beginning Corrective Downswing

INCLUDES ANALYSIS ON MAJOR US$ DOLLAR PAIRS/CROSSES – ASIAN/EM CURRENCIES – MEDIUM-TERM CYCLES – LONG-DATED YIELDS US/EUROPE/JAPAN + SPREADS

We’re pleased to announce the publication of WaveTrack’s annual 2021 trilogy video series of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, CURRENCIES & INTEREST RATES – Parts I & II were released during the last month – please contact us for information.

• PART I – STOCK INDICES – OUT NOW!

• PART II – COMMODITIES – OUT NOW!

• PART III – CURRENCIES & INTEREST RATES

CURRENCIES REVIEW – Highlights from Mid-Year 2020

• The US$ dollar index has resumed its 7.8-year downward cycle from March’s COVID-19 price-spike high of 102.99. Over the next several years, the dollar is forecast significantly lower as primary wave 3 gains downside momentum – forecasts towards 56.00+/-

• Shorter-term, the US$ dollar index is approaching downside targets towards 91.00+/- for the completion of an initial five wave impulse pattern from March’s 102.99 high. This combined with an extreme ‘oversold’ reading indicates a dollar counter-trend upswing will unfold for the next 2-3 months

The actual low in the US$ dollar index was 89.21, traded last January ’21. Since then, the dollar has begun a 5-6 month counter-trend rally which is forecast unfolding into a typical [a]-b]-[c] zig zag correction heading for the fib. 50% retracement area around 95.85/-. This is confirming a switch from the existing ‘Risk-On’ ‘Reflationary-Trade’ strategies to ‘Risk-Off’ ‘Reflationary-Trade Unwinding’ within a Safe-Haven period lasting into the end of Q3 2021.

Currencies – Key Drivers/Events for 2021

The US$ dollar has been declining for almost a year now, having ended a 2-year counter-trend rally peak into the March 20 COVID-19 pandemic peak of 102.99. At the core of this decline is the sheer amount of monetary and fiscal stimulus central banks and governments are willing to use to combat the effects of economic fallout due to the global coronavirus pandemic. The Federal Reserve and the new U.S. administration of Joe Biden are a good example – National Debt has surged higher to $27.86 trillion dollars – see fig #1.

Fig #1 – US National Dept – WaveTrack International – Currencies and Interest Rates Video Outlook 2021

This chart courtesy of WolfStreet.com shows exactly what’s happened since March ’20, the cut-off line at the height of the coronavirus pandemic. The rise in debt has gone exponential since then, rising by $4.55 trillion in just under 12 months. That will undoubtedly cause rising inflationary pressures going forward, weakening the US$ dollar in the process.

EW-Forecasts for 2021

If you’ve tuned-in to our annual reports before, you’ll already know that the US$ dollar index is engaged in a 7.8-year cycle downtrend that began from the Jan.’17 high of 103.82. This is labelled as primary wave 3 within an Elliott Wave impulse downtrend that began from the July ’01 high of 121.02. You can probably imagine this means the dollar is set to decline rapidly over the next several years.

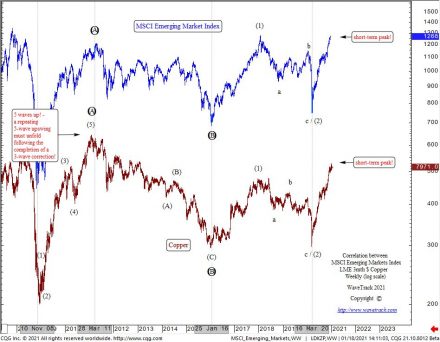

So far this year, over the past 8-weeks, the Asset Performance league table shows the US$ dollar index holding onto recent lows traded in early-January above its low of 89.21 – see fig #2. Gold features as the worst performer although that’s more to do with the fact that long-dated interest rates have been trending strongly higher. Otherwise, the star performers are commodities, the CRB index, Crude/Brent oil, Copper and to some extent, Emerging Markets. These have all continued advancing strongly in accordance to the existing ‘Risk-On’ ‘Reflationary-Trade’ strategies. But that’s about to change!

The Next 5-6 Months

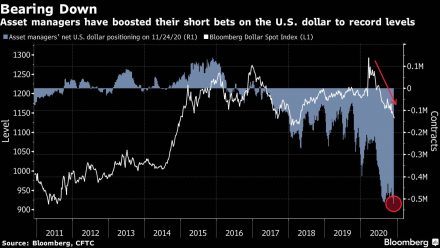

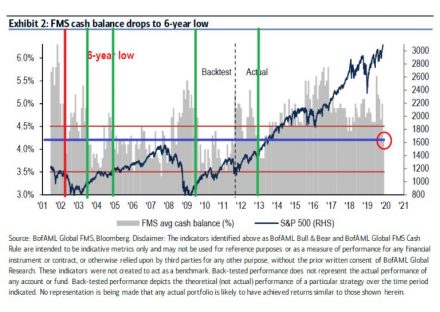

The US$ dollar remains very oversold, in fact, asset managers have increased their short-positioning to record levels in early-January – see fig #3. The numbers show in excess of -500,000 short contracts which was nowhere near levels seen back in 2011 when the dollar was actually trading a lot lower.

Furthermore, in its latest Fund Manager Survey, Bank of America/Merrill Lynch asked its fund manager clients what they considered the most crowded trades. In 3rd position was a Short-Dollar positioning with only Long Technology and Bitcoin ahead of it. That’s really something! See fig #4.

We know that such statistics can be misleading when it comes to timing imbalances that eventually lead to directional change, but sentiment data like this can be used in conjunction with Elliott Wave analysis which we can confirm shows that dollar oversold condition is about to change with significant corrective rallies already underway. The US$ dollar index is forecast up to 95.85+/- over the next 5-6 months, maybe even higher.

Ahead of this change, the best performing currency so far this year has been Stlg/US$ – see fig #5. That’s surprising when you consider this post-Brexit, but there you are! The Norwegian Krona is next in the league table, but that’s not surprising given the strength in Crude/Brent oil prices. In fact, all the commodity currencies in the G10- basket have done pretty well, especially since the March ’20 COVID-19 lows.

Latest Annual Report

The main theme for Currencies underlines the long-term downtrend of the US$ dollar within the backdrop of rising inflationary pressures but a 5-6 month period where this dissipates, where the dollar begins a counter-trend rally which means all the other dollar currency pairs with the G10 will decline into corrections during the same period.

Emerging Market currencies will decline over the next 5-6 months, as will nearly all Asian currencies we track within the ADXY basket. This report updates many currency crosses, totalling 98 charts!

Interest Rates

We know that long-dated interest rates are on the rise, capturing the headlines over recent weeks. This has caught the bond markets by surprise because of the commitment from the Federal Reserve and other central banks around the world including the ECB, Bank of Japan and Bank of China in maintaining unlimited monetary stimulus through bond purchases. But that hasn’t prevented the long-dated interest rate maturities from rising dramatically since January. The main reason is that investors are worried that reflationary pressures are exerting themselves with no end in sight.

The ‘Real Yield’ as measured in 30yr treasuries is approaching zero 0.00% per cent having spent most of the time in negative since the COVID-19 pandemic broke last year – see fig #6. It was last year’s real yield plunge which sent cash flooding into stock markets. While expensive, they looked like a good deal compared with real yields of minus -1%. But fiscal stimulus and prospects of economic reopening have lifted real 30-year Treasury yields to eight-month highs, just 11 basis points shy of 0% and that’s what’s getting investors agitated. Could yields continue to exponentially rise? We think not!

Whilst the long-term trends show a new 30+ year uptrend cycle for global interest rates, including treasury yields began from before last year’s COVID-19 pandemic lows, it is due to take a breather over the next 5-6 months. The uptrend in the US10yr treasury yield has begun from last year’s historical low of 0.378% unfolding into a typical Elliott Wave 1-2-1 formation, a preamble to a strong multi-year uptrend. But the August ’20 advance from the secondary low of 0.500% has just completed a five wave impulse pattern into the late-February high of 1.554%. It’s necessary for a counter-trend 2nd wave downswing to now unfold. This suggests a temporary unwinding of the ‘Reflation-Trade’.

In Bank of America/ML’s GFM survey, the expectations of a steeper dollar yield curve are at levels above those during the Lehman bankruptcy crisis of 2008! See fig #7. That reflects just how bearish bond holders are, and conversely, why US10yr yields are too high at the moment. A contraction in the yield curve would almost certainly translate into a correction in benchmark US10yr treasury yields for the remainder of this year.

This latest annual report also examines the benchmark German DE10yr yield alongside the US10yr-DE10yr spread and Italian and Japanese yields/trends.

New Currencies & Interest Rates 2021 Video – PART III/III

We’ve amassed over 130 charts (a new record!!) from our EW-Forecast database in this year’s Currencies & Interest Rates 2021 video. Each one provides a telling story into the way Elliott Wave price trends are developing in this next INFLATION-POP’ phase of cycle development. We’re taking a look at some very specific patterns that span the entire 15.6-year US$ dollar cycle, explaining its current location and why inflation will trigger huge US$ dollar declines but simultaneously appreciating major Emerging Market and Asian Currencies.

We’re updating some amazing Elliott Wave forecasts for U.S. interest rates, US10yr, US10yr, US05yr and even US02yr together with a schematic look at several spread relationships with European rates not forgetting upside targets for the US10yr Inflation Tips – it’s a must-see!

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get!

Contents: 130 charts | VIDEO DURATION: 2 hours 54 mins.

