EuroStoxx 50 Jump Annuls Grexit Concerns!

by WaveTrack International| July 10, 2015 | No Comments

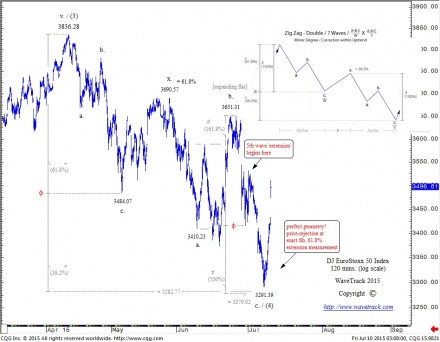

European markets have staged price-rejection into key ‘golden-ratio’ levels during Wednesday’s trading with the EuroStoxx 50 ending its double zig zag pattern from the April highs at 3291.39. Prices are now trading over 7% per cent higher basis today’s jump!

Extending the first zig zag by a fib. 61.8% ratio projected the completion of the second zig zag to 3282.77 with the actual low coming in at 3291.39! Perfect geometry!

Even before this test occurred, the probability of a reversal-signature was assigned a high rating because of the integrity of the double zig zag pattern (see last Wednesday’s EW-Compass report) – compare this archetypal pattern with the tutorial (top-right of chart). It gave prior insight that whatever the outcome over the Greek debt negotiations, the markets would react favourably – this is in stark contrast to the latest Reuters poll that showed a majority of 55% economists were pessimistic, favouring a Greek exit!

What do you rely on for the sound evaluation of market trends?

WaveTrack’s Elliott Wave Success