BUND – await for a reversal!

by m.tamosauskas| August 15, 2012 | No Comments

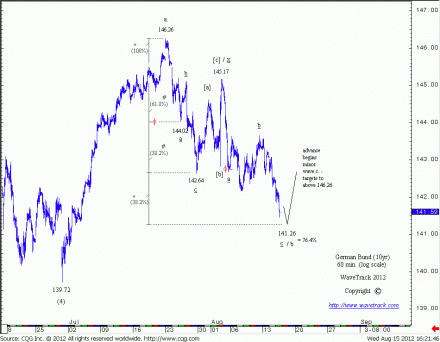

Germany’s 10 year Euro Bund future is quickly approaching its measured downside target to 141.26 discussed last week (see previous post).

Intermediate wave (5)’s advance from the June low of 139.72 is expected to unfold into a single zig zag pattern as the concluding sequence of a larger/aggregate ending diagonal pattern. Minor wave a. completed from 139.72 to the July 23rd high of 146.26. This upswing is now being balanced by a counter-trend decline as minor wave b. unfolding into a double zig zag pattern.

The first zig zag unfolded from 146.26 to 142.64 – by itself it cuts into a perfect Golden Ratio (marked as red phi symbol), where minute wave a is exactly a 61.8% ratio of the entire zig zag decline between 146.26 and 142.64. The second zig zag is now almost complete with an ultimate target towards 141.26. This is derived by extending the first zig zag by a fib. 38.2% ratio. It is astonishing that the same level also represents a fib. 76.4% retracement of the preceding upswing. When two of convergences of deferent of trend form together in close proximity (in this case equality), this attracts the price towards it in a culmination of the existing trend. Once completed, minor wave c. is expected to begin its advance projecting targets back above 146.26 as a minimum requirement. It is important to note, that a more bearish count from 146.26 (e.g. series of 1’s and 2’s) was negated when minute wave x exceeded the high of minute wave b of the first zig zag.

More importantly, this contract is negatively correlated to global stock indices – it provides a excellent timing indicator not only for a return higher for the Bund, but a reversal signature to confirm the conclusion of the stock market counter-trend advance from the June ’12 lows. Watch for a reversal signature during the next several trading days.

(Become an EW-Compass report subscriber and see how this pattern continues to develop and what’s coming up in the larger time-series).