The contents of this CURRENCY & INTEREST RATES VIDEO include Elliott Wave analysis for:

Currencies (100 charts):

• US$ Index + Cycles

• Euro/US$ + Cycles

• Stlg/US$

• US$/Yen

• US$/CHF

• US$/NOK

• US$/SEK

• AUD/US$

• US$/CAD

• NZD/US$

• Euro/Stlg

• Euro/CHF

• Euro/NOK

• Euro/Yen

• Euro/AUD

• Euro/CNY

• Stlg/YEN

• Stlg/CHF

• Stlg/NOK

• Stlg/ZAR

• Stlg/AUD

• AUD/NOK

• CAD/NOK

• AUD/CAD

• AUD/NZD

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• US$/TRY

• US$/PLZ

• Bitcoin

Interest Rates (30 charts):

• US30yr Yield + Cycles

• US10yr Yield + Cycles

• US5yr Yield

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• 3mth EuroDollar-US10yr Yield Spread

• Comparison US10-DE10yr vs S&P 500

• US10yr TIPS Break Even Inflation Rate

• US10-DE10yr Yield Spread

• DE10yr Yield

• ITY10yr Yield

• JPY10yr Yield

>How to buy the Currencies + Interest Rates Video Outlook 2021

Simply contact us @ services@wavetrack.com to buy the CURRENCIES + INTEREST RATES Video Outlook 2021 for USD 48.00 (+ VAT where applicable) or alternatively our Triple Video Offer for USD 96.00 (+ VAT where applicable) – Review the content of WaveTrack Stock Indices Video PART I here and the Commodities Video PART II here.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Ending-Diagonal Patterns as Last Sequence within Secular-Bull?

by WaveTrack International| February 17, 2021 | No Comments

Ending-Diagonal Patterns as Last Sequence within Secular-Bull / Inflation-Pop Cycle Uptrends

Fig #8 – Nikkei 225 Index – Weekly by WaveTrack International more deteails published in the Elliott Wave-Compass Report www.wavetrack.com

Ending-Diagonal Patterns as Last Sequence within Secular-Bull/Inflation-Pop Cycle Uptrends – read more in today’s Elliott Wave Compass report!

Tags: Ending-Diagonal Elliott Wave Pattern

Zig Zag Rallies from March ’20 COVID-19 Lows

by WaveTrack International| February 12, 2021 | No Comments

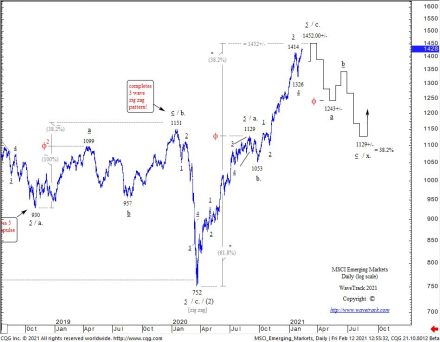

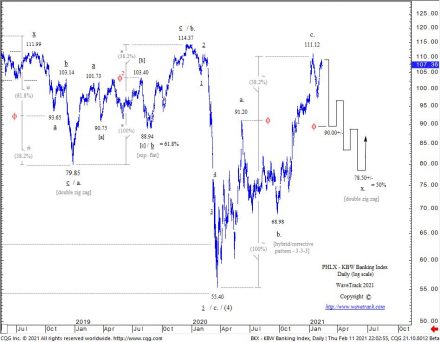

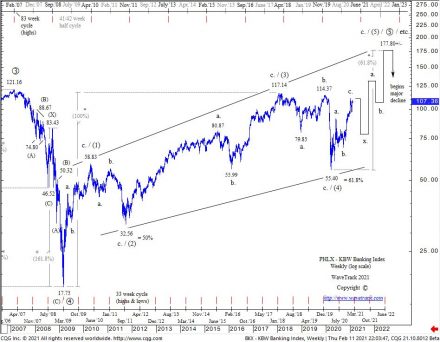

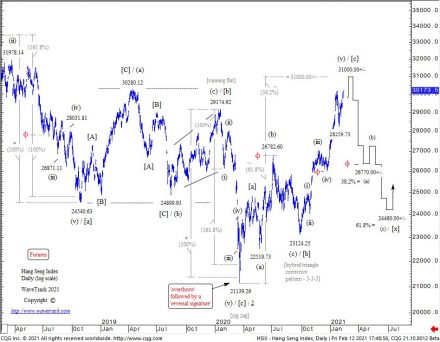

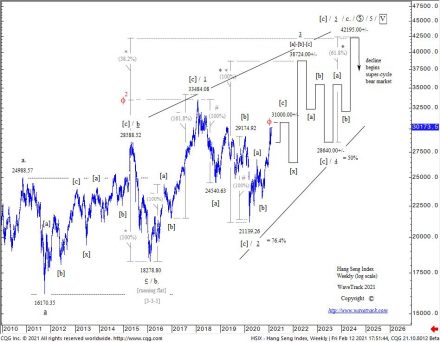

MSCI Emerging Market Index – Hang Seng – KBW Banking Index

Zig Zag Rallies from March ’20 COVID-19 Lows – read more in today’s Elliott Wave Compass report!

COMMODITY Video Outlook 2021 | Part II

by WaveTrack International| January 22, 2021 | No Comments

‘FINAL STAGE of the COMMODITY ‘INFLATION-POP UPTREND’

THIS REPORT INCLUDES ANALYSIS ON MEDIUM-TERM CYCLES & EQUITY MINERS

We’re pleased to announce the publication of WaveTrack’s annual 2021 video updates of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART II, COMMODITY VIDEO OUTLOOK 2021 – Part I was released last month and Part III will be published in early-February.

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Commodity Elliott Wave Forecasts 2021 – Summary

• The Commodity Super-Cycle began from the Great Depression lows of year-1932, typically unfolding over the next 76-year period into an Elliott Wave impulse pattern ending in year-2008. Since then, a two-decade long corrective downswing has begun a new deflationary era but with pockets of rising inflationary pressures.

• Rising inflationary pressures began after the financial-crisis of 2007-09. The next stage resumed in early 2016, took a pause in 2018-2020 and is now set to surge higher through 2023/24 – this is the final stage of the ‘Inflation-Pop’ uptrend/cycle.

• Commodities have undergone extreme sell-offs during the COVID-19 panic that lasted through the first-quarter of 2020. Last January’s report cited a ‘Q1 Sell-Off’ prior to a major recovery. And that’s exactly what’s happened! All commodity sectors were hit hard, Base Metals, Precious Metals & Energy but especially Crude/Brent oil. Since then, major recoveries have begun and these are seen lasting into the next cycle peaks due in 2023/24.

• The US$ dollar resumed its 7.8-year cycle downtrend in March ‘20. An Elliott Wave 3rd-of-3rd wave is set to accelerate lower over the next several years. This becomes one of the main drivers that pushes commodity prices sharply higher.

• Shorter-term, commodity price advances from the March ’20 COVID-19 pandemic lows are approaching interim peaks having unfolded higher into five wave impulse patterns. A multi-month corrective downswing is forecast through Q1 and part of Q2 ’21 coinciding with a counter-trend rally/advance in the US$ dollar – begins a risk-off period.

• Base Metals Copper, Aluminum, Lead and Zinc have all trended higher from their March ’20 COVID-19 pandemic lows into five wave impulse patterns that are only now approaching completion. A multi-month correction is set to begin, pulling prices lower for several months.

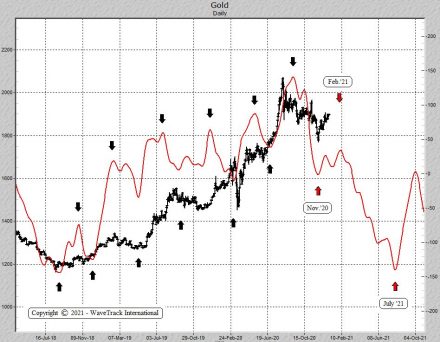

• Precious Metals Gold and Silver both ended 3rd wave peaks last August ’20 and have since been engaged in multi-month counter-trend 4th wave declines. The price-extremities are lower for gold but already reached for silver. Gold is forecast lower into July ’21 basis its composite cycle. Platinum is expected to outperform gold but is also engaged in a counter-trend decline from its Jan.’21 high.

• Energy Price advances from the April ’20 lows for both Crude/Brent oil have unfolded into three wave A-B-C zig zag formations, ending right now, into January ’21 highs. A multi-month risk-off decline is forecast through to mid-year where prices retrace fib. 38.2% to max. 50% of the preceding advance from the COVID-19 pandemic lows. Thereafter, surging higher again through to 2023-24 as the final stage of the ‘Inflation-Pop’ uptrend/cycle.

Risk-Off Correction Beginning Q1 – ‘Inflation-Pop’ Uptrends Resume Q3

Commodities have surged higher over the past 10-month period having collapsed into important lows last year during the March ’20 COVID-19 pandemic. These advances represent the ‘Final Stage of the Inflation-Pop Uptrend’ which is poised to accelerate commodity prices significantly higher over the next several years.

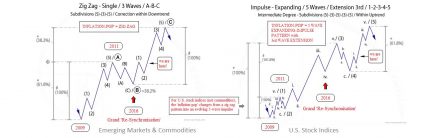

The Elliott Wave pattern rhythm of Commodity price rises from the ‘Inflation-Pop’ lows of 2007-09. This is archetypically different to the same advance unfolding in global stock indices from the financial-crisis lows – see fig #1. This is often misunderstood. Yet, it can be explained from observing the historical long-term trends of both, from the Great Depression lows of 1932.

When these two asset classes began long-term uptrends from 1932, they both unfolded into cycle degree five wave impulse patterns. This commodity super-cycle actually ended its five wave structure in year-2008. However, U.S. stock markets have continued their equivalent pattern higher. The financial-crisis sell-off into the late-2008/early-2009 lows triggered the beginning of a multi-decennial A-B-C expanding flat pattern for commodities, ending cycle wave A but this low was simply a 4th wave correction for stock markets. The next advance for commodities represents cycle wave B, itself a primary degree A-B-C zig zag (see tutorial chart) pattern destined for new record highs. Meanwhile, the same period for U.S. stock indices began a 5th wave which must ultimately subdivide into a five wave impulse pattern. Most importantly, these two differing Elliott Wave patterns have been unfolding ever since.

Positive Correlation

Their positive-correlation remained in sync during the initial ‘Inflation-Pop’ advance from 2009 to 2011 but then it broke-down for five years. It was necessary because commodity prices had to begin a corrective downswing as primary wave B. But for U.S. stock indices, they were simultaneously engaged in accelerative third-wave advances within the larger 5th wave uptrend. This disparity was eventually reconciled when both declined into formative lows in late-2015/early-2016. At the time, we described this event as the grand ‘Re-Synchronisation’.

Final Stage of the Inflation-Pop Uptrend

Since then, commodity prices, especially Base Metals and their corresponding Mining Stocks have traded higher in huge multiple gains. And those uptrends are still engaged to the upside. There was another sub-sector disparity which has subsequently been realigned when Energy contracts like Crude Oil and Brent oil collapsed last year, into the April ’20 COVID-19 lows. But advances in both underlying Base Metals and Energy contracts have since entered the Final Stage of the Inflation-Pop Uptrend’ which is poised to accelerate prices significantly higher over the next several years. So what is triggering these events?

Monetary & Fiscal Stimulus

Central banks have responded to the COVID-19 pandemic by significantly increase money supply – see fig #2.

The U.S. Federal Reserve alone has increased M1 money supply so much the figures saw an increase of $2.2 trillion dollars, a sudden jolt to existing debt representing a 56% per cent increase. With so much money sloshing around, its no wonder that asset prices are rising across-the-board.

Commodity Outlook 2021 and the US$ Dollar Outlook

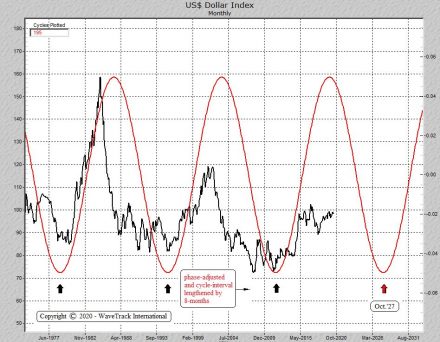

One contributor that’s expected to drive asset values significantly higher over the next few years is a weakening US$ dollar – see fig #3. There’s a distinct 15.6-year cycle recurrence for the US$ dollar index which has signalled the various peaks and troughs over the past several decades. In this updated cycle, the length of the interval has been increased to 16.25 years in order to align the cycle-troughs of the late-1970’s, mid-1990’s, early-2010’s into the next major lows of 2027.

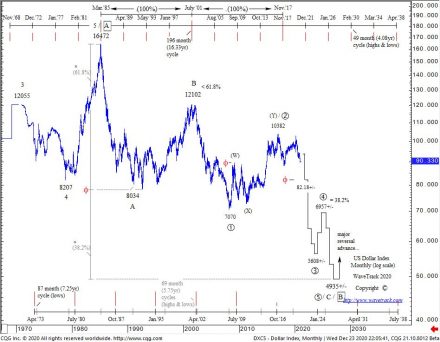

Such US$ dollar declines are shown unfolding as the final sequence of the dollar index’s cycle degree A-B-C downswing that began from all-time-highs of 164.72 that peaked back in February 1985 – see fig #4. Looking ahead over the next several years, we expect the dollar to decline rapidly. To be exact, around -45% per cent fuelling the final stage of the commodity inflation-pop. Downside targets are towards 56.08+/- and ultimately 49.34+/-.

Risk-Off Correction Beginning Q1 2021

Before commodity prices resume their inflation-pop uptrend, there’s going to be a risk-off correction beginning Q1 ’21 lasting though to mid-year. What triggers this? Most probably, a US$ dollar counter-trend rally!

Asset managers have a net U.S. dollar positioning at extreme record lows – see fig #5. That alone suggests the dollar index will soon begin a multi-month counter-trend rally. But does this corroborate with Elliott Wave and cycle analysis? Yes, the daily composite cycle is forming an important low right now, into January 2021 – see fig #6. Moreover, from an EW perspective, the index’s decline from the March ’20 COVID-19 peak of 102.99 is ending a five wave impulse pattern at January’s low of 89.21. This confirms a dollar risk-off/safe-haven phase has begun, lasting through to mid-year, maybe longer? That would certainly cause commodity prices to undergo significant corrective declines.

We can’t always know what fundamentals trigger such events, but a good guess is another downturn in global economic activity as COVID-19 second-phase lockdowns continue for another few months.

Commodity Deflation/Inflation

Another indication of risk-off during the next several months comes from interpreting Bank of America’s deflation/inflation data as a ‘contrarian’ indicator – see fig #7. Bank of America lists inflation assets as commodities, real estate, Treasury inflation-protected securities (TIPS), U.S. banks and value stocks. Deflation assets include government bonds, corporate bonds, the S&P 500, and growth stocks.

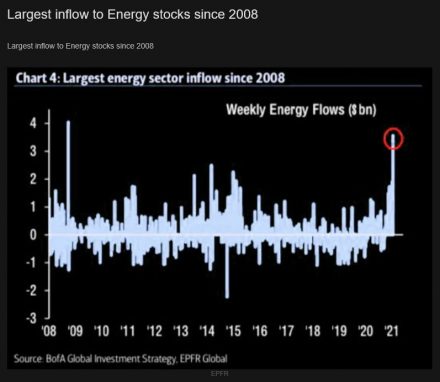

They report that inflation assets are outperforming deflation assets by the most since 2006 and that’s a direct result of large asset managers believing the central bank and fiscal stimulus narrative and consequently buying undervalued assets. This really began last August/September ’20 – up until then, asset managers were expecting a double-dip recession but they quickly changed tack afterwards and have since binged on buying these inflationary assets, particularly commodities and emerging markets – see fig #8. Just last week saw the second-largest inflow to energy stocks, the third-largest inflow to Treasury inflation-protected securities, sixth-largest inflow to emerging markets, and the largest inflows to bank loans in nearly four years, according to the Bank of America data. Municipal bonds, which are exempt from federal and most state taxes, saw record inflows.

And to a point that now looks like an extreme – from a contrarian standpoint, a ripe environment for a correction to begin in 2021!!

Commodities – Copper, Gold & Energy

Copper prices have advanced from their March ’20 COVID-19 lows to begin the final stage of the ‘Inflation-Pop’ uptrend/cycle. Elliott Wave analysis forecasts new record highs over the next several years leading into the expected peak around 2023-24. But shorter-term, a correction lasting for the next several months is about to get underway in response to finishing a five wave impulse uptrend.

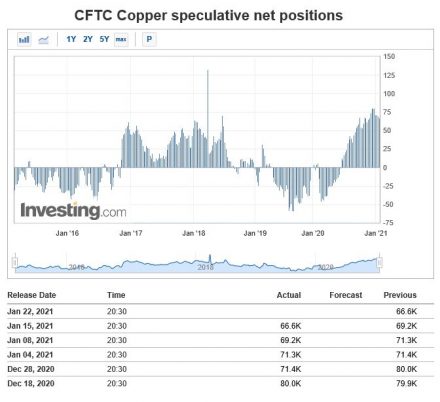

The latest CFTC data shows frothy net speculative long positioning at 66,600 contracts, historically high – see fig #9. That’s down from 80,000 late-December but still well above 5-year highs, an early-warning that prices are a little top-heavy.

US 10yr Tips

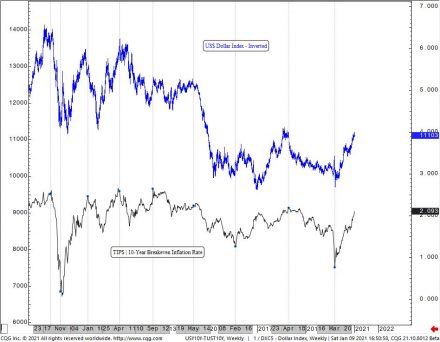

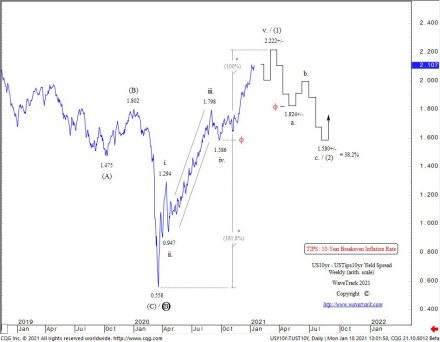

The US10yr breakeven inflation rate yield is also looking stretched to the upside – see fig’s #10 & #11.

Note the inverted correlation with the US$ dollar index which is already showing signs of beginning a multi-month upside risk-off correction. And from an Elliott Wave perspective, it has trended higher from the March ’20 COVID-19 lows of 0.558 into a five wave impulse pattern that is close to upside completion. A multi-month correction is about to begin, lasting several months before resuming its larger inflationary uptrend.

Gold

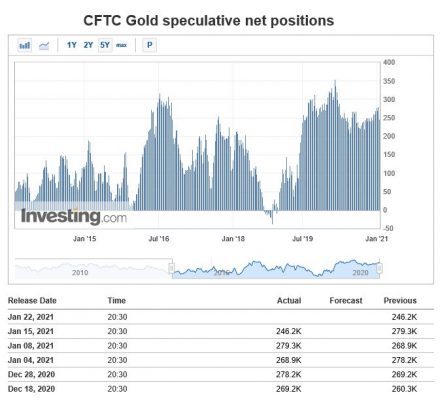

Gold is an interesting commodity which attracted huge bullish interest last July/August. Although bullion prices traded up to new record highs last August, to 2072.12, prices have since begun counter-trend corrections. The latest CFTC shows how that peak coincided with peaks in net speculative long positioning although below record highs – see fig #12. Our cycle analysis also points towards more price declines through to July ’21 – see fig #13. And from an Elliott Wave perspective, gold is heading lower as wave (A) within a 4th wave correction but itself part of a five wave impulse uptrend that began from the Dec.’15 lows. That could keep gold range-trading for some time.

Energy

In the energy sector, we’ve updated Crude/Brent oil showing how last year’s major declines ended super-cycle wave A from the all-time-highs of July ’08. Wave A is the first sequence in a very long-term triangle pattern where wave B is currently engaged in an ‘Inflation-Pop’ rally. However, we don’t expect wave B to reach new record highs because it’s showing early signs that it’s developing higher into a double zig zag pattern where the first cycle degree A-B-C zig zag is ending right now – so watch out for a multi-month correction!

A correction seems possible when we look at the latest Bank of America survey – see fig #14. This shows the largest inflow into energy stocks since 2008 – okay that’s not the underlying commodity but the positive-correlation remains constant.

New Commodity 2021 Video – PART II/III

We’ve amassed over 90 commodity charts from our EW-Forecast database in this year’s Commodities 2021 video!! Each one provides a telling story into the way Elliott Wave price trends are developing in this next ‘INFLATION-POP’ phase of cycle development. We’re taking a look at some very specific patterns that span the entire SUPER-CYCLE, explaining why the super-cycle began from the GREAT DEPRESSION lows of 1932 and not from the lows of 1999 and how this ended in 2006-2008 and why the multi-decennial corrective downswing that began soon afterwards is taking the form of a very specific, but identifiable Elliott Wave pattern.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Commodities Video Part II

Contents: 92 charts

Time: 2 hours 25 mins.

• CRB-Cash index + Cycles

• US Dollar index + Cycles

• DB Agriculture Fund

• Copper + Cycles

• Aluminium

• Lead

• Zinc

• Nickel

• Tin

• XME Metals & Mining Index

• BHP-Billiton

• Antofagasta

• Anglo American

• Kazakhmys Copper

• Glencore

• Rio Tinto

• Teck Resources

• Vale

• Silver/Copper Correlation Study

• Gold + Cycles

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• Silver + Cycles

• XAU Gold/Silver Index

• Platinum

• Palladium

• Crude Oil + Cycles

• Brent Oil

• XOP Oil and Gas Index

• Natural Gas

How to buy the Commodity Video Outlook 2021

Simply contact us @ services@wavetrack.com to buy the COMMODITY Video Outlook 2021 for USD 48.00 (+ VAT where applicable) or alternatively our Triple Video Offer for USD 96.00 (+ VAT where applicable) – Review the content of WaveTrack Stock Indices Video PART I here. The last part of our Triple Video Series for Currencies and Interest Rates will be available approx. February/March 2021.

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Stock Index Video Outlook – 2021 | PART I/III

by WaveTrack International| December 28, 2020 | No Comments

STOCK INDEX VIDEO OUTLOOK –

‘FINAL STAGE of the SECULAR-BULL UPTREND’

This report combines ELLIOTT WAVE with updated SENTIMENT & ECONOMIC INDICATOR STUDIES

We’re pleased to announce the publication of WaveTrack’s Annual 2021 video updates of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART I, STOCK INDEX VIDEO – Parts II & III will be published during January/February.

• PART I – STOCK INDICES

• PART II – COMMODITIES

• PART III – CURRENCIES & INTEREST RATES

Elliott Wave Stock Index Forecasts for 2021 – Summary

Fiscal & Monetary Stimulus Rescue

In last June’s mid-year report, COVID-19 Aftermath II – Secular-Bull Market Uptrend Resumes! we discussed how stock markets had collapsed, then staged a massive ‘V’-Shaped recovery. Whilst economists were still scratching their heads about the dislocation between the economic fall-out of a COVID-19 pandemic and exponential rises in stock markets, insiders were buying the markets basis one simple fact – central banks and governments around the world were embarking upon a historic, unprecedented path of fiscal and monetary stimulus as never seen before . And that means prices must rise! – and they did!

Global Fund Manager Survey

It was months later that Bank of America/Merrill Lynch’s Global Fund Manager Survey showed a sudden improvement in sentiment. Up until then, fund managers were still debating whether a recovery had begun at all! The majority said the rally was a brief one, with COVID-19 being the drag going forward. It wasn’t until after the northern-hemisphere annual summer holidays ended in mid-September that the realisation of a more sustained economic recovery began to filter into the mindset. By that time, the benchmark S&P 500 was higher by +64% per cent. Since then, a downswing followed by an upswing has taken the S&P 500 to a new record high. But even at today’s levels of 3733.00, that’s only +4% per cent gain since early-September. And yet more funds have been allocated into the markets over the last few months than at any other time since March.

From an Elliott Wave perspective, you’d think that such an event as the COVID-19 pandemic would be a trigger for a secular bear market to begin. It’s certainly reverberated through many different economic statistics. A good example is the gyrational swings in the U.S. GDP (Gross Domestic Product) figures – see fig’s #1 & #2. Before COVID-19, annual GDP growth was around 2.10% per cent. And when the coronavirus struck and governments went into lock down mode, GDP collapsed to a low of minus -31.4% per cent, only to rebound later to +33.1% in the Q3 reporting. As you can see, these two swings are unprecedented. Even as far back as the 1940’s when the historical data began – crazy!

Fiscal and Monetary Stimulus

More impressive is the way central banks and governments have stepped in with an estimated $19.5 trillion dollars of fiscal and monetary stimulus in an attempt to shield their economies from the coronavirus pandemic. Record sums that take balance sheets and deficits to peacetime record highs. The sum equates to about 17% of an $87 trillion global economy. Leading the top-10 list is the United States with over $2.5 trillion pledged – see fig #3. Europe has since announced a new €1.5 trillion Euro-denominated package although spanning the next several years.

U.S. M1 money supply has risen exponentially since March, growing by $2.2trn – see fig #4. As Elliott Wave analysts, whenever we see exponential rises like this, it almost always confirms the final sequence within a longer-term uptrend. Just like this one that began from the lowly-lows of the 1970’s. The trick is predicting how far and for how long it continues to rise before forming a major peak, then declining just as quickly in the subsequent years to form that all-so-familiar parabolic bell-shaped curve.

I think we have a pretty good idea of what conditions will end the current asset price rise and an indication of when that peak occurs.

Dow Jones On-Course for Long-Term 40,000-42,000 Upside Targets

Back in November/December 2014, six years ago, the Dow was trading at 17817.00, approaching original upside targets forecast back in 2010. But this secular-bull peak wasn’t aligned to the completion of corresponding ‘Inflation-Pop’ upside targets for Emerging Market indices and key Commodities like Copper and Crude Oil.

This was a big hint that the secular-bull uptrend in the Dow Jones (DJIA) and other developed market indices were far from complete. Further analysis revealed some amazing Fibonacci-Price-Ratio (FPR) ‘proportion’ values across the entire history of its major five wave impulse uptrend dating back to the Great Depression lows of 1932 – see fig #5. They coalesced towards Dow 40,000-42,000!

The secular-bull uptrend was labelled unfolding into a cycle degree pattern, 1-2-3-4-5. Extending waves 1-4 by a fib. 161.8% ratio projected ultimate upside targets for wave 5 towards 41116.70+/-,

1 (40.50) – 4 (570.00) x 161.8% = 5 @ 41116.70

Furthermore, subdividing cycle wave 5 into primary degree, 1-2-3-4-5, a fib-price-ratio convergence forms at 41982.10+/- where primary wave 5 unfolds by a fib. 61.8% correlative ratio of waves 1-3,

1 (570.00) – 3 (11750.30) x 61.8% = 5 @ 41982.10

Subdividing primary wave 5 into intermediate degree, (1)-(2)-(3)-(4)-(5) also provides ultimate upside targets for wave (5) towards 39207.00+/- derived by extending wave (1) by a fib. 161.8% ratio,

(1) [6470.00-12391.30] x 161.8% = (5) @ 39207.00

These three upside targets average out at 40768.60+/-

And so, proportionally, symmetrically and harmonically, Dow 40-42k remains to this day, a very realistic probability of being reached before the secular-bull uptrend is completed.

Timing the ‘Inflation-Pop’ Peak

Cycle analysis has since shown a 94-year cycle peak due in late-2023/early-2024 that has our attention in providing the timing for the ‘Inflation-Pop’ bubble-burst. See June’s report or this new, updated PART I STOCK INDICES annual report/video.

US$ Dollar Outlook

One contributor that’s expected to drive asset values significantly higher over the few years is a weakening US$ dollar – see fig #6.

There’s a distinct 15.6-year cycle recurrence for the US$ dollar index which has signalled the various peaks and troughs over the past several decades. However, in our original cycle analysis, the 15.6-year model showed the dollar’s decline into its next ‘trough’ due in 2023/24. But we wonder if there’s enough time for a -45% decline basis our Elliott Wave analysis where cycle wave C declines bottom around 49.35+/– see fig #7?

It’s possible to lengthen the cycle interval to 16.25 years, which connects the cycle-troughs together in a more synchronous rhythm. That would stretch the next cycle-trough into Oct.’27. That would allow more time for the dollar’s decline to test 49.35+/-. It might also lengthen the stock market secular-bull uptrend too?

Shorter-Term – Risk-Off During Q1 ‘21

Shorter-term analysis suggests the post-COVID-19 risk-on advances in global stock markets and commodities is about to take a rest. One hint comes from the oversold condition in the US$ dollar – see fig #8. In this chart from Bloomberg, asset managers are shown with huge net-short positioning, at record levels. That will almost certainly trigger a relief rally in the dollar soon, indicating the stock market will undergo a severe correction during Q1 2021, contrary to consensus opinion.

The US$ dollar index is approaching the downside completion of a five wave impulse pattern from March’s COVID-19 peak of 102.99 where downside targets already being tested at 89.73 but potentially extending to 88.21+/- prior to a sustained counter-trend, multi-month advance – see fig #9. This would suggest a period of risk-off during Q1 ’21.

Stock Index and Sentiment

Citigroup’s Market Sentiment index is confirming the same risk-off period is about to begin across New Year – see fig #10. It advanced to a fresh record high at 1.65 vs 1.61 last week and 1.10 in the week prior. Anything above .40 is considered euphoric and from a contrarian perspective, is screaming out for a stock market correction.

Earlier last month, Bank of America/Merrill Lynch’s GFM survey showed investor optimism had sky-rocketed over the past months, since September, where levels are at 46% per cent whilst hedge funds’ equity exposure remains high at 41% per cent – see fig #11.

S&P 500 – Short-Term Correction Q1 ‘21

The S&P 500’s advance from the March COVID-19 low of 2174.00 has unfolded into a five wave impulse pattern, labelled minor wave i. one within intermediate wave (5)’s ongoing uptrend. Subdividing into minute degree, 1-2-3-4-5, wave 5 completed into the early-September high of 3587.00. This was slightly higher than upside targets of 3511.00+/- and just below 3595.00+/- derived by extending wave 1 by a fib. 161.8% ratio – see fig #12.

Minor wave ii. two’s correction is already underway, unfolding into a three wave a-b-c expanding flat pattern. This allows a modest higher-high in the second sequence prior to a third wave decline. This explains why the S&P has since traded up to 3733.00. Applying Elliott’s guideline that corrections fall back towards ‘fourth wave preceding degree’, minimum downside targets are towards the area of minute wave 4’s low of 2923.75. That translates into a heft decline of around -20% per cent during Q1 ’21, very much against the consensus view.

European Indices / Emerging Markets + Asia – Australia – Japan

An important aspect related to the next surge higher is the Elliott Wave pattern development of European and Asian indices. These have very different patterns in upside progress from the financial-crisis lows of 2008/09. But they do conform to the ‘Inflation-Pop’ schematic of zig zags or double zig zag advances over multiple decade periods.

If you’re an asset manager located in Europe or Asia, it’s imperative to understand how these benchmark indices fit into the larger U.S. picture! This latest annual 2021 report takes an in-depth look at the price-projections for the MSCI EM index plus many more EM and ASIAN indices.

Annual 2021 Outlook – Report/Video

Our annual 2021 Stock Index report/video is PART I of a three-part trilogy series of Elliott Wave analysis and the outlook into the final stages of the secular-bull ‘Inflation-Pop’ cycle.

We’ll be taking a close introspective look across many U.S. indices, the large-cap and small-cap trends, but also across many different sectors too including the FANGS+ index, U.S./European Banks, Biotechnology, Technology and many more – we’re also updating some fascinating Elliott Wave counts for several economic data points too, including Consumer Sentiment, Consumer Confidence, Price to Book Ratio, Price-Sales Ratio! It all adds-up to one thing – huge gains over the next few years!

New Stock Index 2021 Video – PART I/III

This ANNUAL 2021 VIDEO UPDATE for STOCK INDICES is like nothing you’ve seen anywhere else in the world – it’s unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Cycles, Sentiment extremes and Economic data trends.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Contents Stock Index Video Outlook 2021

Charts: 84 | Video: 1 hour 59 mins.

Read more «Stock Index Video Outlook – 2021 | PART I/III»

The EW-Navigator

by WaveTrack International| November 23, 2020 | No Comments

U.S./European stock Indices set for Further Declines into Year-End – Underperformance in Technology – Emerging Markets to Pull Lower – Energy Stocks on Buy Signals + Eurozone Banks – US$ Dollar Heading Higher – Interest Rates Pulling Lower within Uptrend

The world is still adjusting to the uncertainties of this year’s COVID-19 pandemic. Especially, its effect on economic globalisation, second-phase lockdowns, huge rises in corporate defaults, and of course, the results of a U.S. election. Within that, risks of an uprising of popularism over mandatory vaccination and the withdrawal of civil rights are seemingly put aside as the financial world gorges on another round of central bank liquidity, driving asset prices significantly higher from the March lows. Back in 2011, the Elliott Wave Navigator report created a new term to describe the effects of a post-financial-crisis recovery, the ‘Inflation-Pop’. Almost a decade later, billionaire mavericks controlling family offices, hedge funds, and some of the world’s largest asset managers are now uttering the same words, ‘Inflation’ – ‘Inflationary’. What was it that inspired that long-range forecast back in 2011? And what effects does it hold in store for the coming decade as 2021 approaches?

This month’s report begins by taking a look at the current location of the U.S. stock markets’ price-development since last March, highlighting shorter-term risks supported by the very latest cycle analysis.

There’s good reason to forecast a 2-month correction unfolding from September’s/current highs especially when you consider just how bullish sentiment is right now, at least from a contrarian standpoint. The latest Global Fund Manager Survey from Bank of America/Merrill Lynch shows investors are in ‘full-bull’ mode as they push more funds into emerging markets, small-cap stocks, and the banking sector on hopes a COVID-19 vaccine will turn around these hard-hit market sectors.

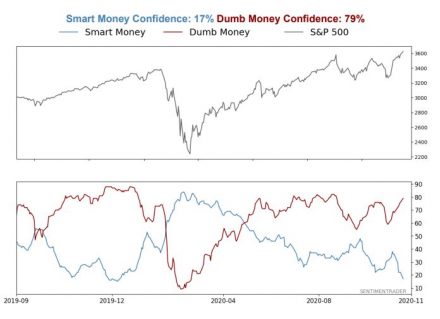

Sentiment is the most stretched since January as highlighted in the latest SentimenTrader report. The spread between ‘Smart Money’ and ‘Dumb Money’ confidence has eroded to minus -62% on their scale, one of the widest since data began recording in 1999.

Moving on, this month’s report updates the Nasdaq 100 and FANG+ index with price-directional forecasts through to year-end. Our monthly U.S. sector analysis updates the Elliott Wave pattern development of XLK-Technology, XLY-Consumer Discretionary, XLB-Materials, XLF-Financials, and two energy contracts, XLE-Energy and XOP Oil & Gas.

In recent months, since the COVID-19 pandemic lows reached last March, we’ve turned bullish in the Eurozone banks sector. The latest charts of the Eurostoxx Banks index are updated alongside short-term and medium-term price forecasts.

Major buy signals were triggered last March for Emerging Markets too, so this latest report also updates the relative position of upside progress in the MSCI EM index with some cautionary highlights for the next 2-month period.

In the Currency section of the EW-Navigator, we take a medium-term look at the US$ dollar’s pattern development and yes, it looks very bearish from the perspective of including the all-time-peak reached in year-1985. Elliott Wave analysis combined with cycle analysis bot point towards a marked depreciation of the US$ dollar over the next several years. That would certainly go a long way in triggering the next round, or phase 2 of the ‘Inflation-Pop’ cycle.

This month’s currency section focuses on the commodity currencies, the Australian dollar AUD/US$, the Canadian dollar US$/CAD, China’s Renminbi/Yuan US$/CNY, Brazilian REAL US$/BRL, Norwegian Krona US$/NOK, Russia’s Rouble US$/RUB and South Africa’s Rand US$/ZAR. These have huge upside potential over the next several years but we’re going to take a more introspective look at their shorter-term cycle mainly because Commodity markets are a little top-heavy since surging higher from the March COVID-19 lows.

Our final section on interest rates includes the latest analysis for the US10yr treasury yield, Germany’s benchmark Eurozone long-dated DE10yr yield, and a rather intriguing downside level for Italian ITY10yr yields – don’t miss this!

FOREX and BONDS Video PART III/III

by WaveTrack International| August 11, 2020 | No Comments

FOREX and BONDS Mid-Year Video Update PART III/III

US$ Dollar Completed 2nd Wave Peak Last March during COVID-19 Panic. 7.8-Year Cycle Downtrend has Resumed. Shorter-Term Rally in Dollar Over Next Few Months. Commodity Currencies Signalling Major Reversal Last March & Now Heading Higher. Asian Currencies Formed Major Lows. U.S. Long-Dated Interest Rates ended Deflationary Cycle Last March. Rising Trends Although Curve Control Expected. European Interest Rates Trending Higher From COVID-19 Lows

INCLUDES ANALYSIS ON MAJOR US$ DOLLAR PAIRS/CROSSES – ASIAN/EM CURRENCIES – MEDIUM-TERM CYCLES – LONG-DATED YIELDS US/EUROPE/JAPAN + SPREADS

We’re pleased to announce the publication of WaveTrack’s annual 2020 trilogy video series of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART III, FOREX & BONDS – Parts I & II were released during the last month – please contact us for information.

• PART I – STOCK INDICES – OUT NOW!

• PART II – COMMODITIES – OUT NOW!

• PART III – FOREX & BONDS – OUT NOW!

Forex Review – H1 2020

If you remember our January/February’s annual PART III EW-Forecast Report/Video began by forecasting the US$ dollar index approaching a major corrective high. Trading up from 98.69 finalising at 100.54+-/-, max. 102.79+/-. This was the finalising sequence of a 2-year counter-trend a-b-c zig zag rally that originated from the Feb.’18 low of 88.26. It was expected to be a landmark event. Mainly, because it had consumed an unusually long period of time within the more dominant 7.8-year downtrending cycle that began dollar descent from the higher Jan.’17 peak of 103.82.

The coronavirus pandemic was at its peak in China. However, it hadn’t yet crossed over into the consciousness of the West. But as the weeks passed, the COVID-19 pandemic spread across continental Europe and later the U.S. with devastating effect with global stock markets collapsing and their economies with it. The US$ dollar index staged a sharp decline into an early-March low of 94.65. Initially, this triggered thoughts that upside targets have been slightly short, with the dominant downtrend already in progress. Nevertheless, this was a prelude to a sudden and sharp dollar advance to 102.99 as investors sought safe-havens amidst short-term dollar funding shortages.

Ironically, the March high at 102.99 was only 20 pips above January/February’s original upside targets. But this test came and went in the most unexpected way.

The dollar’s subsequent decline from the March high has since triggered the beginning of a new multi-year downtrend. This is evident across most dollar currency pairs. With many Commodity Currencies bottoming in March, the stage is set for some impressive renaissance gains over the next several years.

Forex and Bonds – Key Drivers & Sentiment for H2 2020

The key drivers for the remainder of this year are much the same, the influence from Chinese technology firms and its growing geopolitical influence, Eurozone debt, growing populism, trade wars, a second-wave of COVID-19 and the failure of global fiscal stimulus. But there’s also a risk in the West of a push-back against mandatory vaccination, tracking/travel restrictions and all coming ahead of November’s U.S. Presidential elections. Despite lowered expectations of rising inflationary pressures since COVID-19, there’s a growing concern of a repeat of the 1970’s ‘Inflation-Pop’.

Any one of these events could send investors rushing to buy safe-haven dollars. However, from an Elliott Wave perspective, the medium and longer-term trends remain firmly downward, looking ahead over the next several years.

Global Fund Manger Surveys

In its latest Global Fund Manager Survey, analysts at Bank of America/Merrill-Lynch have reported from its survey of investors that 44% per cent expect a U-shaped recovery following the economic fallout from COVID-19 – 30% per cent expect it to be a W-shaped recovery whilst only 14% per cent expect a V-shaped recovery – see fig #1. Obviously, 12% per cent didn’t respond, but there are clearly differences in the way economies are heading over the rest of this year.

In the same survey, when asked how the economy is expected to develop over the next twelve months, the response showed 72% expected stronger growth. This is the highest level since January 2014. Whilst 36% expected economies to get a lot stronger which was the highest figure recorded in the data that began in Oct.’94 – see fig #2.

Our Elliott Wave interpretation of this suggests the post-COVID-19 economic recovery is now reaching an interim peak. And will likely take a rest period, undergoing a counter-trend correction during the coming months. That translates into a correction in the stock market. Mainly, an upside correction for the dollar, and a period of risk-off/safe-haven strategies.

Forex EW-Forecasts H2 2020

Whilst the US$ dollar remains on a downward trajectory over the medium-term, that is, over the next several years, the outlook is becoming more bullish over the shorter-term, spanning the next few months.

A five wave impulse downswing is visible in the US$ dollar index’s decline from that March spike-high of 102.99 which heightens the probability of a counter-trend upswing unfolding thorough August to October/November.

Morgan Stanley’s US Dollar Position

In a recent research note, investment bank Morgan Stanley said it had now shifted from its dollar-bearish stance and turned ‘tactically neutral’ on the U.S. currency, citing the dollar is at its most oversold level in over 40-years. The bank has exited its short position on the dollar index whilst also closing long positions on the euro and Australian dollar.

WaveTrack’s Elliott Wave US Dollar Forecast

That certainly seems to concur with our Elliott Wave count! The latest aggregated US$ dollar positioning basis COT data also supports the idea that the dollar has entered an oversold condition – see fig #3. Whilst this doesn’t necessarily ensure a dollar rally is ahead because an oversold reading can remain that way in a strong downtrend, it does hint of one especially if supported by an Elliott Wave count. The COT data shows the dollar’s net speculative positioning has been declining since May ’19 and is now negative at minus -$19.1bn dollars. That’s approaching levels not seen since May ’18, shortly after the dollar ended is intermediate wave (1) downtrend at 88.26 that began from the Jan.’17 peak of 103.82.

In this next graphic, we see the same oversold signal basis a ‘relative strength index’, or RSI – see fig #4. The current reading at the beginning of August is 26.2998 registering one of the most oversold levels of the past decade.

EUR Component

Of course, the US$ dollar index weighting of its basket of currencies shows the EURO currency as the largest component at 57.6%. So it’s not surprising the EURO is correspondingly at an overbought condition right now. The latest COT net speculative positioning is at plus +180,600 contracts, historically very high, even higher than the previous peak of April ’18 when it was at 151,500 contracts and trading at 1.2556 (now at 1.1785) – see fig #5. The equivalent dollar positioning value is at plus +16.016bn dollars, extremely high and from an Elliott Wave count, is approaching the completion of a corresponding five wave impulse uptrend that began last March from 1.0635.

G8 Currencies

When taking a comparative look across all of the G8 currencies, the medium-term and shorter-term outlooks suggest a similar story. Certainly, where the US$ dollar is firmly engaged in a downtrend for the next several years but positioning for a shorter-term counter-trend rally.

Sterling vs. US Dollar

This is definitely the case for Stlg/US$, although we expect some level of short-term outperformance. US$/Yen is set to trend higher over the coming year or two although this contradicts the idea of a weaker dollar. This is more to do with its positive-correlation with the Nikkei 225’s stock index uptrend, and its correlation to the US10yr yield, both of which reflect risk-on strategies over the period, thus weakening the Yen more than the dollar.

US Dollar vs. CHF/NOK/CAD

The US$/CHF Swiss Franc is poised to benefit by a weaker US$ dollar downtrend with Elliott Wave projections below the Aug.’11 low of 0.7064. The US$/NOK is forecast to trend significantly lower over the next several years reflecting Norwegian Krona strength as a commodity-based currency, linked to a major ‘Inflation-Pop’ recovery in Crude/Brent oil prices. Another commodity currency is the Australian dollar – the AUD/US$ is also tipped to strengthen dramatically, trending higher through the final stages of the ‘Inflation-Pop’ cycle, ultimately breaking above its previous year-2011 high of 1.1083. This is also true for another petro currency, the Canadian dollar where the US$/CAD ended its pre-financial-crisis counter-trend advance only recently, into the March ’20 COVID-19 high of 1.4669 and now in the early stages of a multi-year downtrend.

Currency Crosses – Euro/GBP/AUD/NOK/CAD

The latest Elliott Wave analysis of currency crosses has extended our portfolio to include AUD/NOK, CAD/NOK and AUD/CAD – these suggest AUD strength over NOK and CAD through the final stage of the ‘Inflation-Pop’ cycle – the CAD/NOK cross is trending lower. See report for full details.

Asian & Global Currency Pairs

Something very special occurred last March when many Asian currencies continued to weaken against the US$ dollar. The Asian Dollar Index (ADXY) sold-off sharply during the COVID-19 panic but trading down into long-awaited targets of 99.80+/- to only a fraction above, at 100.30. This low coincided with a major high in the dollar index (DXY) at 102.99 but confirming the ADXY ending a 12-year corrective expanding flat pattern from the Feb.’08 high of 116.40.

See Forex report for full details.

US$/BRL/RUB/ZAR/MXN/ARS/TRY/PLZ

See Forex and Bonds report for full details.

Bitcoin

A recent survey from a U.S. investment bank noted that baby-boomers were inclined to buy gold as a safe-haven investment but millennials prefer to invest in Bitcoin.

As for Bitcoin, our Elliott Wave analysis continues the same theme outlined earlier this year – the multi-year outlook remains very bullish, with the prospect of outperforming gold by a huge margin over the next decade.

Interest Rates – Review

Last January/February’s Elliott Wave analysis forecasted long-dated treasury yields declining to new record lows during the 1st quarter 2020 period. But little did we know just how far those yields would decline!

U.S. Treasury Yields Cycles and Elliott Wave Forecasts

The triple AAA rated corporate bond yield has a 60-year cycle dating back to the early 1700’s – see fig #6. Its last peak was the ‘inflationary’ high traded back in year-1981 at 15.84%. The subsequent ‘deflationary’ era has so far, extended beyond the half-60yr cycle of 30 years which was due to end in mid-2016 to this year, 2020. This is most probably a result of central bank intervention. Specifically, its quantitative easing and accommodative monetary policies. However, the further the yield passes beyond this date, the more risk of a springboard effect higher later.

US10yr yield

The US10yr yield hit a low last March at 0.377% before responding immediately higher to begin a new longer-term uptrend. Like the thirty-year yield, once primary wave 3 begins, its pace and trajectory could be slow, at least in its early stages of development.

The Bank of America/Merrill-Lynch’s recent Global Fund Manager Survey reported that 54% of investors said the Fed would not introduce Yield Curve Control at its next meeting in September. About 30% did say they expected it. However, in this case, we’re interested in what the majority think and expect – see fig #7.

Basis our weekly composite cycle of the US10yr yield, the yield forms an important low in August/September. It should then turn higher. Consequently, this would start a primary wave 3’s advance. Yet, it may not necessarily accelerate higher, at least in the beginning, basis the cycle – see fig #8. Note how the cycle turns higher. However, not to any significant trajectory. Rather, it trends higher gradually until October ’21. Could that suggest the Federal Reserve will implement yield curve control soon?

Dollar Spreads

See Forex report for full details.

Dollar/Euro Spread

See Forex report for full details.

Inflation TIPS

The US10yr Breakeven Inflation Rate hit a low last March at 0.727, extending primary wave B’s corrective downswing that began from year-2011’s high of 2.654. But importantly, the spread remained above the financial-crisis low of 0.077 which defined the beginning of the ‘Inflation-Pop’ cycle. The TIPS has since traded up to 1.571% which is perfectly in-line with upside progress as primary wave C. Inflationary pressures are on the rise!

European Yields

The benchmark DE10yr yield edged slightly below the Aug.’19 low of -0.743% during the COVID-19 panic last March. Touching a new historical low at -0.910%. It immediately traded higher later in the month to -0.146 confirming its multi-decennial corrective downswing from the year-1981 inflation-pop high of 11.500% had completed whilst opening the way for a new era of rising interest rates to begin. Over the next few years, we expect the yield to trend higher. Possibly, attempting targets towards 2.085+/- as primary wave 1.

Spreads

See Forex and Bond report for full details.

Italy

See Forex and Bond report for full details.

Japan

See Forex and Bond report for full details.

New Forex & Interest Rates mid-year 2020 Video – PART III/III

We’ve amassed over 100 charts (a new record!!) from our EW-Forecast database in this mid-year Forex and Interest Rates 2020 video. Each one provides a telling story into the way Elliott Wave price trends are developing in this next INFLATION-POP’ phase of cycle development. We’re taking a look at some very specific patterns that span the entire 15.6-year US$ dollar cycle. And explaining their current location and why inflation will trigger huge US$ dollar declines. Yet, simultaneously appreciating major Emerging Market and Asian Currencies.

We’re updating some amazing Elliott Wave forecasts for U.S. interest rates, US10yr, US10yr, US05yr, and even US02yr together with a schematic look at several spread relationships with European rates not forgetting upside targets for the US10yr Inflation Tips. It’s a must-see!

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get

Contents: 100 charts | Video duration: 2 hours 15 mins.

The contents of this FOREX & BONDS VIDEO include Elliott Wave analysis for:

• US$ Index + Cycles

• Euro/US$ + Cycles

• Stlg/US$

• US$/Yen

• US$/CHF

• US$/NOK

• AUD/US$

• NZD/US$

• US$/CAD

• Euro/Stlg

• Euro/CHF

• Euro/NOK

• Euro/Yen

• Euro/AUD

• Stlg/YEN

• Stlg/CHF

• Stlg/NOK

• Stlg/ZAR

• Stlg/AUD

• AUD/NOK

• CAD/NOK

• AUD/CAD

• Asian ADXY

• US$/Renminbi

• US$/KRW

• US$/SGD

• US$/INR

• US$/TWD

• USD/THB

• US$/MYR

• US$/IDR

• US$/PHP

• USD/BRL

• USD/RUB

• US$/ZAR

• US$/MXN

• US$/ARS

• US$/TRY

• US$/PLZ

• Bitcoin

Interest Rates (30 charts):

• US30yr Yield + Cycles

• US10yr Yield + Cycles

• US5yr Yield

• US2yr Yield

• US2yr-10yr Yield Spread

• US10yr-30yr Yield Spread

• 3mth EuroDollar-US10yr Yield Spread

• Comparison US10-DE10yr vs S&P 500

• US10yr TIPS Break Even Inflation Rate

• US10-DE10yr Yield Spread

• DE10yr Yield

• ITY10yr Yield

• JPY10yr Yield

BUY NOW on WaveTrack’s VIMEO Video On Demand Page

Click here to buy the CURRENCIES and INTEREST RATES Mid-Year Video Update 2020

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

Commodities 2020 Mid-Year Video Series

by WaveTrack International| July 15, 2020 | No Comments

Commodities Hit Major Lows –‘Inflation-Pop’ Lift-Off – Next 2-3 Year Uptrends Underway

We’re pleased to announce today’s release is PART II, COMMODITIES – Part I was released last month and Part III will be published in late-July

• PART I – STOCK INDICES – out now!

• PART II – COMMODITIES – out now!

• PART III – CURRENCIES & INTEREST RATES – coming soon!

Elliott Wave Forecasts – Mid-Year 2020 – Summary

EW-Forecast Review – H1 2020

The Annual 2020 report published last January (2020) highlighted first-quarter Q1 ’20 downside risk across the commodities sector – ‘…This specifically applies to base metals like Copper, Aluminium and Lead’…’Commodities like Crude/Brent oil are still some way from ending corrective X wave declines that began from the Oct.’18 highs. So far, downside targets are still -32% per cent below current levels…’. It continued…’ The probability of a Q1 dip in prices is evident across other asset classes – the US10yr treasury yield downtrend that began from the Oct.’18 peak of 3.262% remains incomplete, requiring another but final decline to lower-lows, below last September’s low of 1.429%. Also, U.S. stock markets are set to end last October’s uptrend – those gains of +16% per cent must be corrected to the downside…Various Base Metal Mining stocks are set to trade lower over the next few months too. The US$ dollar could flip higher for a few months, indicating the same risk-off event…’.

Commodities and Coronavirus Aftermath

These forecasts were realised as the coronavirus pandemic spread from China, across continental Europe and later to the United States. There was no contemplation at the time that the COVID-19 pandemic would be the catalyst for the expected declines across commodity markets. However, Elliott Wave patterns were already warning of a significant sell-off.

Price declines were even more severe that these bearish forecasts. Copper declined by -30% per cent. Crude/Brent oil collapsed by an unprecedented -90% per cent whilst industrial precious metal fell by -40% per cent. Even gold wobbled! And traded down -15% per cent into March’s low. Stock markets declined by -35% per cent whilst the US10yr yield traded down to historical lows of 0.378% per cent.

Fig #3 – Track Record – MSCI EM and Copper Correlation Study – 4th January 2020 by WaveTrack International

Commodities and V-Shaped Recovery

Commodities have certainly undergone a V-shaped recovery since forming important lows last March. Despite warnings of a second-wave of coronavirus infections spreading across the U.S. and South America, this is unlikely to lead to prices trending below last March’s lows. Base metals ended major corrective lows as did industrial precious metals together with Crude/Brent oil.

Aftermath of Coronavirus Sell-Off

V-shaped recoveries have begun from March’s lows and these are sustainable uptrends that are forecast unfolding over the next 2-3 years. But commodity trends don’t head higher in straight lines but are instead punctuated by intervals of corrective declines. Price advances are reaching interim upside targets right now.

New Commodities Mid-Year 2020 Video – PART II/III

We’ve amassed over 75 commodity charts from our EW-Forecast database in this mid-year 2020 video. Each one provides a telling story into the way Elliott Wave price trends are developing in this next INFLATION-POP’ phase of cycle development. We’re taking a look at some very specific patterns that span the entire SUPER-CYCLE, explaining why the super-cycle began from the GREAT DEPRESSION lows of 1932 and not from the lows of 1999 and how this ended in 2006-2008 and why the multi-decennial corrective downswing that began soon afterwards has taken the form of a very specific, but identifiable Elliott Wave pattern into the COVID-19 lows.

We invite you to take this next step in our financial journey with us. Video subscription details are below. Just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

Commodities Video Part II

Contents: 78 charts

Time: 2 hours 10 mins.

• CRB-Cash index

• US Dollar index + Cycles

• Copper + Cycles

• Aluminium

• Lead

• Zinc

• Nickel

• Tin

• XME Metals & Mining Index

• BHP-Billiton

• Freeport McMoran

• Antofagasta

• Anglo American

• Kazakhmys Copper

• Glencore

• Rio Tinto

• Teck Resources

• Vale

• Gold + Cycles

• GDX Gold Miners Index

• Newmont Mining

• Amer Barrick Gold

• Agnico Eagle Mines

• AngloGold Ashanti

• Silver + Cycles

• XAU Gold/Silver Index

• Platinum

• Palladium

• Crude Oil + Cycles

• Brent Oil

• XOP Oil and Gas Index

BUY NOW on WaveTrack’s VIMEO Video On Demand Page

Click here to buy the COMMODITIES Mid-Year Video Update 2020

*(additional VAT may be added depending on your country – currently US, Canada, Asia have no added VAT but most European countries do)

We’re sure you’ll reap the benefits – don’t forget to contact us with any Elliott Wave questions – Peter is always keen to hear you views, queries and comments.

Visit us @ www.wavetrack.com

We’re sure you’ll reap the benefits. Don’t forget to contact us with any Elliott Wave questions. Our EW-team is always keen to hear your views, queries, and comments.

Visit us @ www.wavetrack.com

Stock Index Mid-Year Video Series – 2020 | PART I/III

by WaveTrack International| June 24, 2020 | No Comments

COVID-19 Aftermath II – Secular-Bull Market Uptrend Resumes!

This report combines ELLIOTT WAVE with updated SENTIMENT & ECONOMIC INDICATOR STUDIES

We’re pleased to announce the publication of WaveTrack’s mid-year 2020 video updates of medium-term ELLIOTT WAVE price-forecasts. Today’s release is PART I, STOCK INDICES – Parts II & III will be published during the next month.

• PART I – STOCK INDEX

• PART II – COMMODITIES

• PART III – CURRENCIES & INTEREST RATES

EW-Forecast Review – H1 2020

The Annual 2020 report published last December (2019) highlighted several main points, including –

Well, a lot’s happened since then! The coronavirus pandemic has decimated global economies with a collapse in almost all areas of manufacturing and services. Only online sales survived the downturn. But even Amazon’s shares traded sharply lower during the worst of the stock market rout in February/March with declines of -25% per cent compared to the benchmark SP500’s decline of -36% per cent.

International Monetary Fund (IMF)

The International Monetary Fund (IMF) has recently made a statement saying the current COVID-19 crisis is ‘unlike anything the world has seen before’. The organisation forecast in April a contraction of -3% for the global economy in 2020. However, the IMF has since said it could be even worse. It noted that the services industry had been more severely impacted than manufacturing. This represents a change from previous crises, where a lack of investment hit manufacturing activity hardest.

The IMF added ‘For the first time since the Great Depression, both advanced and emerging market economies will be in recession in 2020. The forthcoming June World Economic Outlook Update is likely to show negative growth rates even worse than previously estimated’.

This downbeat assessment has been echoed in the data. The IHS Markit/JP Morgan Global PMI Output Index shows a massive slide lower during the height of the coronavirus pandemic. As a result, the index kept falling from 52.0 down to 26.0 before staging a V-shaped rally from the March/April low – see fig #1. The less sensitive quarterly GDP figures haven’t yet reflected that extreme downturn, but they will do once compiled, but lagging behind.

Enter the Central Banks

In response to the effects of COVID-19 and the lockdowns, central banks and governments have begun an estimated $15 trillion dollars of stimulus in order to protect their economies from systemic collapse. These are record sums that will explode balance sheets and deficits to peacetime highs and to levels that equate to about 17% per cent of an $87 trillion dollar global economy. It’s a massive undertaking.

Stimulus so far – $15 trillion and counting

In a Reuters report from Ritvik Carvalho, it states that central banks have so far unveiled as much as $15 trillion dollars of funding into the financial system in an attempt to reverse the economic slump – see fig #2. It’s caused an exponential rise in the balance sheets. And in reaching that number, Reuters has included the increase in central bank balance sheets since the crisis erupted, new government cash injections and spending pledges, as well as about $7 trillion worth of quasi-fiscal loans and credit guarantees. Much of the latter may never be drawn upon, which would reduce the size of the fiscal stimulus. Central banks will also buy more bonds. Some are even saying there is no cap on purchases, inflating the $15 trillion number between now and end-2020.

Earlier this month (June), the European Central Bank (ECB) announced that it will increase its Pandemic Emergency Purchase Programme (PEPP) by €600 billion euros as it attempts to bolster the region’s economy following the coronavirus crisis. The amount is in addition to the existing €750 billion euros of government bond purchases that the ECB announced in March, taking to total to €1.35 trillion euros.

Meanwhile, the Federal Reserve announced its expanding its current stimulus programme to include the purchasing of corporate bonds as a function of its Secondary Market Corporate Credit Facility (SMCCF). The Fed’s stimulus has already exceeded $2.3 trillion dollars and together with various fiscal stimulus by the U.S. government, is expected to be as high as $5.0 trillion dollars.

Coronavirus – 2nd Wave?

Just as lockdowns have been relaxed and economies begin to reopen, so warnings have emerged over a 2nd wave of COVID-19 infections.

‘The second wave has begun’ said William Schaffner of the Vanderbilt University School of Medicine following reports of a spike in infection rates in Arizona, Florida and California. White House health advisor Dr. Anthony Fauci said in a recent announcement that a second wave of the coronavirus outbreak in the United States ‘could happen’ but is ‘not inevitable’.

Mike Ryan, executive director of the World Health Organisation’s (WHO’s) Health Emergencies Programme, said ‘calling instances like these a second wave isn’t quite accurate – most of the world right now is still very much in the first wave of this pandemic’ – it’s not surprising at all that any country coming out of this so-called lockdown can have clusters of disease, reemergence of disease’.

Investors are confused and you can understand why!

Sentiment

In the late-May Global Fund Manager survey conducted by Bank of America/Merrill Lynch, it reported that just 10% of fund managers expected a V-shaped recovery, only 25% a new bull market. In contrast 75% expect a U or W-shaped recovery with 68% believing a bear market rally began from the March lows – see fig #3.

fig #3 – FMS Investors Are Still More Bearish Than Bullish – Source: BofA Global Fund Manager Survey

Around the same time, Reuters conducted a similar sentiment poll of more than 250 economists highlighting recessions in most major economies would be deeper this year than previously predicted. Almost three-quarters of economists said the recovery would be either U-shaped, with a prolonged trough, or like a tick mark where the speed of the recovery is not as quick as the drop-off. Only 15 respondents predicted a strong, V-shaped recovery. The others said it would be W-shaped, where a vigorous rebound results in another sharp slump, or L-shaped where the economy flat-lines after the downturn – see fig #4.

From this we can discern that fund managers and economists have been very cautious since the COVID-19 pandemic hit financial markets during February/March’s sell-off – and they haven’t changed their opinions into late-May despite stock markets gaining back most of those -36% per cent losses since March’s lows.

What Next? Elliott Wave Perspective

COVID-19 Aftermath II – Secular-Bull Market Uptrend Resumes!

Despite all the conflicting news stories, COVID-19 vs. Central Banks, the outlook for global stock markets are clearly bullish, at least from an Elliott Wave perspective.

The benchmark SP500 completed a 4th wave correction into March’s low of 2191.86 with a new 5th wave uptrend getting underway since – this explains the V-shaped recovery into the mid-June high – see fig #5. The 4th wave, intermediate wave (4) completed a clearly-defined expanding flat pattern, labelled a-b-c subdividing 3-3-5 from the Jan.’18 high of 2872.87 – all criteria in correctly identifying this pattern were fulfilled, including its overall ‘form’ where wave minor wave a. establishes its initial trading-range ending in Dec.’18 at 2346.58 which is later exceeded slightly as waves b. and c., the former at 3393.52 and the latter into March’s low of 2191.86.

fig #5 – SP500 – Track Record – dated 25th March 2020 – WaveTrack International Financial Forecasting

Importance of Keeping it all in the Right Ratio and Proportion

Another criteria is ratio and proportion. Ratio is fulfilled where the initial downswing within minor wave a. at 2532.69 is extended by a fib. 61.8% ratio in projecting its low at 2346.58. Also, extending the initial upswing of wave b. to 2954.13 by a fib. 61.8% ratio projects the exact high at 3393.52. The final criteria is overall proportionality where minor wave a. is extended by a fib. 38.2% ratio in projecting the terminal low for minor wave c. to 2172.00+/-, the actual low being just 20 points higher at 2191.86.

The completion of the SP500’s expanding flat pattern is not a one-off coincidence. This same pattern is replicated in many other indices. Larger expanding flat patterns also completed last March for European indices too, the Eurostoxx 50 and the Xetra Dax. The Eurostoxx 50’s expanding flat is clearly defined because its second sequence, primary wave B has definitively unfolded into a double zig zag pattern, (A)-(B)-(C)-(X)-(A)-(B)-(C) from the Feb.’16 low of 2672.73 nudging to a momentary higher-high last February ending at 3867.28 – see fig #6. The coronavirus sell-off completed primary wave C into the exact fib. 38.2% extension level of primary wave A’s low of 2672.73 at 2302.84, just 26 points from the idealised measurement!

Emerging Markets + Asia – Australia – Japan

Emerging markets tell the same bullish story. They’re all signalling major coronavirus lows last March. The next two charts echo the same bullish outlook across Asian and the rest of the world’s indices – see fig’s #7 + fig #8.

This shows last December’s MSCI Emerging Market index forecast in preparation for the 2020 annual video report. It forecast a collapse lower as minor wave c. from a price-expectancy high of 1132-1172+/- towards a low of 825+/- that completes a counter-trend zig zag pattern from the Jan.’18 high.

As you can see, the decline began from 1151 then declined to a major low of 752 before staging a reversal-signature upswing. This is confirming a resumption of its much larger uptrend.

Conclusion

Despite all the conflicting news surrounding COVID-19, financial stock markets are giving clearly bullish signs going forward. We’re excited to see these developments and hope you’ll join us in looking through over 70 charts supporting this outlook in our latest mid-year update.

New Stock Index H2-2020 Video – PART I/III

This MID-YEAR 2020 VIDEO UPDATE for STOCK INDICES is like nothing you’ve seen anywhere else in the world – it’s unique to WaveTrack International, how we foresee trends developing through the lens of Elliott Wave Principle (EWP) and how its forecasts correlate with Cycles, Sentiment extremes and Economic data trends.

We invite you to take this next step in our financial journey with us – video subscription details are below – just follow the links and we’ll see you soon!

Most sincerely,

Peter Goodburn

Founder and Chief Elliott Wave Analyst

WaveTrack International

What you get!

Contents: 73 charts – 1 hour 55 mins.

• Economic Sentiment Indicators (9 charts)

• AAII Bullish Sentiment

• Cape P/E Ratio

• Dow Jones 30 + Cycles

• S&P 500 + Cycles

• Russell 2000

• Nasdaq 100

• Dow Jones Transport

• Dow Jones Utilities

• KBW Banking Index

• XLF Financial

• XLK Technology

• NASDAQ Biotechnology

• XLP Consumer Staples

• XLY Consumer Discretionary

• XOP Oil + Gas Index

• EuroStoxx 50

• Xetra Dax 30

• FTSE-100

• FTSE-30

• EuroStoxx Banks

• Deutsche Bank

• UniCredit

• MSCI Emerging Market

• MSCI BRIC

• MSCI China

• China Enterprises

• MSCI Hong Kong